The COVID-19 pandemic has resulted in unprecedented large and rapid

changes in many data series, and similarly unprecedented large policy

responses, making analysis of, and longer run predictions for, the economy

and housing markets exceptionally difficult and uncertain. HUD will continue

to monitor market conditions in the HMA and provide an updated report/

addendum in the future.

COMPREHENSIVE HOUSING MARKET ANALYSIS

Gainesville, Florida

U.S. Department of Housing and Urban Development,

Oce of Policy Development and Research

As of January 1, 2021

Share on:

!

!

!

£

¤

441

£

¤

41

£

¤

441

University of Florida

§

¨¦

75

§

¨¦

75

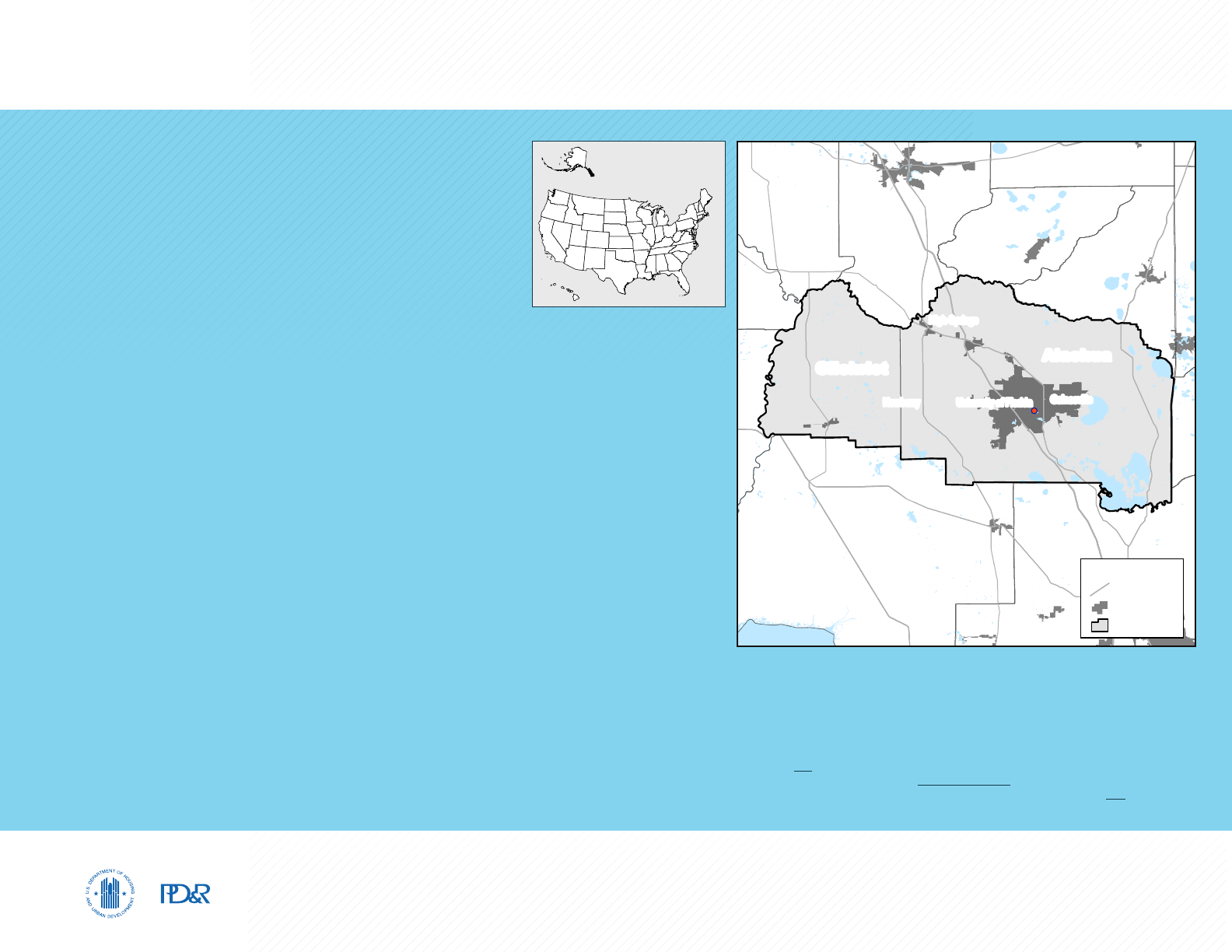

Alachua

Gilchrist

Newberry

Gainesville

High Springs

Levy

Marion

Columbia

Union

Bradford

Baker

Suwannee

Putnam

Lafayette

Dixie

Clay

!

Places of Interest

Major Roads

Urbanized Areas

Gainesville HMA

k

Executive Summary 2Gainesville, Florida Comprehensive Housing Market Analysis as of January 1, 2021

Comprehensive Housing Market Analysis Gainesville, Florida

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Executive Summary

Housing Market Area Description

The Gainesville Housing Market Area (HMA) is coterminous with the

Metropolitan Statistical Area of the same name, including Alachua

and Gilchrist Counties.

The population is currently estimated at 290,600.

The HMA is in northern central Florida and is home to the University

of Florida (UF) and UF Health. The presence of the university

supports high-tech jobs, and tourists are attracted to the HMA for

its museums, performing arts, natural spring waters, and more than

200 miles of walking trails.

Tools and Resources

Find interim updates for this metropolitan area, and select geographies nationally,

at PD&R’s Market-at-a-Glance tool.

Additional data for the HMA can be found in this report’s supplemental tables.

For information on HUD-supported activity in this area, see the Community Assessment Reporting Tool.

Executive Summary 3Gainesville, Florida Comprehensive Housing Market Analysis as of January 1, 2021

Comprehensive Housing Market Analysis Gainesville, Florida

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Market Qualifiers

Nonfarm payrolls increased by an average of 2,700

jobs, or 2.0 percent, a year from 2012 through 2019,

before declining by 5,400 jobs, or 3.6 percent,

to 142,600 jobs in 2020. Job losses during the

recent year were concentrated in the second

quarter of 2020 as a result of actions taken to slow

the spread of COVID-19. By comparison, 2,400

jobs, or 1.6 percent, were added in 2019. During

2020, job losses were greatest in the leisure and

hospitality sector, which declined by 2,600 jobs,

or 16.1 percent. During the 3-year forecast period,

nonfarm payroll growth is expected to average 1.6

percent annually as jobs lost during the pandemic

are regained.

The sales housing market has an estimated

1.5-percent vacancy rate, down from a 3.1-percent

rate in 2010. During 2020, existing home sales

decreased 4 percent, whereas the average existing

home sales price was up 8 percent from a year

earlier, to $226,700 (Zonda). During the next 3

years, demand is expected for 2,475 new homes;

the 840 homes currently under construction are

expected to meet part of the demand during the first

year of the forecast period.

The rental housing market in the HMA had an

overall estimated vacancy rate of 11.8 percent, down

from 12.4 percent in April 2010. Apartment market

conditions are slightly tight, with a 3.2-percent

vacancy rate during the fourth quarter of 2020,

compared with a 2.5-percent rate a year earlier

(Moody’s Analytics REIS). During the forecast period,

demand is expected for 1,775 new rental units.

The 1,625 units currently under construction are

expected to satisfy most of the demand during the

forecast period.

Economy

Weak: During 2020, nonfarm

payrolls decreased 3.6 percent,

following more than 8 years of

job gains

Rental Market

Balanced: During the fourth quarter

of 2020, the average apartment

rent increased 1 percent from a year

earlier to $1,013 a month.

Sales Market

Balanced: New and existing

home sales decreased 2 percent

during 2020.

TABLE OF CONTENTS

Economic Conditions 4

Population and Households 9

Home Sales Market 12

Rental Market 17

Terminology Definitions and Notes 21

Notes: Total demand represents estimated production necessary to achieve a balanced market at the end of the forecast period. Units under

construction as of January 1, 2021. The forecast period is January 1, 2021, to January 1, 2024.

Source: Estimates by the analyst

3-Year Housing Demand Forecast

Sales Units Rental Units

Gainesville HMA

Total Demand 2,475 1,775

Under Construction 840 1,625

Economic Conditions 4Gainesville, Florida Comprehensive Housing Market Analysis as of January 1, 2021

Comprehensive Housing Market Analysis Gainesville, Florida

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Economic Conditions

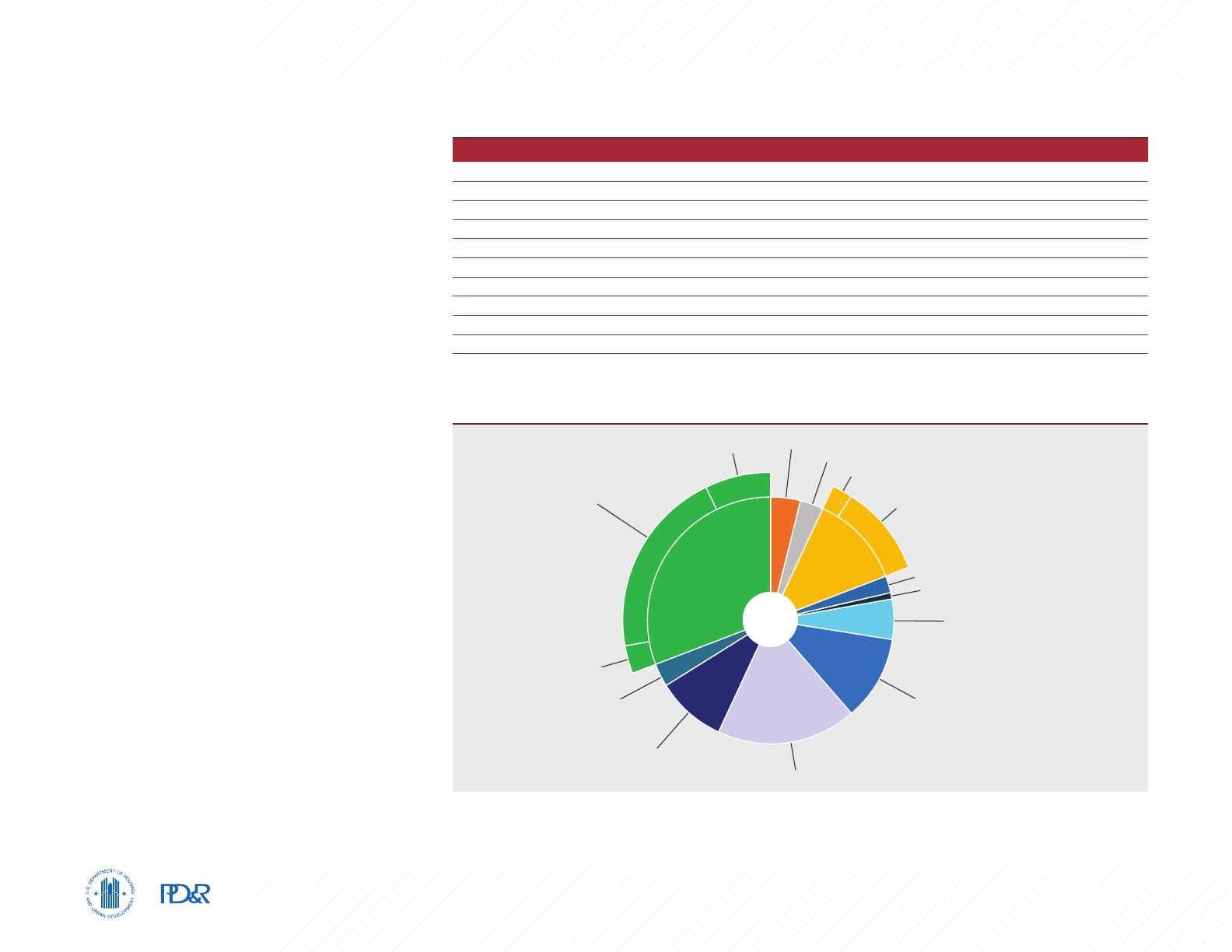

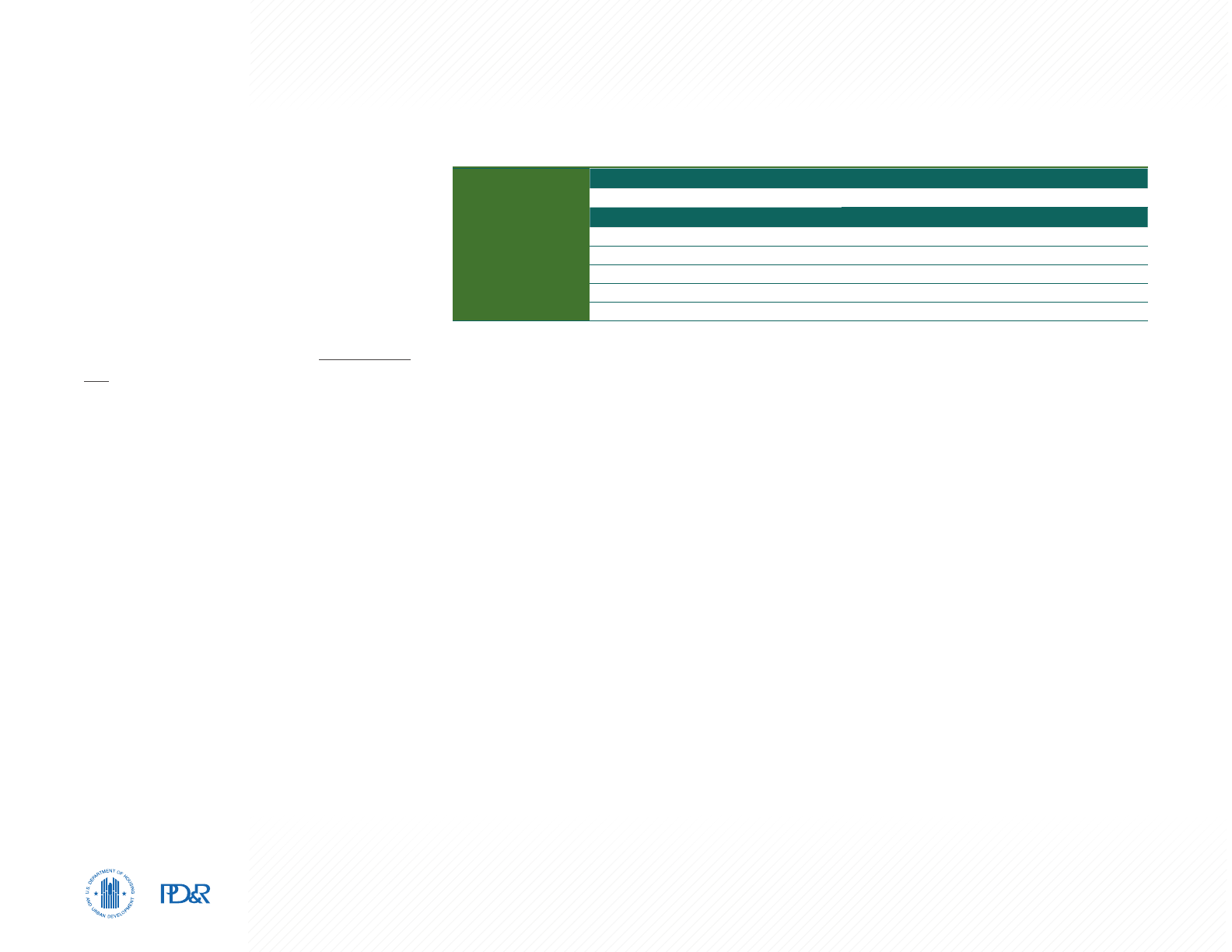

Largest sector: Government

The government sector represents

30 percent of the payrolls in the

Gainesville HMA.

Primary Local Economic Factors

The Gainesville HMA is supported by UF, the largest

employer in the HMA and a state-funded institution

with 31,500 employees (Table 1) that enrolls more

than 50,000 students a year. The state government

subsector accounts for 20 percent of all jobs in the

HMA (Figure 1) and includes UF. Students, faculty,

and graduates of UF, along with research centers

at the university, support creating high-tech jobs

in the HMA. The UF Innovation District is a mixed-

use community of offices, luxury apartments, and

entertainment venues between UF and downtown

Gainesville. Collaboration between UF and

companies in the Innovation District bolsters payrolls

in the HMA, including jobs in the transportation and

utilities sector, which nearly doubled from 2001

through 2019, and in the professional and business

services sector, which increased by an average of

300 jobs, or 2.1 percent, during the same period

(Figure 2). At the Innovation District, Kimley-Horn,

a consulting company, has hired 120 UF graduates

since 2013. In addition to the importance of UF,

tourism strengthens the local economy, and the

leisure and hospitality sector accounts for 9 percent

of payrolls in the Gainesville HMA. Before the

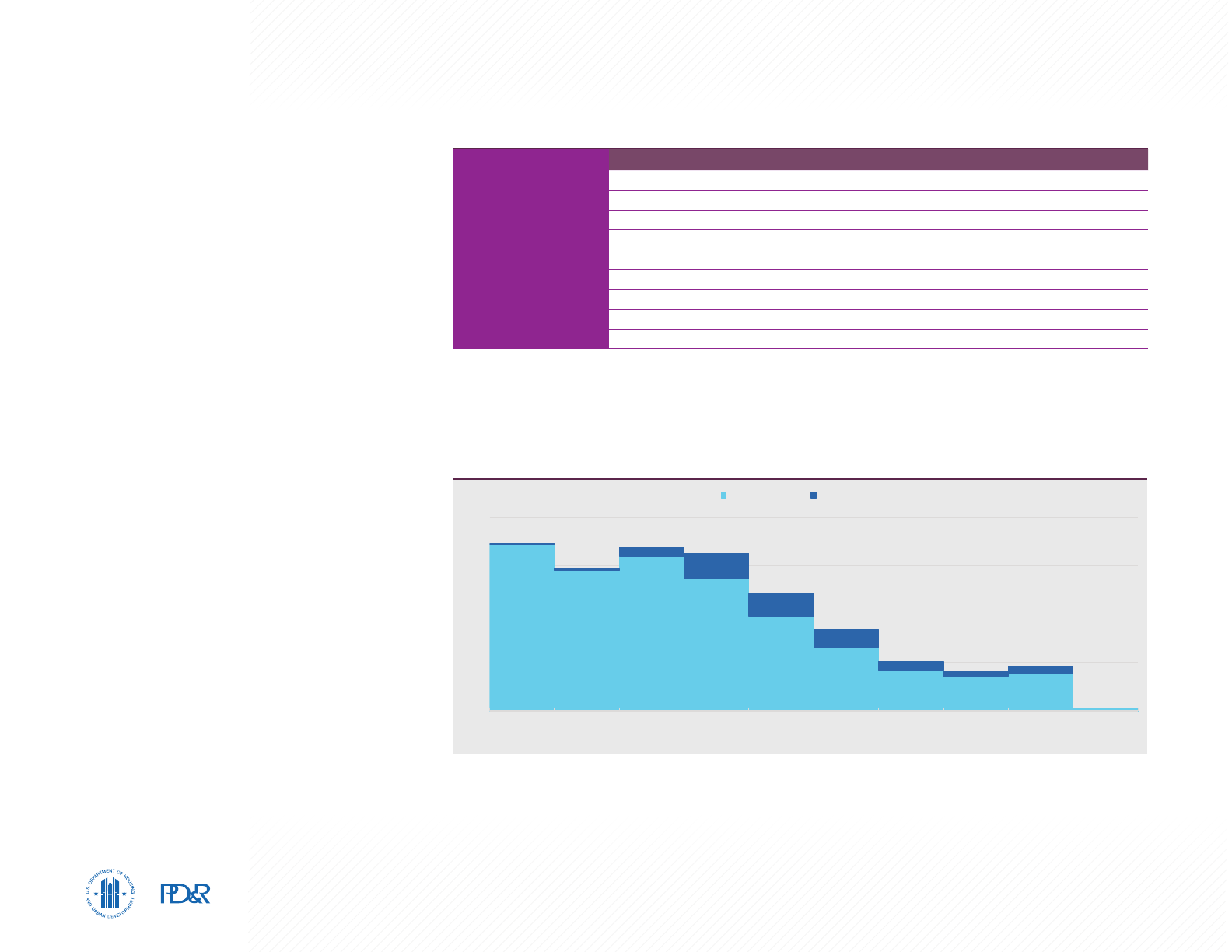

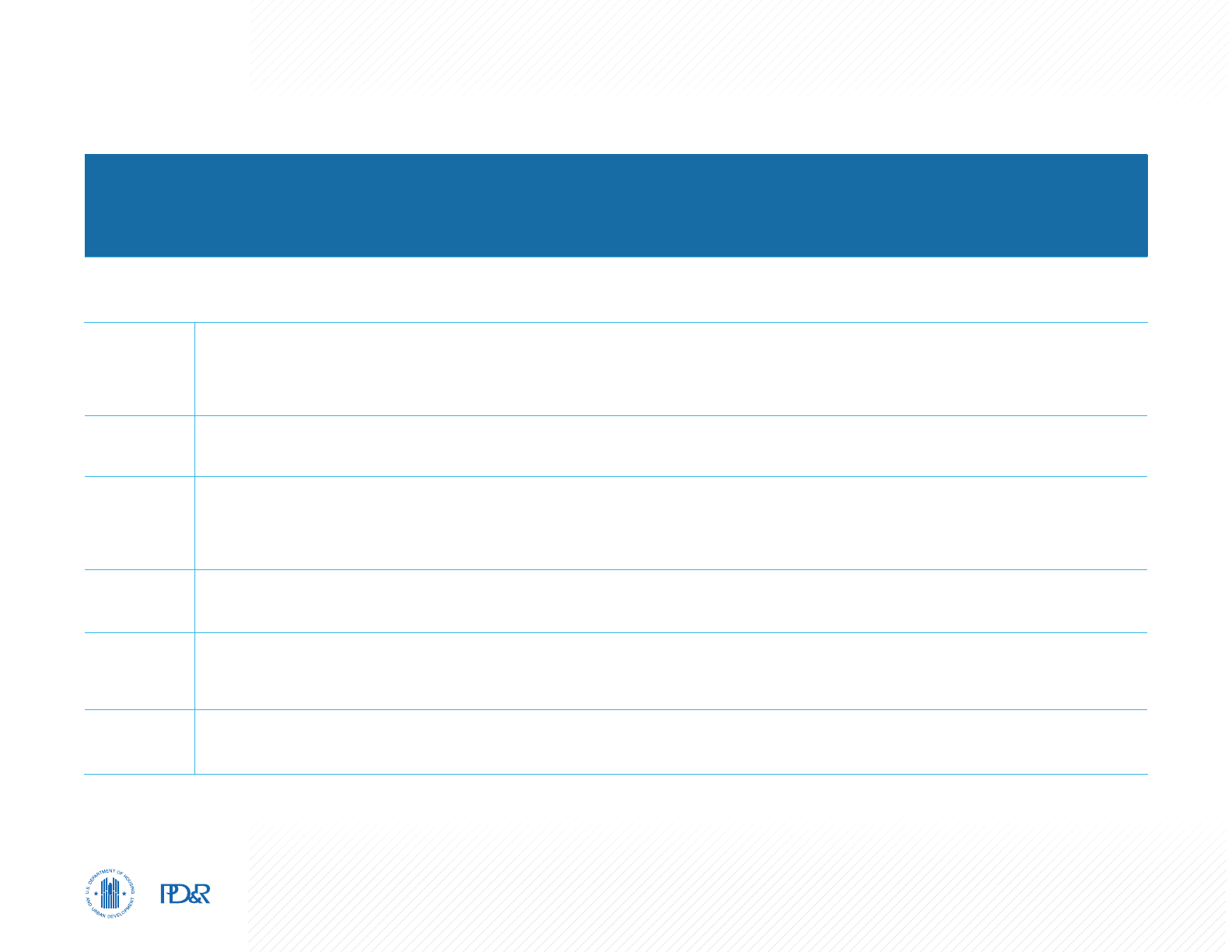

Table 1. Major Employers in the Gainesville HMA

Name of Employer Nonfarm Payroll Sector Number of Employees

University of Florida Government 31,500

University of Florida Health Education & Health Services 12,950

Malcom Randall Department of Veterans Aairs Medical Center Government 6,125

North Florida Regional Medical Center Education & Health Services 1,950

Gator Dining Services Leisure & Hospitality 1,200

Nationwide Mutual Insurance Company Professional & Business Services 1,325

Sante Fe College Government 900

Walmart Inc. Wholesale & Retail Trade 900

Publix Super Markets, Inc. Wholesale & Retail Trade 750

RTI Surgical Inc. Manufacturing 550

Note: Excludes local school districts.

Source: Greater Gainesville Chamber of Commerce

Mining, Logging, & Construction 4%

Manufacturing 3%

Wholesale 2%

Retail 10%

Transportation & Utilities 2%

Information 1%

Financial Activities 5%

Professional &

Business Services 11%

Leisure & Hospitality 9%

Other Services 3%

Federal 3%

State 20%

Local 7%

Education & Health Services 18%

Government

30%

Trade 13%

Total

142.6

Figure 1. Share of Nonfarm Payroll Jobs in the Gainesville HMA, by Sector

Notes: Total nonfarm payroll is in thousands. Percentages may not add to 100 percent due to rounding. Percentage of retail and wholesale do not

add up to total trade sector due to rounding. Based on 12-month averages through December 2020.

Source: U.S. Bureau of Labor Statistics

Economic Conditions 5Gainesville, Florida Comprehensive Housing Market Analysis as of January 1, 2021

Comprehensive Housing Market Analysis Gainesville, Florida

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

pandemic, during 2019, this sector accounted for 11

percent of payrolls in the HMA. Tourists are attracted

to the HMA to enjoy unspoiled wetlands and fresh

springs, UF Gators football, and university museums

and galleries. Visitors to UF Health come from

throughout the northern Florida region for the highly

rated healthcare.

Current Conditions—Impacts

of COVID-19

Nonfarm Payrolls

During 2020, nonfarm payrolls in the Gainesville

HMA decreased by 5,400 jobs, or 3.6 percent

(Table 2). By comparison, during 2020, nonfarm

payrolls in the state and nation decreased 4.3 and

5.8 percent, respectively. In the HMA, the mining,

logging, and construction sector increased by 100

jobs, or 1.6 percent. Some of the sector gain can be

attributed to the recent increase in homebuilding,

the construction of the new baseball field at UF that

was finished in October of 2020, and the three-story

tower at North Florida Regional Medical Center

that was completed in November 2020. However,

most nonfarm payroll sectors in the HMA lost jobs

during 2020. The largest decline was in the leisure

and hospitality sector, which lost 2,600 jobs, or

16.1 percent. COVID-19 was declared a pandemic

by the World Health Organization on March 11,

2020. The state of Florida issued a shelter-in-place

order beginning on April 3, 2020. Among other

restrictions, the order resulted in the closure of all

schools, restaurant dining rooms, barbershops and

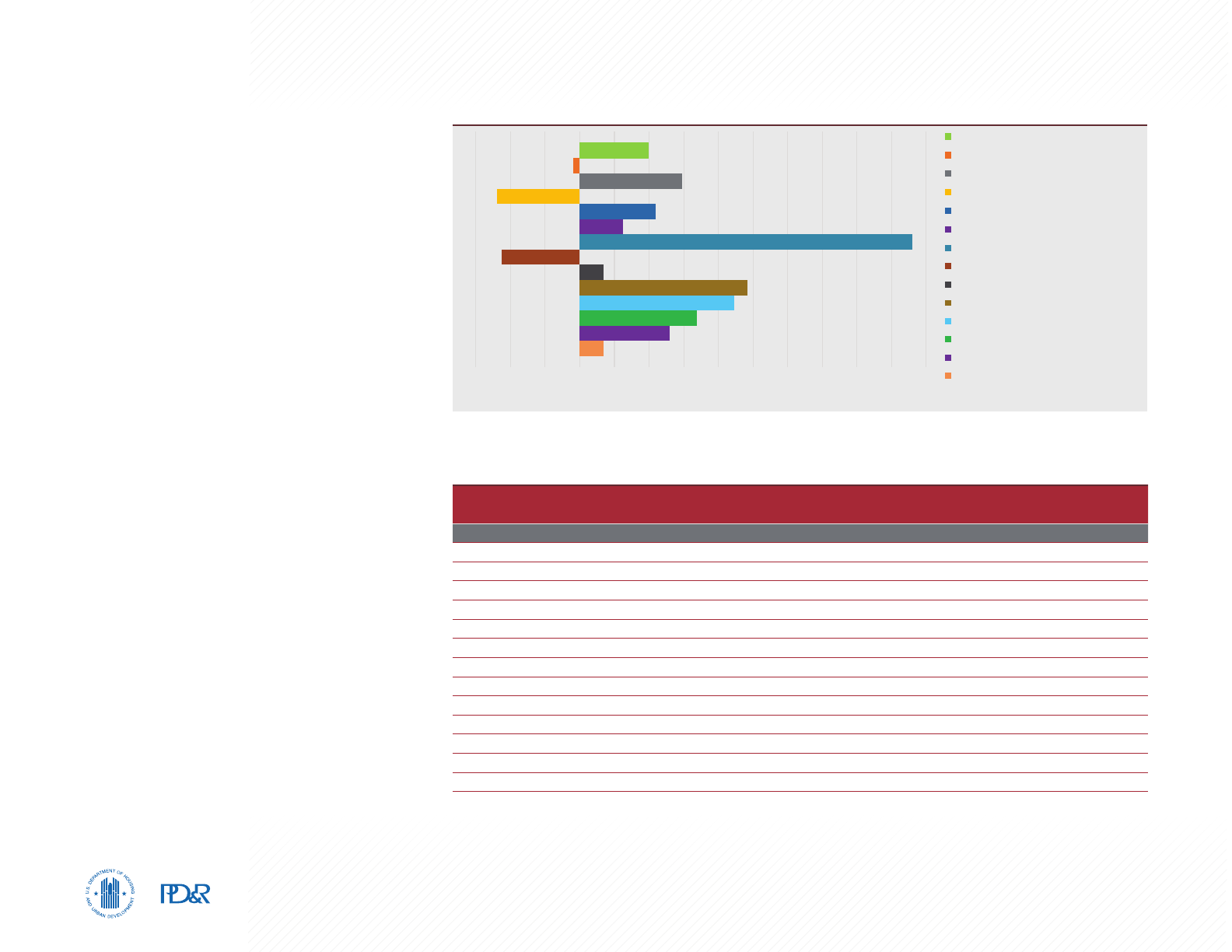

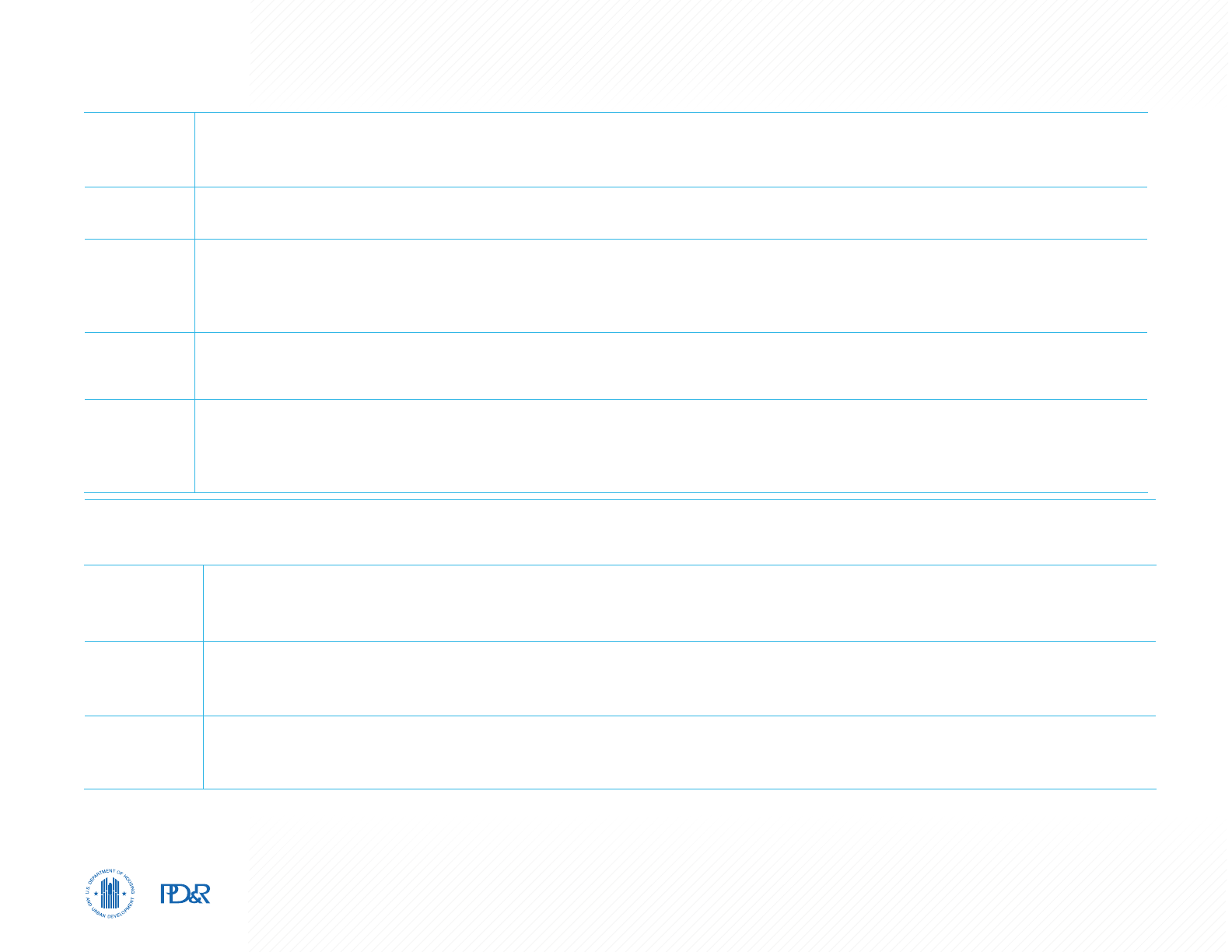

Table 2. 12-Month Average Nonfarm Payroll Jobs (1,000s) in the Gainesville HMA, by Sector

12 Months Ending

December 2019

12 Months Ending

December 2020

Absolute

Change

Percentage

Change

Total Nonfarm Payroll Jobs 148.0 142.6 -5.4 -3.6

Goods-Producing Sectors 10.9 11.0 0.1 0.9

Mining, Logging, & Construction 6.1 6.2 0.1 1.6

Manufacturing 4.8 4.8 0.0 0.0

Service-Providing Sectors 137.1 131.6 -5.5 -4.0

Wholesale & Retail Trade 18.0 17.9 -0.1 -0.6

Transportation & Utilities 3.3 3.3 0.0 0.0

Information 1.8 1.7 -0.1 -5.6

Financial Activities 6.8 6.7 -0.1 -1.5

Professional & Business Services 15.3 15.4 0.1 0.7

Education & Health Services 27.5 26.3 -1.2 -4.4

Leisure & Hospitality 16.1 13.5 -2.6 -16.1

Other Services 4.4 4.2 -0.2 -4.5

Government 44.0 42.9 -1.1 -2.5

Notes:

Based on 12-month averages through December 2019 and December 2020. Numbers may not add to totals due to rounding. Data are in thousands.

Source: U.S. Bureau of Labor Statistics

Total Nonfarm Payroll Jobs

Goods-Producing Sectors

Mining, Logging, &

Construction

Manufacturing

Service-Providing Sectors

Wholesale & Retail Trade

Transportation & Utilities

Information

Financial Activities

Professional & Business

Services

Education & Health Services

Leisure & Hospitality

Other Services

Government

-30 -20 -10 0 10 20 30 40 50 60 70 80 90 100

Change in Jobs (%)

Figure 2. Sector Growth in the Gainesville HMA, 2001 Through 2019

Note: The current date is January 1, 2021.

Source: U.S. Bureau of Labor Statistics

Economic Conditions 6Gainesville, Florida Comprehensive Housing Market Analysis as of January 1, 2021

Comprehensive Housing Market Analysis Gainesville, Florida

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

salons, bars, and gyms in the state; the order also

required that all businesses deemed nonessential

must limit their activity to minimum basic operations.

Although the order was relaxed in late April,

many businesses had significantly lower sales as

commerce slowed due to the unwillingness of

consumers to return to pre-pandemic behaviors.

From February to April 2020, nonfarm payrolls

declined by 18,600 jobs, or 12 percent. As of

January 1, 2021, 10,900 jobs had been regained,

representing 59 percent of jobs lost. Currently,

nonfarm payrolls are still 5 percent below the

February 2020 level (not seasonally adjusted).

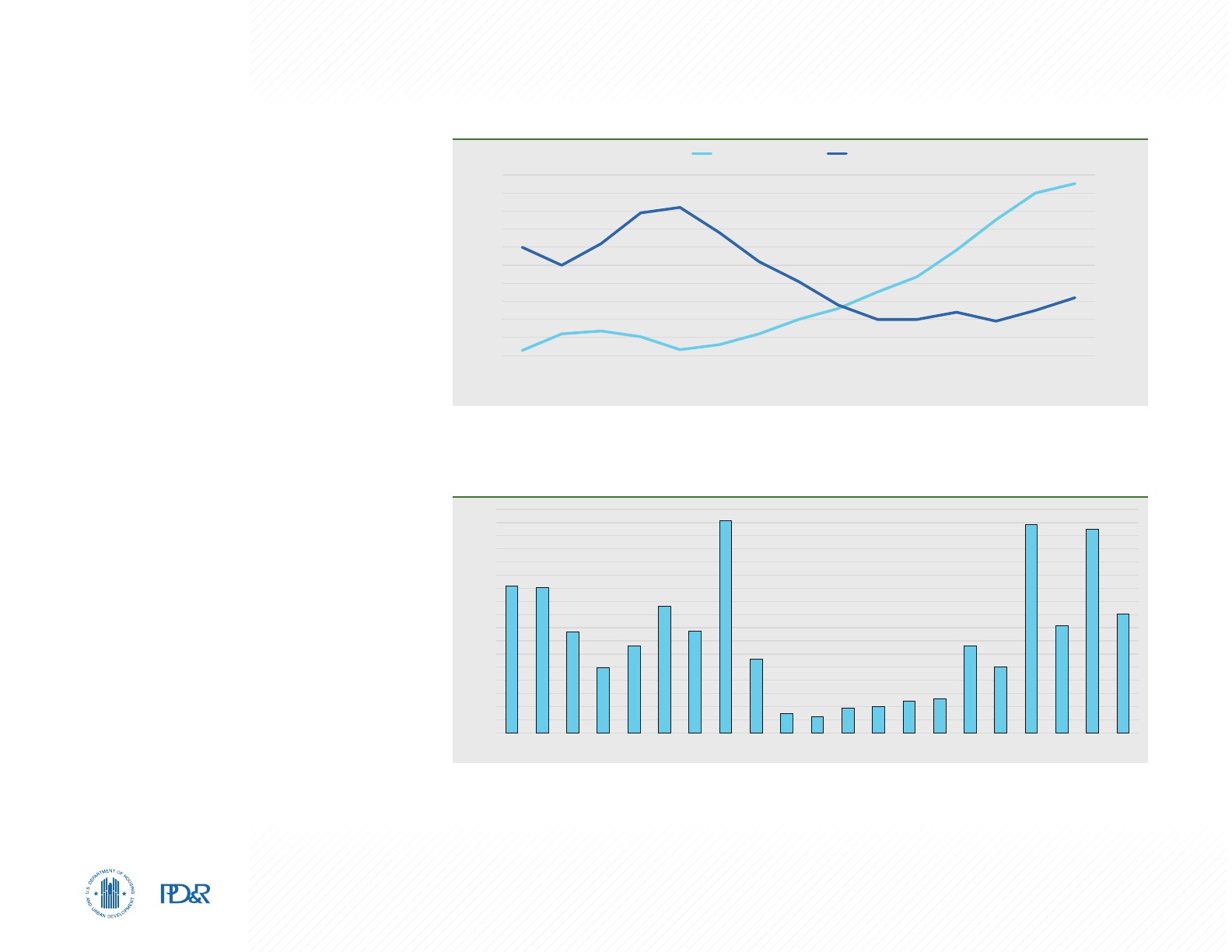

Unemployment

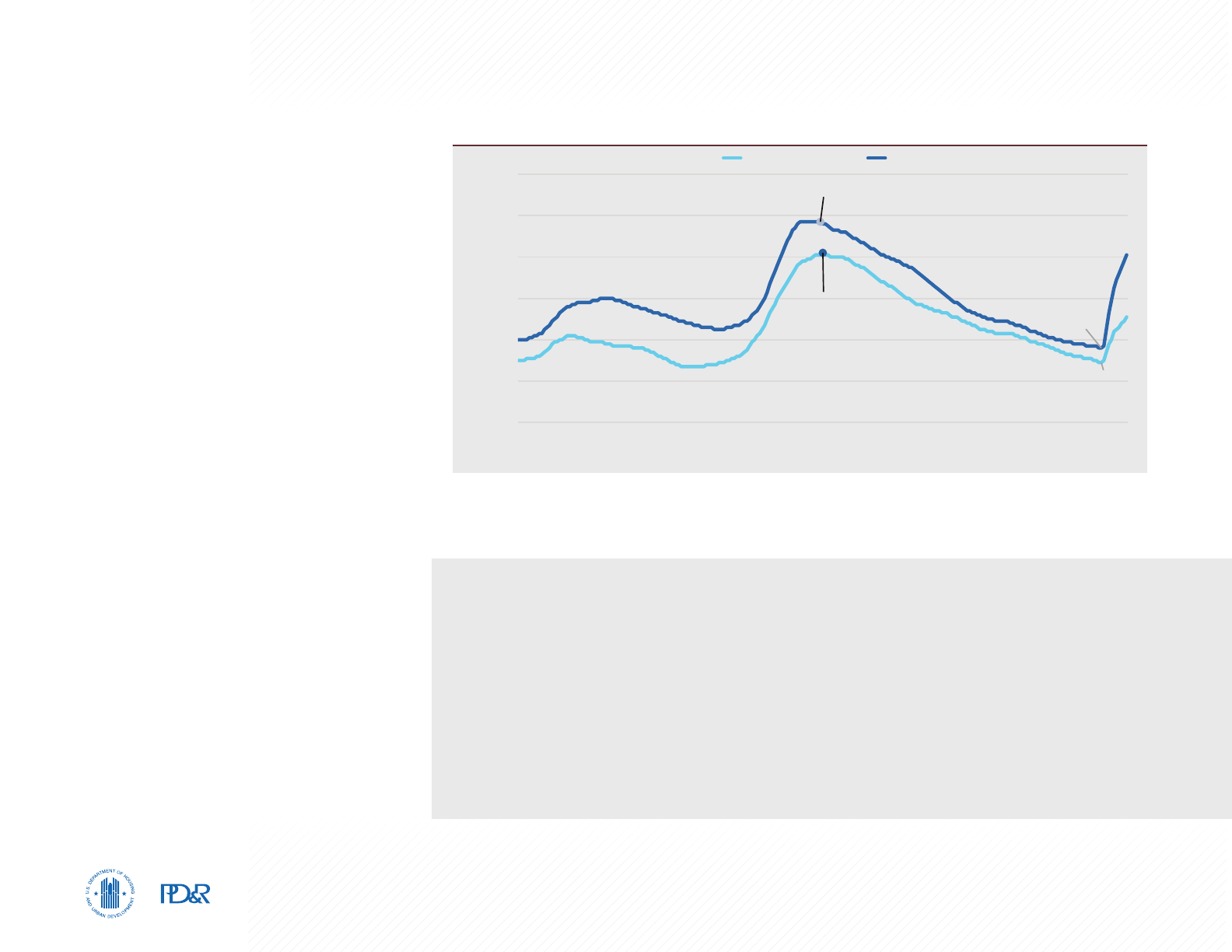

After the unemployment rate in the HMA peaked

at 8.2 percent during 2010, the rate declined to a

low of 2.9 percent during the 12 months ending

February 2020 (Figure 3). As a result of the efforts

used to contain the spread of COVID-19, the

unemployment rate increased to 5.1 percent during

2020, up from 3.0 percent a year earlier. The rate in

the HMA has been consistently below the national

rate, which increased from a low of 3.6 percent

during the 12 months ending February 2020 to the

current rate of 8.1 percent. The national rate peaked

during the 12 months ending November 2010 at

9.7 percent.

2.9

3.6

8.2

9.7

0.0

2.0

4.0

6.0

8.0

10.0

12.0

Dec-00

Dec-01

Dec-02

Dec-03

Dec-04

Dec-05

Dec-06

Dec-07

Dec-08

Dec-09

Dec-10

Dec-11

Dec-12

Dec-13

Dec-14

Dec-15

Dec-16

Dec-17

Dec-18

Dec-19

Dec-20

Unemployment Rate (%)

Gainesville HMA Nation

Figure 3. 12-Month Average Unemployment Rate in the Gainesville HMA and the Nation

Note: Based on the 12-month moving average.

Source: U.S. Bureau of Labor Statistics

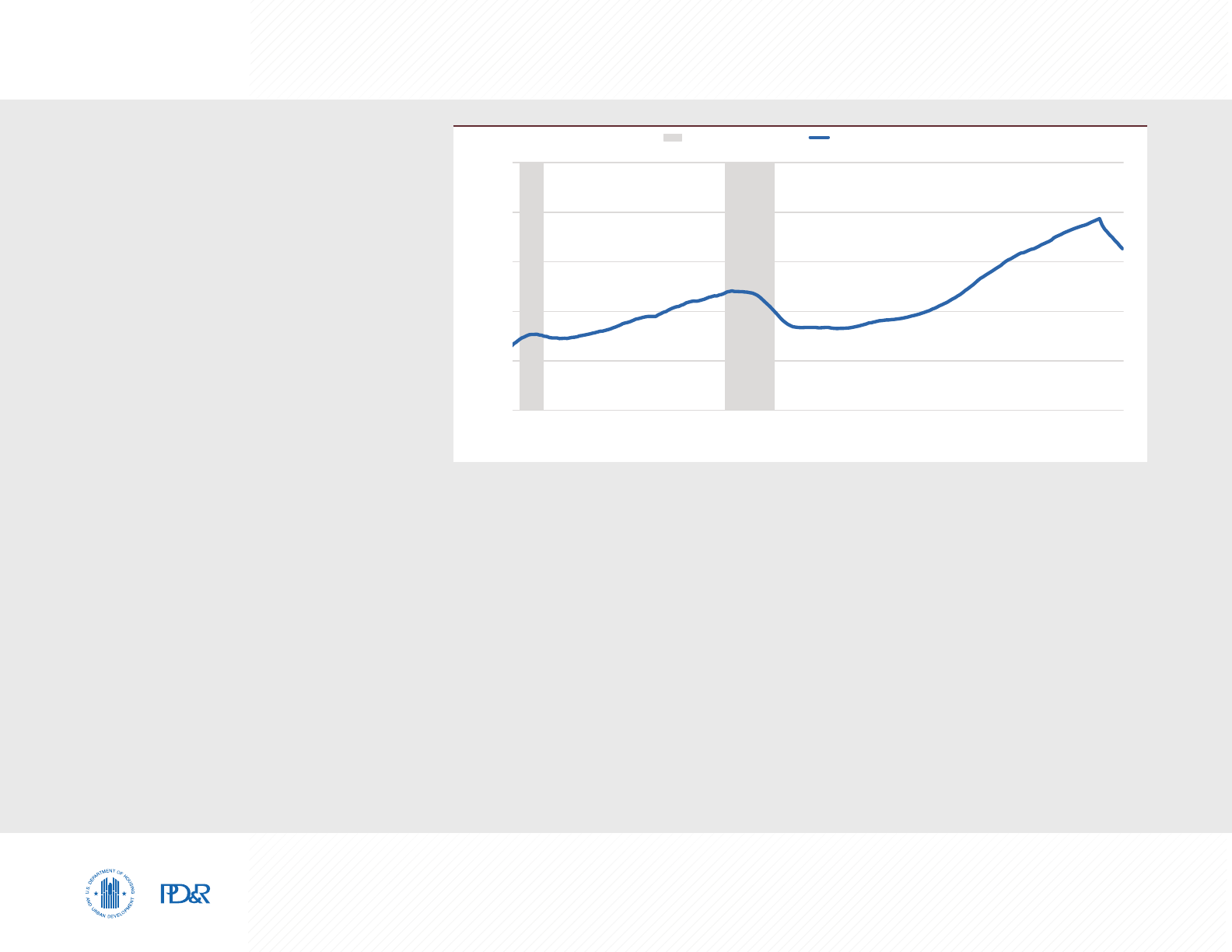

Economic Periods of Significance

2001 through 2008

The economy expanded by an average of 1,400 jobs, or 1.1 percent, annually from 2003 through 2008,

following a period of relatively flat nonfarm payroll growth during 2001 and 2002 (Figure 4). The leisure and

hospitality, the professional and business services, and the education and health services sectors led the

growth from 2003 through 2008, adding an average of 400, 300, and 300 jobs, or 3.0, 3.3, and 1.5 percent, a

year, respectively. In 2007 and 2008, Walmart Inc. and Sysco Corporation added facilities in the warehouse and

distribution hub located between Interstate 75 and U.S. Route 41 in northern Alachua County, adding 600 and

150 jobs, respectively.

Economic Conditions 7Gainesville, Florida Comprehensive Housing Market Analysis as of January 1, 2021

Comprehensive Housing Market Analysis Gainesville, Florida

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

2009 through 2011

In the wake of the Great Recession (which lasted

nationally from December 2007 through June

2009), nonfarm payrolls in the HMA declined by an

average of 2,200 jobs, or 1.7 percent, annually from

2009 through 2011. The largest annual losses in

the HMA were in the goods-producing sectors. The

mining, logging, and construction sector decreased

by an average of 600 jobs, or 11.9 percent, a year,

and the manufacturing sector declined by an

average of 400 jobs, or 7.7 percent, annually. Losses

in the construction industry can be attributed to the

sudden drop in homebuilding from 2009 through

2011. In 2011, the Coca-Cola Company laid off 87

employees in High Springs, and Georgia-Pacific

eliminated 400 jobs.

2012 through 2015

The local economy began a modest recovery in

2012. Nonfarm payrolls rose an average of 2,100

jobs, or 1.6 percent, a year from 2012 through

2015. The education and health services and the

professional and business services sectors led the

growth, increasing by an average of 500 jobs, or 2.0

and 4.5 percent, respectively. UF Health expanded

its pediatric cardiac intensive care unit and opened

UF Health Congenital Heart Center in 2014. These

developments, along with the construction of

the $46 million UF education building in 2015,

contributed to gains in the mining, logging, and

construction sector, which added an average of 200

jobs, or 4.8 percent, annually from 2012 through 2015.

Figure 4. 12-Month Average Nonfarm Payrolls in the Gainesville HMA

Note: 12-month moving average.

Sources: U.S. Bureau of Labor Statistics; National Bureau of Economic Research

110

120

130

140

150

160

Nonfarm Payrolls (in Thousands)

National Recession Nonfarm Payrolls

Dec-00

Dec-01

Dec-02

Dec-03

Dec-04

Dec-05

Dec-06

Dec-07

Dec-08

Dec-09

Dec-10

Dec-11

Dec-12

Dec-13

Dec-14

Dec-15

Dec-16

Dec-17

Dec-18

Dec-19

Dec-20

2016 through 2019

Nonfarm payroll growth in the Gainesville HMA accelerated from 2016 through 2019, increasing by an average

of 3,300 jobs, or 2.3 percent, annually. During 2015, nonfarm payrolls exceeded the 2008 high. Although the

rate of growth in the HMA during this period was stronger compared with previous periods, it was slower than

the average growth of 2.4 percent for the nation and 3.5 percent for Florida. Again, the education and health

services and the professional and business services sectors led the growth, increasing by respective averages

of 800 and 600 jobs, or 3.2 and 4.4 percent, annually. Payrolls in the transportation and utilities sector

increased by an average of 100 jobs, or 4.2 percent, annually from 2016 through 2019. Optym, an automation

transportation and logistics company, opened its headquarters in the Innovation District in 2017 and added 155

employees. Amazon.com, Inc. opened a distribution center in 2018 in northern Gainesville, which added 100

employees. The mining, logging, and construction sector had the largest average annual percentage increase

from 2016 through 2019, up 6.7 percent, or by an average of 400 jobs. Some of these gains can be attributed to

an increase in homebuilding as well as UF Health construction projects during this period.

Economic Conditions 8Gainesville, Florida Comprehensive Housing Market Analysis as of January 1, 2021

Comprehensive Housing Market Analysis Gainesville, Florida

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Economic Sectors of Significance

State Government Subsector

Payrolls in the state government subsector represent nearly two-thirds of the

government sector, which is the largest sector in the HMA, comprising 30 percent

of all payrolls. The state subsector decreased by 1,000 jobs, or 3.5 percent,

during 2020. This is compared with a gain of 200 jobs, or 0.6 percent, during

2019. The state government subsector includes UF, with an annual statewide

economic impact estimated at $10.4 billion for the 2017–2018 fiscal year (UF

Economic Impact Analysis, 2018). Employment at UF rose from 29,600 full- and

part-time employees during the fall of 2015 to nearly 31,500 employees in the fall

of 2019, an average annual increase of 480 employees, or 1.6 percent. During the

same period, UF enrollment increased by an average of 1,000 students annually.

Approximately 57,850 students were enrolled at UF in the fall of 2020, up from

56,550 a year earlier. The university has been gaining in popularity and was

ranked sixth-best public university in the nation by

U.S. News and World Report

in 2020.

Education and Health Services

The education and health services sector is the second largest sector in the

Gainesville HMA and currently accounts for 26,300 jobs, or 18 percent of total

nonfarm payrolls. During 2020, payrolls in the sector decreased by 1,200 jobs,

or 4.4 percent, compared with a gain of 1,100 jobs, or 4.0 percent, during 2019.

The education and health services sector has added jobs nearly every year since

2001, increasing by an average of 400 jobs, or 1.8 percent, annually from 2001

through 2018. In December 2017, UF Health opened the UF Health and Vascular

Hospital and UF Health Neuromedicine Hospital, which added 216 new rooms at

the cost of $415 million. A new North Florida Regional Medical Center freestanding

emergency facility also opened in Gainesville in 2017—one of four emergency

facilities added to the Gainesville HMA since 2015—adding 45 jobs.

Leisure and Hospitality

The leisure and hospitality sector increased by an average of 300 jobs, or 2.2

percent, from 2011 through 2019. During the past year, however, the leisure and

hospitality sector declined by 2,600 jobs, or 16.1 percent, because travel slowed

amid efforts to limit the spread of COVID-19. Tourists are attracted to the sporting

events, museums and art galleries at UF, the wetlands, and the natural springs

in the northern part of the HMA. In 2019, visitors to Alachua County spent an

estimated $841 million (Alachua County Visitor and Convention Bureau). Some of

these visitors attended UF Gators football games. In 2019, the average Gators

game filled more than 96 percent of the nearly 89,000 seats at Ben Hill Griffin

Stadium, the largest football stadium in Florida. Visitors also come to the HMA

to access the UF Health Shands Hospital, which was tied with the Mayo Clinic as

the best ranked hospital in Florida by

U.S. News and World Report

in 2020. Hotel

Eleo, a $32 million, 173-room boutique hotel, opened in the summer of 2020

on the UF campus to accommodate patients and other university visitors. Six

hotels were completed in the HMA from 2016 through the current date, adding

approximately 770 rooms.

Employment Forecast

During the 3-year forecast period, nonfarm payrolls are expected to increase

an average of 1.6 percent annually, with most sectors expected to add jobs. Job

growth is expected to continue in the education and health services sector. North

Florida Regional Medical Center, just east of Interstate 75 in Gainesville, expects

to expand its workforce at the newly completed South Tower by more than

250 jobs during 2021. The mining, logging, and construction sector is expected

to continue to grow partly because construction of a new $85 million football

complex at UF began in late 2020 and is expected to be completed in the winter

of 2021.

Population and Households 9Gainesville, Florida Comprehensive Housing Market Analysis as of January 1, 2021

Comprehensive Housing Market Analysis Gainesville, Florida

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Population and

Households

Current population: 290,600

Population growth since 2010 has been

weaker than during the previous decade

because net in-migration and net natural

increase have slowed.

Population Trends

Population growth has generally followed economic

trends in the HMA because net in-migration

accompanied job gains. During the early-to-

mid 2000s, when the economy expanded, the

population growth rate rose from an average of

1.3 percent, or 2,975 people, annually from 2000

to 2003 to an average of 1.6 percent, or 3,925

people, annually from 2003 to 2008 (Census

Bureau decennial census counts and population

estimates as of July 1; Figure 5). Net in-migration

increased from an average of 2,025 in the early

2000s to 2,750 a year from 2003 to 2008, and net

natural change increased from an average of 950

to 1,175 a year. Population growth slowed during

the economic downturn to an average of 1,725

people, or 0.7 percent, from 2008 to 2011, and net

in-migration declined to 450 people a year, but net

natural change increased to an average of 1,275

people. When the economy began expanding,

net in-migration averaged 1,275 people a year,

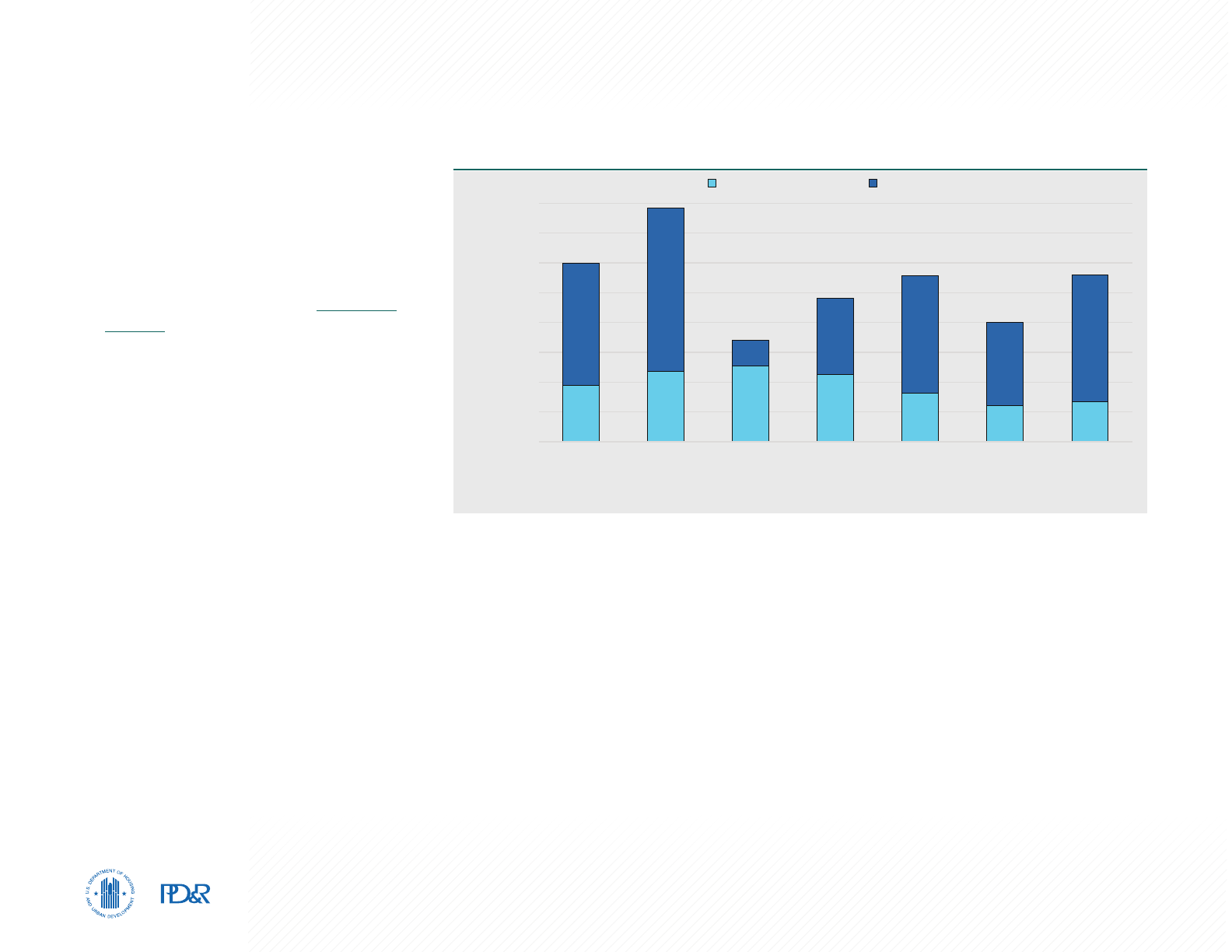

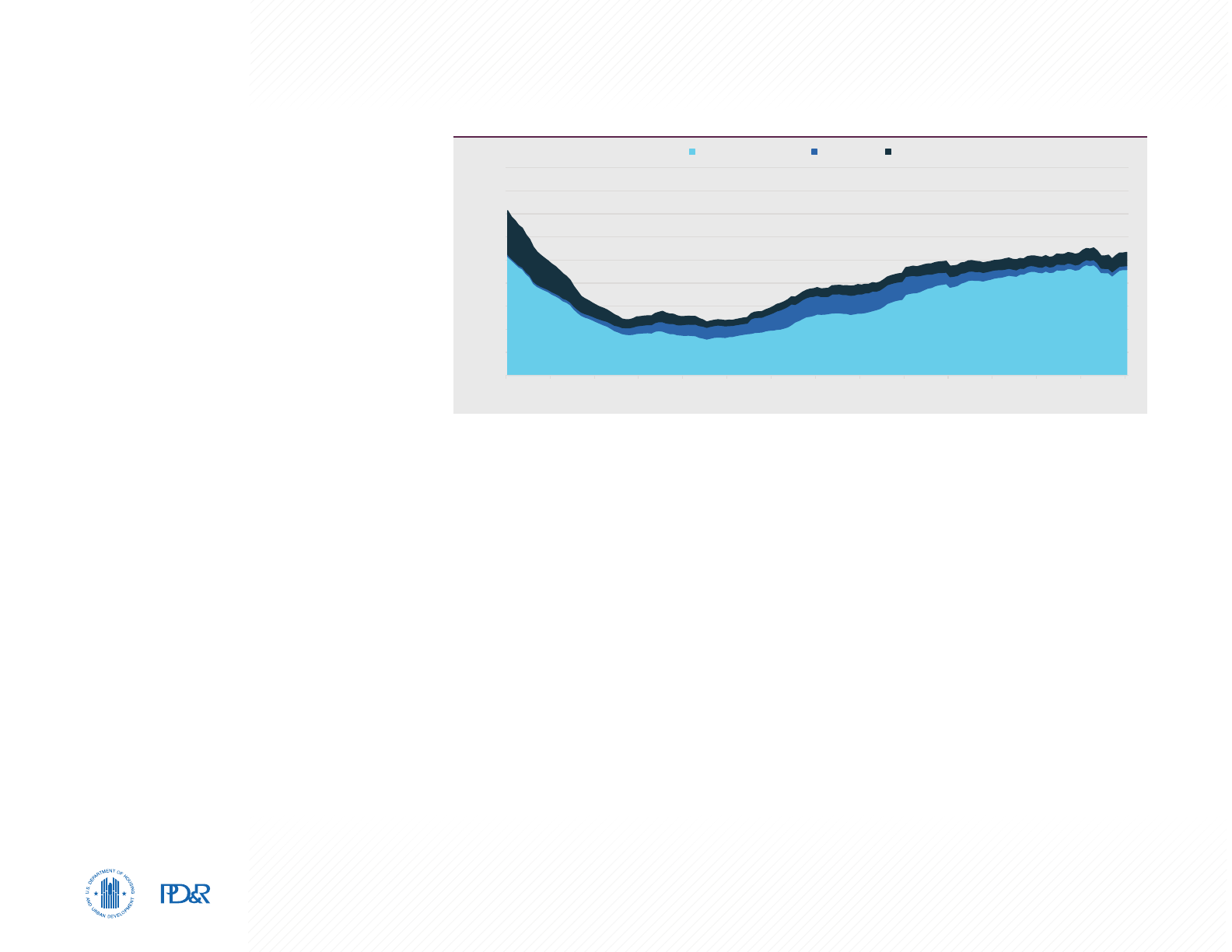

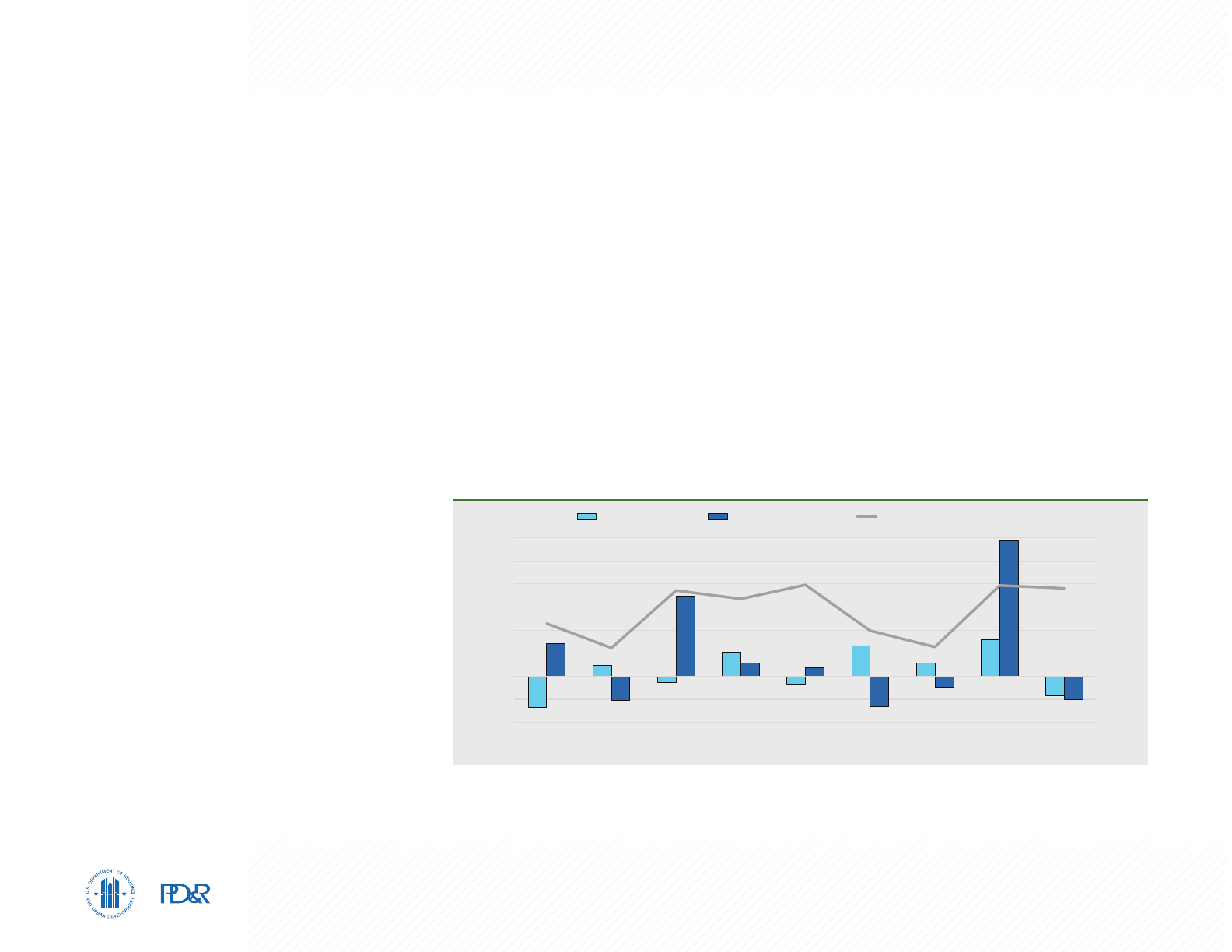

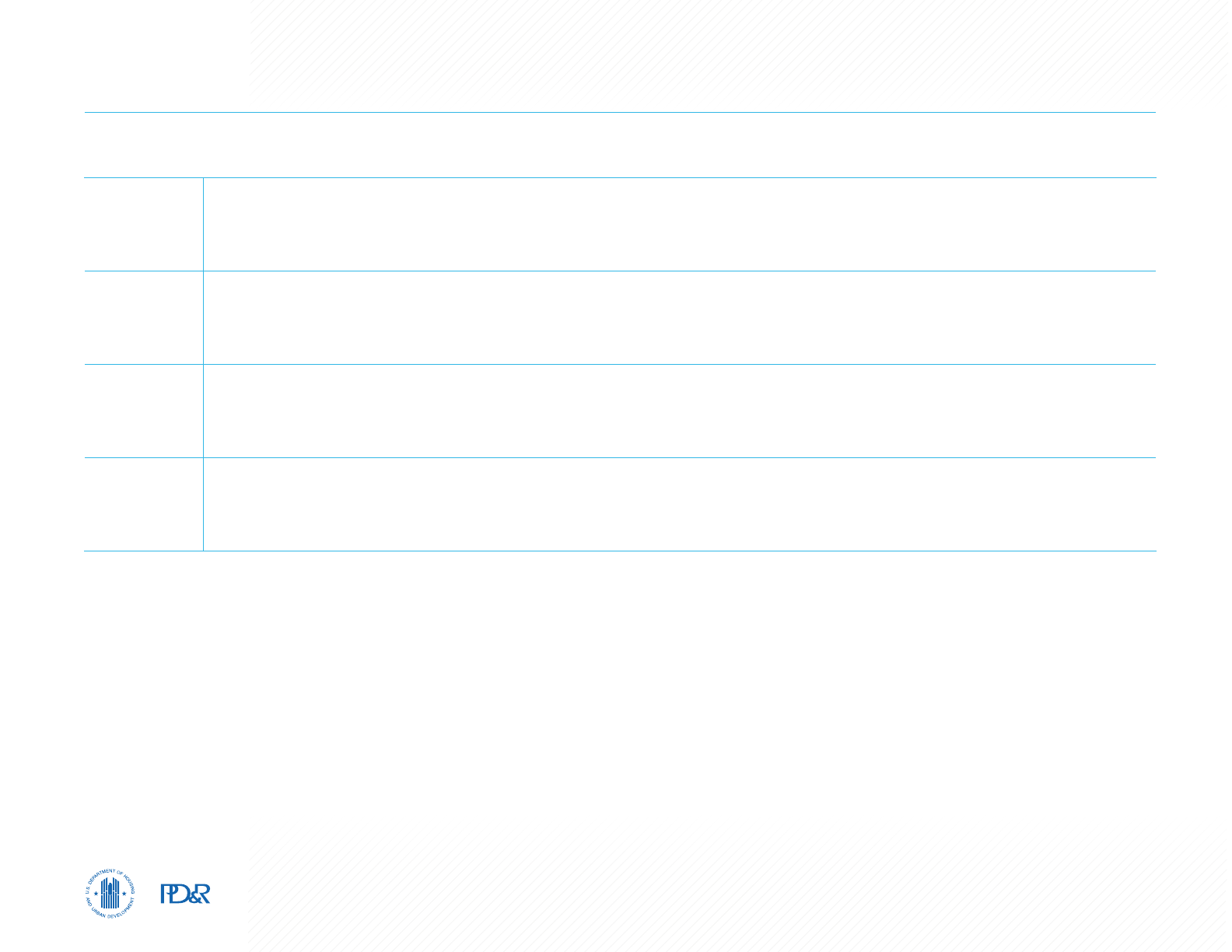

Figure 5. Components of Population Change in the Gainesville HMA, 2000 Through the Forecast

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

Population Change

Net Natural Change Net Migration

2000-2003

2003-2008

2008-2011

2011-2015

2015-2019

2019-Current

Current-Forecast

Notes: Net natural change and net migration totals are average annual totals over the time period. The forecast period is from the current date

(January 1, 2021) to January 1, 2024.

Sources: U.S. Census Bureau; current to forecast—estimates by the analyst

which offset a slowdown in net natural change to an average of 1,125 people, resulting in moderate population

growth of 2,400 people, or 0.9 percent, annually from 2011 to 2015. As the expansion accelerated, from 2015 to

2019, net in-migration increased to an average of 2,000 people a year, and net natural change slowed further

to an average of 800 people a year; population increased by an average of 2,800 people, or 1.0 percent,

annually. Despite strengthening economic conditions, the rate of population growth since 2010 was slower

than during the previous decade; this was due to a reduction in both net in-migration and net natural increase,

which averaged 1,525 and 990 a year, respectively, from 2010 to 2019, compared with 2,225 and 1,125 a year,

respectively, from 2000 to 2009. UF students represent nearly 20 percent of the population in the HMA as of

January 1, 2021, slightly higher than the 19-percent student portion of the population in 2010. UF enrollment has

grown an average of 1.4 percent annually since 2010 compared with 0.9 percent for the overall population.

Population and Households 10Gainesville, Florida Comprehensive Housing Market Analysis as of January 1, 2021

Comprehensive Housing Market Analysis Gainesville, Florida

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

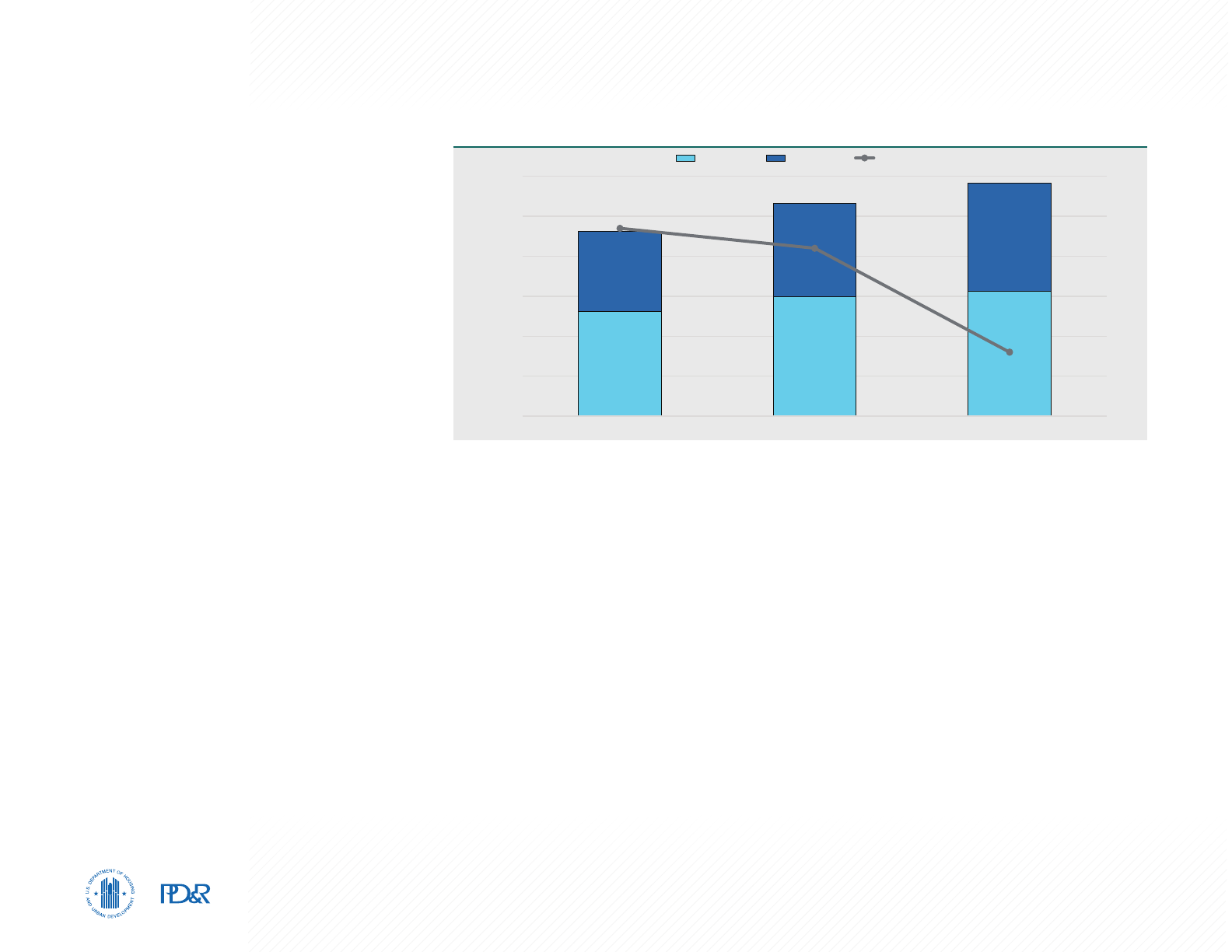

Household Trends

As of January 1, 2021, the number of households is

estimated at 116,700 (Figure 6). Similar to population

growth, household growth has slowed since 2010,

averaging 930, or 0.8 percent, annually, compared

with an average annual increase of 1,400, or 1.4

percent, from 2000 to 2010. During the 2000s, the

homeownership rate declined slightly from 56.7

percent in 2000 to 56.2 percent in 2010. From

2010 to the current date, the homeownership rate

has declined to 53.6 percent. Only 27 percent of

the growth in households has been attributed to

owner households since 2010, compared with 53

percent of growth from 2000 to 2010. On the other

hand, renter household formation has continued at

a similar pace since 2010, averaging 1.4 percent,

or 690 households, annually, compared with an

average annual increase of 1.5 percent, or 660

households, during the 2000-to-2010 period. Some

of the new renter households in the HMA were

students. At UF, approximately 11,550 students live

on campus (UF Housing). Most of the remaining

46,250 students live nearby in privately-owned

apartments and homes, representing approximately

15,400 households, or approximately 13 percent

of total households in the HMA and 28 percent

of renter households. Since 2010, approximately

600 beds have been added to the UF dormitory

inventory, whereas enrollment has increased by

more than 7,000 students.

56.7

56.2

53.6

52

53

54

55

56

57

58

0

20,000

40,000

60,000

80,000

100,000

120,000

2000 2010 Current

Homeownership Rate (%)

Households

Owner Renter Homeownership Rate (%)

Note: The current date is January 1, 2021.

Sources: 2000 and 2010—2000 Census and 2010 Census; current—estimates by the analyst

Figure 6. Households by Tenure and Homeownership Rate in the Gainesville HMA

Forecast

During the next 3 years, the Gainesville HMA population is expected to increase by an average of 2,800, or

1.0 percent, annually to 299,000, slightly higher than the population growth rate since 2010 (Table 3). Net

in-migration of 2,125 people is expected annually, and net natural increase is estimated to slow slightly to 675

people a year. The HMA will continue to attract new residents due to added payrolls and increased student

enrollment because of the high ranking of the university. The number of households in the HMA is expected to

increase at a slightly slower rate of 1,125, or 0.9 percent, a year to 120,000 by the end of the forecast. Slower

household growth is expected partly because students tend to form larger households. More than 40 percent of

the new households in the HMA are expected to be renter households.

Population and Households 11Gainesville, Florida Comprehensive Housing Market Analysis as of January 1, 2021

Comprehensive Housing Market Analysis Gainesville, Florida

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Population

Quick Facts

2010 Current Forecast

Population

264,275 290,600 299,000

Average Annual Change

3,200 2,450 2,800

Percentage Change

1.3 0.9 1.0

Household

Quick Facts

2010 Current Forecast

Households

106,637 116,700 120,000

Average Annual Change

1,400 930 1,125

Percentage Change

1.4 0.8 0.9

Notes: Average annual changes and percentage changes are based on averages from 2000 to 2010, 2010 to current, and current to forecast.

The forecast period is from the current date (January 1, 2021) to January 1, 2024.

Sources: 2000 and 2010—2000 Census and 2010 Census; current and forecast—estimates by the analyst

Table 3. Gainesville HMA Population and Household Quick Facts

Home Sales Market 12Gainesville, Florida Comprehensive Housing Market Analysis as of January 1, 2021

Comprehensive Housing Market Analysis Gainesville, Florida

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Home Sales Market

Market Conditions: Balanced

Total home sales are currently at

approximately two-thirds of the

2006 pre-Great Recession peak.

Recent Conditions

The sales housing market in the Gainesville HMA is

currently balanced, with an estimated vacancy rate

of 1.5 percent (Table 4), down from 3.1 percent in

April 2010 when conditions were soft. Approximately

5,325 new and existing homes sold during 2020.

Approximately 17 percent of the homes sold ranged

in price from $150,000 to $199,000 (Figure 7).

The inventory of active home listings during

December 2020 averaged 1.6 months of supply,

down from 2.6 months of supply during December

2019 (Gainesville-Alachua County Association

of Realtors®). The sales market has tightened

considerably compared with the recent high of

December 2012 when the average months of supply

of homes was 7.8 months.

Existing Home Sales

Existing home sales have generally increased in the

Gainesville HMA since a low of approximately 2,150

homes sold during 2009 (Zonda). Existing home

sales declined an average of 26 percent annually

from 2007 through 2009, when the economy was

weak, and population growth and the demand for

Home Sales

Quick Facts

Gainesville HMA Nation

Vacancy Rate

1.5% NA

Months of Inventory

1.6 2.3

Total Home Sales

5,325 6,212,000

1-Year Change

-2% -4%

New Home Sales Price

$305,500 $387,800

1-Year Change

0% 1%

Existing Home Sales Price

$226,700 $324,700

1-Year Change

8% 12%

Mortgage Delinquency Rate

3.7% 4.0%

NA = data not available.

Notes: The vacancy rate is as of the current date; home sales and prices are for the 12 months ending December 2020; and months of inventory and

mortgage delinquency data are as of December 2020. The current date is January 1, 2021.

Sources:

Vacancy rate estimate by analyst; CoreLogic, Inc.; Zonda; Gainesville-Alachua County Association of Realtors®

Table 4. Home Sales Quick Facts in the Gainesville HMA

Note: New and existing sales include single-family homes, townhomes, and condominium units.

Source: Zonda

0

5

10

15

20

$99k and

Lower

$100k to

$149k

$150k to

$199k

$200k to

$249k

$250k to

$299k

$300k to

$349k

$350k to

$399k

$400k to

$499k

$500k to

$1.2m

$1.2m and

More

Share of Sales (%)

Existing Sales New Sales

Figure 7. Share of Sales by Price Range During the 12 Months Ending December 2020 in the Gainesville HMA

Home Sales Market 13Gainesville, Florida Comprehensive Housing Market Analysis as of January 1, 2021

Comprehensive Housing Market Analysis Gainesville, Florida

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

homes slowed. From 2010 through 2013, existing

home sales increased rapidly, averaging gains of 13

percent annually, to 3,475 homes during 2013, while

net in-migration began to increase because the

economy was improving. From 2014 through 2019,

the economy improved, and existing home sales

rose an average of 6 percent a year to 4,950 homes

sold during 2019. During 2020, approximately 4,750

homes sold, down 4 percent from a year earlier due

to the effects of COVID-19.

Real estate owned (REO) sales accounted for

less than 2 percent of existing home sales in

the Gainesville HMA in 2006 but increased to a

high of 28 percent in 2012. While the economy

strengthened, REO sales fell 17 percent a year

from 2013 to 2020 and accounted for 4 percent of

existing sales in December 2020. This downward

trend is similar to the trend in REO sales for the

nation, which accounted for a high of more than

27 percent of existing sales in January 2009 and

decreased to slightly more than 3 percent of existing

sales in December 2020.

New Home Sales

Trends in new home sales in the Gainesville HMA

followed the overall trends in the economy, with

sales growth accelerating with job growth. From

2007 through 2011, new home sales fell an average

of 34 percent a year, decreasing from 1,900 homes

in 2006 to a low of 240 homes in 2011 (Figure 8).

As the economy began to recover after the Great

Recession in 2012 and 2013, new home sales rose

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

9,000

Dec-06

Dec-07

Dec-08

Dec-09

Dec-10

Dec-11

Dec-12

Dec-13

Dec-14

Dec-15

Dec-16

Dec-17

Dec-18

Dec-19

Dec-20

Sales Totals

Regular Resale Sales REO Sales New Sales

REO = real estate owned.

Source: Zonda

Figure 8. 12-Month Sales Totals by Type in the Gainesville HMA

an average of 20 percent annually to reach 340 homes sold in 2013. Sales of new homes continued to increase

from 2014 through 2019, gaining 6 percent annually because the economy continued to expand. New home

sales increased 21 percent in 2020 to 590 homes, partly because buyers were more comfortable touring vacant

homes during the pandemic.

Home Sales Prices

During 2020, the average price of an existing home was $226,700, up 8 percent from a year earlier. The price

was 7 percent above the pre-recession peak of $211,200 in August 2007. From 2008 through 2012, when the

local economy slowed and contracted, the average existing home sales price declined 7 percent annually, to

$144,400 in 2012, before rebounding 10 percent during 2013 to $158,300. From 2014 through 2019, prices for

existing homes increased at a moderate pace, rising an average of 5 percent annually to $210,400 in 2019.

The average price for new homes exceeded the 2007 pre-recession high of $236,400 in September 2014.

Before the recession, the average price of a new home rose 12 percent during 2007 before falling an average

of 7 percent annually from 2008 through 2010 (Figure 9). With a stronger economy, prices rose an average of

6 percent a year from 2011 through 2014. From 2015 through 2020, new home sales price growth moderated,

increasing an average of 4 percent a year to $305,500 in 2020.

Home Sales Market 14Gainesville, Florida Comprehensive Housing Market Analysis as of January 1, 2021

Comprehensive Housing Market Analysis Gainesville, Florida

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Seriously Delinquent

Mortgages

The rate of home loans that were seriously

delinquent or had transitioned into REO status in

the HMA has increased recently due to pandemic-

related job losses. During December 2020, the rate

was 3.7 percent in the HMA, up from 1.5 percent

a year earlier, but still well below the peak of 9.3

percent in mid-2012 (CoreLogic, Inc.). This increase

is due to the approximately 960 mortgages in

the HMA that were 90 or more days past due in

December 2020, more than two and one-half

times the number in December 2019. Despite the

recent increase in mortgage delinquencies, the

forbearance plans for federally backed mortgages in

the Coronavirus Aid, Relief, and Economic Security

(CARES) Act have allowed homeowners to avoid

foreclosure. Foreclosures fell by nearly 40 percent

since December 2019, and REOs have fallen by

more than one-half. By comparison, the rate for the

nation was 4.0 percent in December 2020, up from

1.4 percent in December 2019 and below the peak

of 8.6 percent in early 2010.

Sales Permit Activity

The current level of home construction activity, as

measured by the number of single-family homes,

townhomes, and condominiums permitted, is below

the level of the early-to-mid 2000s (Figure 10).

Permitting averaged 1,325 homes a year from 2000

through 2005, before declining by 220 homes, or

0

200

400

600

800

1,000

1,200

1,400

1,600

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

Single-Family Homes/Townhomes Condominiums

Notes: Includes single-family homes, townhomes, and condominiums. Data for 2020 are through December 2020.

Sources: U.S. Census Bureau, Building Permits Survey; 2000 through 2019—final data and estimates by the analyst; 2020—preliminary data and

estimates by the analyst

Figure 10. Average Annual Sales Permitting Activity in the Gainesville HMA

REO = real estate owned.

Source: Zonda

50,000

150,000

250,000

350,000

Dec-05

Dec-06

Dec-07

Dec-08

Dec-09

Dec-10

Dec-11

Dec-12

Dec-13

Dec-14

Dec-15

Dec-16

Dec-17

Dec-18

Dec-19

Dec-20

Average Sales Price ($)

Regular Resale Sales REO Sales New Sales

Figure 9. 12-Month Average Sales Price by Type of Sale in the Gainesville HMA

Home Sales Market 15Gainesville, Florida Comprehensive Housing Market Analysis as of January 1, 2021

Comprehensive Housing Market Analysis Gainesville, Florida

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

25 percent, annually from 2006 through 2011 to a

low of 300 homes in 2011, in response to weaker

sales market conditions. Permitting increased during

2012 and 2013, averaging 490 homes a year. As

the economic expansion strengthened from 2014

through 2019, permitting increased to an average

of 670 homes annually. During 2020, approximately

600 homes were permitted, down 29 percent from

the 840 homes permitted a year earlier (preliminary

data with adjustments by the analyst). The

construction of condominiums was more prevalent

during the early-to-mid 2000s, averaging 90 units

annually from 2000 through 2007. Since 2008,

however, fewer than 30 condominium units have

been permitted.

New Construction

Since 2010, homebuilding activity has mostly

occurred in Alachua County, in the cities of

Gainesville and Newberry, a community 30 miles

east of Gainesville. During the past decade,

nearly 60 percent of the construction has been

in unincorporated Alachua County. At Celebration

Pointe, a planned community east of Interstate 75

near Gainesville, 46 townhomes, with prices starting

in the low $300,000s, have been sold at The Vue, a

subdivision that will have 86 units upon completion

in 2021. About 15 percent of the homes built in the

past decade in the HMA were along Route 441 and

Interstate 75 near High Springs in northern Alachua

County, near employment centers. At Tara Village,

17 of the 20 available homes have been sold, which

NAHB = National Association of Home Builders. Q4 = fourth quarter.

Sources: NAHB; Wells Fargo

55

60

65

70

75

80

85

90

Q4 12

Q4 13

Q4 14

Q4 15

Q4 16

Q4 17

Q4 18

Q4 19

Q4 20

NAHB Opportunity Index

Figure 11. Gainesville HMA Housing Opportunity Index

range from 1,600 to 2,300 square feet and with prices starting at $278,000. Approximately 10 percent of new

homes built in the past decade were in the city of Newberry. All 80 homes have sold in Newberry Corners, now

in the third and final phase of construction. These three- and four-bedroom homes range from 1,546 to 1,876

square feet, with prices ranging from $211,900 to $274,900.

Housing Affordability: Homeownership

Homeownership in the Gainesville HMA declined from 2010 to 2019, similar to the nation as a whole. During

the previous decade, from 2000 to 2010, the homeownership rate in the HMA decreased by 0.4 percentage

points, despite less stringent lending standards in the early-to-mid 2000s. Strengthening economic conditions

did not reverse the trend, and the homeownership rate declined 1.9 percentage points from 2010 to 2019.

Homeownership in the Gainesville HMA is becoming increasingly expensive, and the affordability of buying

a home has trended downward since the early 2010s as home prices have increased at a much faster rate

than income. The National Association of Home Builders’ (NAHB)/Wells Fargo Housing Opportunity Index (HOI)

for the HMA, which represents the share of homes sold that would have been affordable to a family earning

the local median income, was 65.1 during the fourth quarter of 2020, and 131 of the 237 metropolitan areas

measured had greater housing affordability than the Gainesville HMA (Figure 11). The HOI reached a high of

Home Sales Market 16Gainesville, Florida Comprehensive Housing Market Analysis as of January 1, 2021

Comprehensive Housing Market Analysis Gainesville, Florida

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

86.3 during the fourth quarter of 2012 when a

relatively large number of distressed homes for

sale kept downward pressure on home prices.

The HOI trended downward until 2018 and then

started to trend upward again. Home sales prices

in the HMA increased an average of 5 percent

annually from 2012 to 2020; however, the median

income in the HMA increased only 2 percent

annually during the same period. The downward

trending index indicates a decline in affordability.

The recent upward trend in the HOI since 2018 is

partly because higher home prices have been offset

slightly by lower mortgage rates.

Table 5. Demand for New Sales Units in the Gainesville HMA

During the Forecast Period

Sales Units

Demand 2,475 Units

Under Construction 840 Units

Note: The forecast period is from January 1, 2021, to January 1, 2024.

Source: Estimates by the analyst

Forecast

During the next 3 years, demand is expected for 2,475 new homes in the HMA (Table 5). The 840 homes

currently under construction will satisfy a portion of the estimated demand during the first year of the forecast

period. The sales demand is expected to be relatively stable during the 3-year period because population

growth will continue to be modest and stable.

Rental Market 17Gainesville, Florida Comprehensive Housing Market Analysis as of January 1, 2021

Comprehensive Housing Market Analysis Gainesville, Florida

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Rental Market

Market Conditions: Balanced

The apartment market is slightly tight, with

a vacancy rate of 3.2 percent.

Current Conditions and

Recent Trends

Overall rental market conditions are currently

balanced in the Gainesville HMA. The rental vacancy

rate for all rental units (including apartments,

single-family homes, townhomes, and mobile

homes for rent) is estimated at 11.8 percent, down

from 12.4 percent in April 2010 when the market

was soft (Table 6). Rental market conditions had

generally followed economic conditions, becoming

soft during the economic downturn and tightening

when the economy strengthened. The apartment

market is typically tighter than the overall rental

market because of the demand for apartments by

UF students living off-campus. Students occupy

approximately one-fourth of rental units in the HMA.

Currently, there are fewer students on campus

because of countermeasures to slow the spread of

COVID-19. However, students are expected to return

to pre-pandemic levels in the fall of 2021.

Apartment Market Conditions

The apartment market in the HMA is currently

slightly tight. During the fourth quarter of 2020, the

apartment vacancy rate was 3.2 percent, up from

Table 6. Rental Market Quick Facts in the Gainesville HMA

2.5 percent during the fourth quarter of 2019 and below the 5.2 percent rate for the nation (Moody’s Analytics

REIS; Figure 12). The average apartment rent rose $13, or 1 percent, from a year earlier, to $1,013 during the

fourth quarter of 2020. By comparison, the average rent decreased 1 percent, to $1,383, nationally.

Student households account for 28 percent of renter households in the HMA. Some students rent apartments

similar to dormitories in which common rooms are shared and bedrooms are private. Others rent traditional

apartments, often sharing with roommates. The vacancy rate for student apartments, defined as those

apartments that are within 1 mile of the university that have more than 50 percent student renters, was 0.6

percent during the fall of academic year 2020–2021, down from 2.2 percent during the fall of academic year

2019–2020. The average student apartment rent rose $37, or 3 percent, from a year earlier, to $1,188 during the

fall of academic year 2020–2021. By comparison, student apartments that are rented by the bed are not as full.

The average per bed student vacancy rate was 5.7 percent, up from 1.7 percent during the fall of academic year

2019–2020. Part of the increase in per-bed vacancy can be attributed to fewer students on campus because

some have chosen to attend online courses during the pandemic. However, some vacancies can be attributed

to more units being added in the past year. The average student bed rent rose $24, or 4 percent, from a year

earlier, to $698 during the fall of academic year 2020–2021.

From 2006 through 2008, the overall apartment market in the HMA was balanced, and the supply of new

apartment units kept up with demand resulting from the economic expansion; during this period, the vacancy

rate averaged 5.7 percent, and the average rent increased 2 percent a year. The market softened in 2009 and

2010 during the economic downturn in the HMA; the vacancy rate rose to 8.2 percent, and rents fell 2 percent

annually. Market conditions trended toward balanced, with an average vacancy rate falling from 6.8 percent

Rental Market

Quick Facts

2010 (%) Current (%)

Rental Vacancy Rate

12.4 11.8

2010 (%) 2019 (%)

Occupied Rental Units by Structure

Single-Family Attached & Detached

27.0 26.0

Multifamily (2–4 Units)

16.0 18.0

Multifamily (5+ Units)

52.0 46.0

Other (Including Mobile Homes)

6.0 11.0

Notes: The current date is January 1, 2021. Percentages may not add to 100 due to rounding.

Sources: 2010 and 2019 American Community Survey, 1-year data; vacancy rate—2010 Census; current—estimates by the analyst

Rental Market 18Gainesville, Florida Comprehensive Housing Market Analysis as of January 1, 2021

Comprehensive Housing Market Analysis Gainesville, Florida

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

in 2011 to 4.1 percent in 2013 but tightened as

economic and population growth accelerated

and multifamily building remained low. Economic

conditions were relatively strong from 2014 through

2018. Student enrollment increased sharply, by an

average of 1,375, or 2.6 percent a year, compared

with 2011 through 2013, when student enrollment

increased by 160 students, or 0.3 percent a year.

Market conditions transitioned from balanced to

tight because multifamily construction remained

low. The vacancy rate decreased from 2.8 percent

in 2014 to 1.9 percent in 2018, and the average

rent increased 3 percent annually. The market

is expected to remain slightly tight until units

currently under construction are completed in 2021

and 2022.

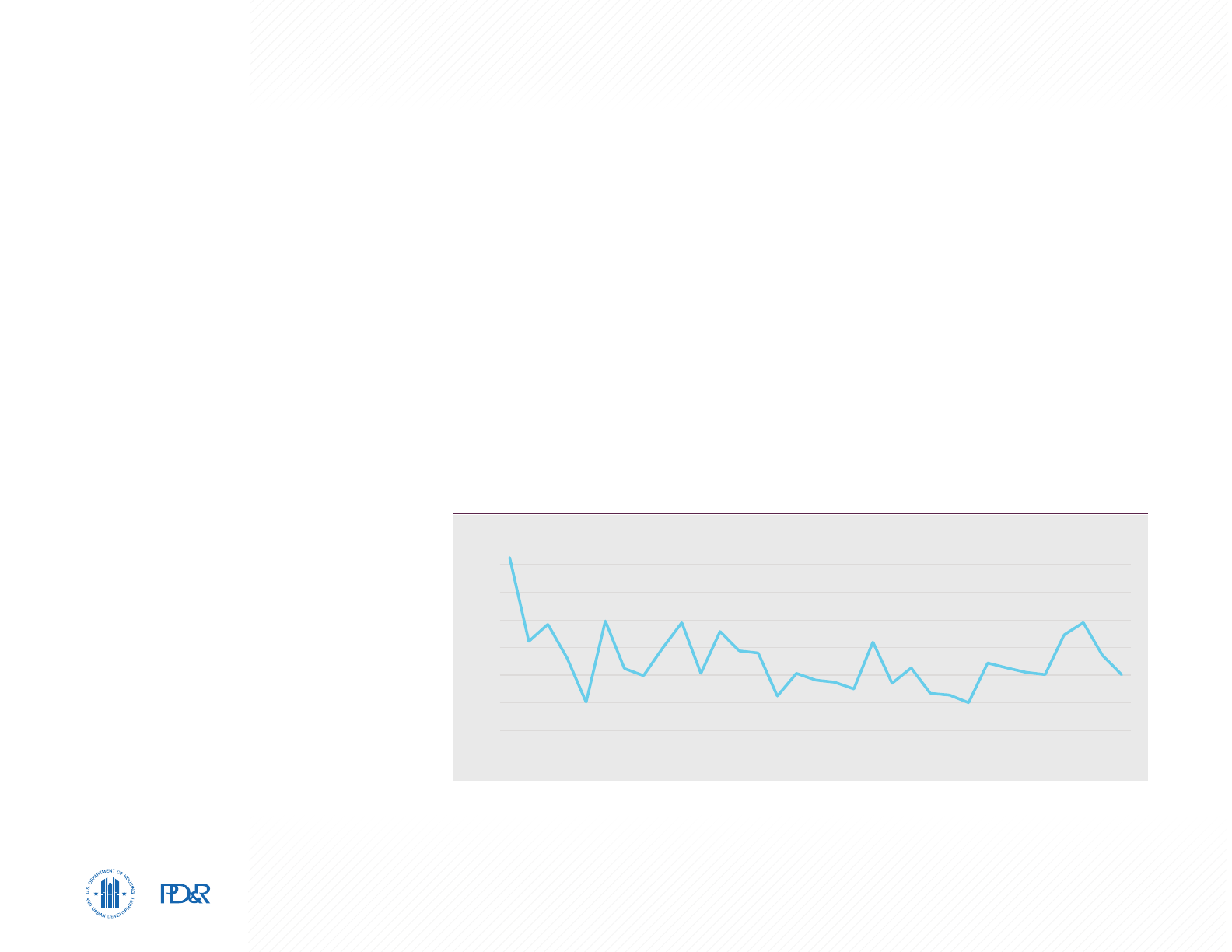

Rental Permit Activity

The number of rental units permitted has trended

higher since 2015 and is currently above the

average level of the early-to-mid 2000s but

below the 2007 peak (Figure 13). The number of

rental units permitted averaged 840 units from

2000 through 2006 in response to economic and

population growth. After reaching a peak of 1,625

in 2007, permitting decreased significantly to

an average of only 280 units permitted annually

during the economic downturn from 2008 through

2010. Permitting averaged 220 units a year from

2011 through 2014 because builders were slow

to respond to the steady expansion of the local

economy. The number of units permitted annually

0

100

200

300

400

500

600

700

800

900

1,000

1,100

1,200

1,300

1,400

1,500

1,600

1,700

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

Figure 13. Average Annual Rental Permitting Activity in the Gainesville HMA

Notes: Includes apartments and units intended for rental occupancy. Data for 2020 are through December 2020.

Sources: U.S. Census Bureau, Building Permits Survey; 2000 through 2019—final data and estimates by the analyst; 2020—preliminary data and

estimates by the analyst

Figure 12. Apartment Rents and Vacancy Rates in the Gainesville HMA

4Q = fourth quarter.

Source: Moody’s Analytics REIS

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

9.0%

10.0%

775

800

825

850

875

900

925

950

975

1,000

1,025

4Q 2006

4Q 2007

4Q 2008

4Q 2009

4Q 2010

4Q 2011

4Q 2012

4Q 2013

4Q 2014

4Q 2015

4Q 2016

4Q 2017

4Q 2018

4Q 2019

4Q 2020

Vacancy Rate (%)

Average Monthly Rent ($)

Average Monthly Rent Vacancy Rate

Rental Market 19Gainesville, Florida Comprehensive Housing Market Analysis as of January 1, 2021

Comprehensive Housing Market Analysis Gainesville, Florida

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

averaged 1,025 units from 2015 through 2019.

During 2020, 900 rental units were permitted, down

more than 40 percent from the 1,550 units permitted

a year earlier (preliminary data with adjustments by

the analyst). Some of this decline can be attributed

to builder caution because of the pandemic and an

increase in lumber prices.

Rental Construction Activity

Rental construction has been mostly concentrated in

the city of Gainesville and unincorporated Alachua

County since 2015. Integra Twenty Four, currently

leasing in west Gainesville, is a 232-unit community

with one-to-three-bedroom units with rents ranging

from $1,349 to $2,275. This development is between

UF and Interstate 75. Slightly more than 5 percent

of the rental units completed in the HMA in the

past 5 years were designed for renters age 55 and

older. On the eastern edge of the city of Gainesville,

Harper’s Pointe is a 66-unit, income-restricted

senior community expected to begin leasing in early

2021. These one- and two-bedroom units have rents

ranging from $680 to $875.

More than 80 percent of the rental units underway

are designed for UF students. Many apartments

for students consist of two-to-four-bedroom units,

with shared common areas and leases for individual

bedrooms. The Hub on Campus, built in 2020

across the street from UF, has 208 units, with

413 beds, and offers furnished bedrooms for rent

ranging from $750 to $1,280 per person. Currently,

apartment units under construction near UF include

50

55

60

65

70

75

80

85

90

-10%

-5%

0%

5%

10%

15%

20%

25%

30%

2011

2012

2013

2014

2015

2016

2017

2018

2019

Gross Rent Affordability Index

Median Gross Rent and Income Growth (%)

Gross Rent Change Median Income Change Gross Rent Affordability Index

Figure 14. Gainesville HMA Gross Rent Affordability Index

MSA = Metropolitan Statistical Area.

Notes: Rental affordability is for the larger Gainesville MSA. The Gross Rent Affordability Index differs from the HUD Rental Affordability Index

published on the U.S. Housing Market Conditions website. It is based on combined rent and utilities expenditure.

Source: American Community Survey, 1-year data

Liv+, a 235-unit apartment community, and Campus Circle, with 156 units. Both communities are within 1 mile

of UF and are expected to be complete by fall of 2021. These developments will rent individual bedrooms in

shared furnished apartments.

Housing Affordability: Renter

Rental affordability in the Gainesville HMA has improved since 2017 because moderate rent growth was

accompanied by a sharp increase in the median income. From 2017 to 2019, the median household income

for renter households in the HMA outpaced median gross monthly rent growth. As a result, the HUD Rental

Affordability Index, a measure of median renter household income relative to qualifying income for the median-

priced rental unit, has remained higher. Figure 14 compares the year-to-year change in the median gross rent

(including single-family homes, apartments, and mobile homes for rent) with the respective change in the

median gross income. After the post-recession low point of 66.1 in 2012, rent affordability fluctuated at higher

levels before reaching a new low of 66.3 in 2017. In 2018, strong income growth was accompanied by an

increase in the affordability index to 79.9. In 2019 the index fell slightly to 79.0.

During the 2013-through-2017 period, an estimated 20.6 percent of all renter households in the HMA were cost

Rental Market 20Gainesville, Florida Comprehensive Housing Market Analysis as of January 1, 2021

Comprehensive Housing Market Analysis Gainesville, Florida

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

burdened—spending between 30 and 49 percent

of their income on rent—while 29.7 percent were

severely cost burdened—spending more than 50

percent of income toward rent (Table 7). Nationwide,

a larger proportion of renter households were

cost burdened; however, fewer were severely cost

burdened, at 21.8 and 22.9 percent, respectively.

Cost burdens are particularly notable, however,

for lower income renter households in the HMA.

For renter households with incomes less than 50

percent of the Area Median Family Income (AMFI), a

slightly lower proportion, 19.0 percent, were paying

between 30 and 49 percent of their incomes toward

rent, but more than one-half of households at these

income levels, or 55.4 percent, were severely cost

burdened. The share was higher nationally for cost-

burdened households, at 25.6 percent, but lower for

severely cost-burdened households, at 50.1 percent.

Cost Burdened Severely Cost Burdened

Gainesville HMA Nation Gainesville HMA Nation

Renter Households with Income <50% HAMFI 19.0 25.6 55.4 50.1

Total Renter Households 20.6 21.8 29.7 22.9

Table 7. Percentage of Cost Burdened Renter Households in the Gainesville HMA by Income, 2013–2017

HAMFI = HUD area median family income.

Note: “Cost-burdened” households spend between 30–49 percent of their income on rent, and “severely cost-burdened” households spend over 50

percent of their income on rent.

Sources: Consolidated Planning/CHAS Data, 2013–2017 American Community Survey, 5-year estimates (huduser.gov)

Note: The forecast period is January 1, 2021, to January 1, 2024.

Source: Estimates by the analyst

Table 8. Demand for New Rental Units in the Gainesville HMA During the Forecast Period

Rental Units

Demand 1,775 Units

Under Construction 1,625 Units

Forecast

During the next 3 years, demand is expected for 1,775 new rental units in the Gainesville HMA (Table 8). Most of

the demand is expected to be met by the 1,625 units currently under construction. The demand is expected to

be relatively stable during each year of the forecast period because renter growth is expected to increase at a

stable rate, in line with student enrollment and job growth.

Terminology Definitions and Notes 21Gainesville, Florida Comprehensive Housing Market Analysis as of January 1, 2021

Comprehensive Housing Market Analysis Gainesville, Florida

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Terminology Definitions and Notes

A. Definitions

Building Permits

Building permits do not necessarily reflect all residential building activity that occurs in an HMA. Some units are constructed or created without a building

permit or are issued a different type of building permit. For example, some units classified as commercial structures are not reflected in the residential building

permits. As a result, the analyst, through diligent fieldwork, makes an estimate of this additional construction activity. Some of these estimates are included in

the discussions of single-family and multifamily building permits.

Cost Burdened Spending more than 30 percent of household income on housing costs.

Demand

The demand estimates in the analysis are not a forecast of building activity. They are the estimates of the total housing production needed to achieve a

balanced market at the end of the 3-year forecast period given conditions on the as-of date of the analysis, growth, losses, and excess vacancies. The

estimates do not account for units currently under construction or units in the development pipeline.

Distressed Sales Short sales and real estate owned (REO) sales.

Existing Home

Sales

Includes regular resale and real estate owned sales.

Forecast Period 1/1/2021–1/1/2024—Estimates by the analyst.

Terminology Definitions and Notes 22Gainesville, Florida Comprehensive Housing Market Analysis as of January 1, 2021

Comprehensive Housing Market Analysis Gainesville, Florida

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Home Sales/

Home Sales

Prices

Includes single-family, townhome, and condominium sales.

Net Natural

Change

Resident births minus resident deaths.

Other Vacant

Units

In this analysis conducted by the U.S. Department of Housing and Urban Development (HUD), other vacant units include all vacant units that are not available

for sale or for rent. The term therefore includes units rented or sold but not occupied; held for seasonal, recreational, or occasional use; used by migrant

workers; and the category specified as “other” vacant by the Census Bureau.

Rental Market/

Rental Vacancy

Rate

Includes apartments and other rental units such as single-family, multifamily, and mobile homes.

Seriously

Delinquent

Mortgages

Mortgages 90+ days delinquent or in foreclosure.

B. Notes on Geography

1.

The metropolitan statistical area definition noted in this report is based on the delineations established by the Office of Management and Budget (OMB) in the

OMB Bulletin dated April 10, 2018.

2. Urbanized areas are defined using the U.S. Census Bureau 2010 Census Urban and Rural Classification and the Urban Area Criteria.

3. The census tracts referenced in this report are from the 2010 Census.

Terminology Definitions and Notes 23Gainesville, Florida Comprehensive Housing Market Analysis as of January 1, 2021

Comprehensive Housing Market Analysis Gainesville, Florida

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

C. Additional Notes

1.

The NAHB Housing Opportunity Index represents the share of homes sold in the HMA that would have been affordable to a family earning the local median

income, based on standard mortgage underwriting criteria.

2.

This analysis has been prepared for the assistance and guidance of HUD in its operations. The factual information, findings, and conclusions may also be

useful to builders, mortgagees, and others concerned with local housing market conditions and trends. The analysis does not purport to make determinations

regarding the acceptability of any mortgage insurance proposals that may be under consideration by the Department.

3.

The factual framework for this analysis follows the guidelines and methods developed by the Economic and Market Analysis Division within HUD. The analysis

and findings are as thorough and current as possible based on information available on the as-of date from local and national sources. As such, findings or

conclusions may be modified by subsequent developments. HUD expresses its appreciation to those industry sources and state and local government officials

who provided data and information on local economic and housing market conditions.

Cover Photo iStock

Contact Information

Karen M. Ostrye, Economist

Atlanta HUD Regional Office

678–732–2233