Exceptional travel experiences have landed.

TD

®

Aeroplan

®

Visa Ininite Privilege

*

Credit Card

The world is waiting. Your new travel Card will take you there.

The TD

®

Aeroplan

®

Visa Ininite Privilege Credit Card

The Card that sets your air travel experiences apart has inally arrived.

TD and Aeroplan® have come together to provide

discerning travellers – like yourself – with premium

travel beneits, elevated travel experiences and special

access. Not only is your Card crafted with metal, it also

comes with premium features designed to make your

travel journey as luxurious as your destination.

Let’s begin your journey, together.

| 4

6

12

16

28

34

38

43

What you’ll ind inside:

Earning Aeroplan points

Redeeming Aeroplan points

Travel beneits

Insur

ance coverage

Convenience

Card security

Quick reference

Discovering exceptional travel beneits is just the beginning.

Earning Aeroplan points

| 7

We’re on board with getting you to your destination, faster.

Exceptional travel starts with every purchase you make with your Card.

We’ve paired earning points with exciting Card features to accelerate your travel goals. Ready to start getting

closer to your next getaway?

Here’s how you’ll earn:

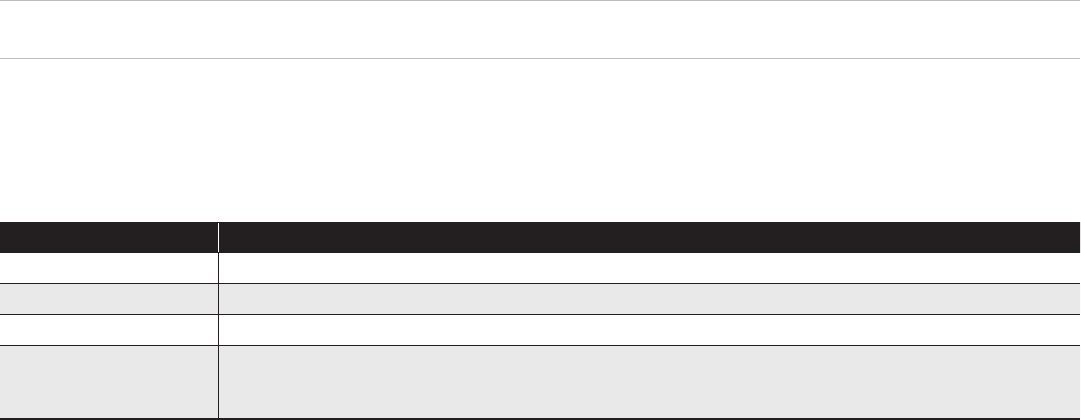

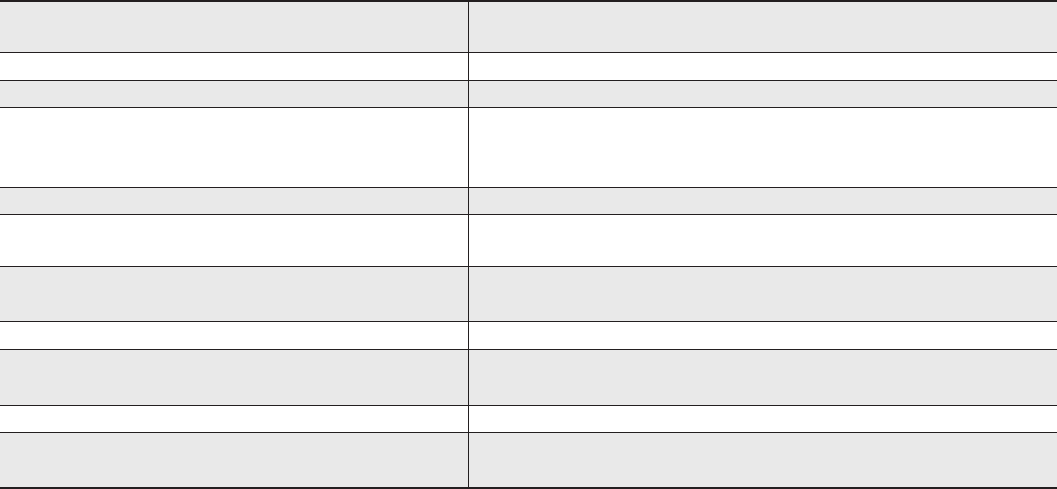

What you earn Purchases made on your Card

2 points

1

for every $1 On eligible Air Canada® purchases (including Air Canada Vacations)

1.5 points

1

for every $1 Gas, Grocery, Travel and Dining

1.25 points

1

for every $1 All other Purchases

Earn points twice

2

Pay with your TD® Aeroplan® Visa Ininite Privilege Card and provide your Aeroplan membership

number at over 150 Aeroplan partner brands. Visit aircanada.com/retailpartners for the complete

list. Or, shop online at 170+ online retailers via the Aeroplan eStore at aircanada.com/aeroplanestore

Remember, your points will not expire so long as you are the Primary Cardholder of a

TD® Aeroplan® Visa Ininite Privilege Card.

| 8

Keep reaching higher with

Aeroplan® Elite Status.

Another way to ly in exceptional fashion.

See how you can take travel to even greater heights with accelerated

earning toward Aeroplan Elite Status.

As the Primary Cardholder, you’ll earn 1,000 Status Qualifying Miles and

one (1) Status Qualifying Segment for every $5,000 of net purchases

(less any returns

and credits) made by you or your Additional Cardholder(s)

using your TD® Aeroplan® Visa Ininite Privilege Card

3

.

T

o learn more about Aeroplan Elite Status,

visit aircanada.com/elite

| 9

Open up new access to

travel beneits.

Give the gift of access to Air Canada travel

beneits to Additional Cardholders.

By adding up to three Additional Cardholders

4

(additional fees apply)

to your Account, you’ll earn points every time they use their Cards to

make Purchases. Additional Cardholders have access to select

Air Canada travel beneits, even when you’re not travelling together.

Additional Cardholders must link their Aeroplan number

at aircanada.com/linkmycard in order to receive access

to

applicable Air Canada travel beneits.

| 10

Set up, save time, earn points.

Earn 1.25 points for every $1 spent on regularly

recurring bill payments set up on your Account.

Simply manage your regularly recurring bill payments on your

Account through participating merchants for things like TV or

phone bills. Save time and avoid late fees when your bills are paid

automatically on their due dates.

Find out how at td.com/billpay

Redeeming Aeroplan points

| 13

Travel upgrades are just the beginning.

As your Aeroplan points add up, your rewards come faster

than you’ve ever imagined.

Redeem your points for travel and for so much more.

Every seat, every light, no restrictions.

Every Air Canada seat available to buy for cash is also

available to be redeemed for points – no restrictions, no

blackout periods. Receive access to preferred pricing

5

on

light rewards. As a Primary Cardholder, you can often

book light rewards for fewer points.

Use Aeroplan points for more than lights.

Redeem your points across your trip, from hotel rooms to

car rentals.

Use Aeroplan points for life’s necessities.

Aeroplan isn’t just about travel. Use your points for

merchandise, experiences and gift certiicates.

To learn more about the many ways you can use your points

to live the exceptional life, visit aircanada.com/redeem

| 14

See more places with Aeroplan.

Choose lights to 200+ destinations with Air Canada®, and to

over 1,300, together with 30+ airline partners

6

.

Where could your Aeroplan points take you?

Plan your future reward travel by using Aeroplan’s Points

Predictor Tool. Check your preferred itinerary, and the tool

will show you the range of points you’ll likely need to redeem

for that light reward.

And don’t forget – as a Primary Cardholder with a

TD® Aeroplan® Visa Ininite Privilege Card, you’ll have

opportunities to redeem for fewer points when you log in

to aircanada.com

Visi

t aircanada.com/pointspredictor

to start exploring today!

Redeem more lexibly with Points + Cash.

You have the lexibility to pay for part of your trip with points

and use your TD® Aeroplan® Visa Ininite Privilege Card to

pay for the rest (and earn points, too).

To learn more about this lexible way to

take light, visit aircanada.com/redeem

Travel beneits

| 17

Take advantage of every extra beneit your Card has to oer.

Your TD® Aeroplan® Visa Ininite Privilege Card comes with

special Air Canada travel beneits.

Treat yourself to a life of travel luxury with exceptional privileges when you ly with Air Canada.

Special Cardholder Advantage.

Relax before takeo with access to an Air Canada Maple Leaf Lounge

TM,7,8

. Primary Cardholders and Additional Cardholders

on the Account can access Air Canada Maple Leaf Lounges in North America whether they’re lying together or

separately with a same day ticket on a departing Air Canada or Star Alliance light. They can even each bring a guest.

Share your travel perks with your travel companions.

Whether you book using points or cash, Primary Cardholders, Additional Cardholders, and travel companions (up to

eight) travelling on the same reservation will all enjoy the following beneits on any light operated by Air Canada®,

Air Canada Rouge® or under the Air Canada Express® banner

7

:

Additional Cardholders must link their Aeroplan number at airca

nada.com/linkmycard

in order to receive access to these Air Canada travel beneits.

| 18

1) Free irst checked bag

9

Travel lightly through the airport and save on baggage fees.

Y

ou and up to eight travel companions travelling on the

same reservation will all enjoy your irst checked bag free

(up to 23kg/50lb) when travel originates on an

Air Canada light.

2) Priority Airport Services

10

Priority Check-In

Check-in faster at the airport. You and up to eight travel

companions travelling on the same reservation will all

receive priority check-in for any trip that originates on an

Air Canada light.

Priority Boarding

Get on board your light earlier. You and up to eight

travelling companions travelling on the same reservation will

all enjoy Zone 2 priority boarding for any Air Canada light.

Priority Baggage Handling

Save time leaving the airport. All your baggage will be

tagged priority, so you and up to eight travel companions

travelling on the same reservation will ind your luggage

among the irst on the carousel when arriving at your

destination. This applies to travel that originates on an

Air Canada light.

3) Priority Airport Standby & Priority Airport Upgrades

11

Get better access to seats when you’re on standby.

If y

ou and travel companions (up to eight) travelling on

the same reservation are on standby at the airport for an

Air Canada light, get on your way with priority. Should a

seat become available, you will be assigned it before

members who have the same status but don’t hold a

TD® Aeroplan® Visa Ininite Privilege Card.

Receive higher priority for airport upgrades.

If you’re a Cardholder with Aeroplan Elite Status, you and

up to eight travel companions travelling on the same

reservation get higher priority when you’re on standby for

an upgrade at the airport on Air Canada lights. Should a

seat become available, you will be assigned to it before

members who have the same status but don’t hold a

TD® Aeroplan® Visa Ininite Privilege Card.

| 19

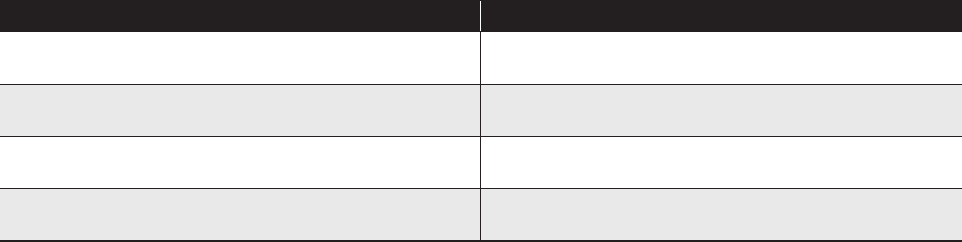

Treat someone to a great trip anywhere in the world.

Travel exceptionally with someone you love on the Annual Worldwide Companion Pass.

As the Primary Cardholder, you can take advantage of an annual round-trip companion pass, which

entitles you to buy a companion ticket from $99 (plus taxes, fees, charges and surcharges). You get a

companion pass automatically on your Card anniversary if you have spent $25,000 on net purchases in

the preceding twelve months

12

. The chart below illustrates how you can use the pass.

Where you want to go: Base fare:

Travel within Canada and the continental United States

(excluding Hawaii)

$99 CAD base fare (plus taxes, fees, charges and

surcharges)

Travel to/from Hawaii, Mexico, Central America and

the Caribbean

$299 CAD base fare (plus taxes, fees, charges and

surcharges)

Travel to/from South America, Europe, the Middle East

and Africa

$499 CAD base fare (plus taxes, fees, charges and

surcharges)

Travel to/from Asia, Australia and New Zealand $599 CAD base fare (plus taxes, fees, charges and

surcharges)

| 20

Get more out of Aeroplan Elite Status.

As the Primary Cardholder, if you already hold Aeroplan Elite Status,

having a TD® Aeroplan® Visa Ininite Privilege Credit Card can help you

access and enjoy even more enhancements:

Mai

ntain Aeroplan Elite Status more easily.

You can roll over up to 200,000 Status Qualifying Miles (SQM) beyond

the status level for which you’ve qualiied, from the prior qualiication

year to qualify for status the next year

13

.

Enjoy your eUpgrades longer.

If you requalify for Aeroplan Elite Status the next year, you can roll over

up to 50 unused eUpgrade credits, to be used during the following

status year

14

.

To learn more about Aeroplan Elite

Status, vis

it aircanada.com/elite

| 21

NEXUS™ Fee Reimbursement

15

.

A smooth journey awaits.

As a TD® Aeroplan® Visa Ininite Privilege Cardholder, you also

hav

e the opportunity to save on your NEXUS fee while you save

time crossing the border. You and your Additional Cardholders

will receive a rebate of up to $100 CAD each, for a NEXUS

application and/or renewal fee charged on your Card, once

every 48 months. The rebate will appear automatically on your

monthly statement as a statement credit.

| 22

Your TD

®

Aeroplan

®

Visa Ininite Privilege Card creates the

convenience and simplicity your life needs.

Let’s look at the qualities that make your Card exceptional.

Visa

Ininite Privilege Beneits

It’s time to take advantage of special oers, unique opportunities and exceptional experiences designed for

TD® Aeroplan® Visa Ininite Privilege Cardholders

16

:

• Global Airport Lounge Access

Receive a complimentary membership to the Visa Airport

Companion

17

Program hosted by Dragonpass International Ltd.

and take advantage of six lounge visits included for each

Cardholder per membership year at over 1,200 airport lounges

worldwide. Enroll through the Visa Airport Companion App or

through visaairportcompanion.ca

• Visa Ininite Privilege Airport Beneits

Receive exclusive perks at Toronto City Airport Terminal,

Vancouver Airport, Ottawa Airport and Montreal-Trudeau

International Airport.

– Enjoy Priority Security Lanes (Toronto, Ottawa,

Vancouver and Montreal-Trudeau)

– Priority airport taxi and limo lane (Vancouver)

– Access to dedicated premium parking spots

(Ottawa and Vancouver)

– Up to 20% o parking (Ottawa, Vancouver and

Montreal-Trudeau)

| 23

• Enroll in the Visa RSVP Rewards™ Beneit

18

and automatically receive

Diamond status delivering beneits at 60+ participating Sandman,

Sandman Signature and Sutton Place Hotels from coast-to-coast

inCanada and beyond.

• Get access to exclusive gourmet dining events that cater to your

reined taste. The Visa Ininite Dining Series serves up culinary

explorations with prized chefs and acclaimed wines.

• Receive seven exclusive beneits when you book your stay through

the Visa Ininite Luxury Hotel Collection, featuring over 900 of the

world’s most intriguing properties. Enjoy an additional eighth beneit

at over 200 properties, exclusively for Visa Ininite Privilege Cardholders.

• Get exclusive access to tickets to curated events across Canada

throughout the year. Visa Ininite Cardholders can also enjoy exclusive

beneits, access and oers for the Toronto International Film Festival®.

• Experience exclusive beneits at over 95 participating wineries

in British Columbia, Ontario, and Sonoma Valley through the

Visa Ininite Wine Country Program. Discover a variety of exciting

beneits on-site when you show your Visa Ininite Privilege Card,

including discounts on wine purchases, complimentary tastings,

private vineyard tours and much more.

| 24

• Receive elevated Troon Rewards® Platinum Status at over

150courses and 20% o on green fees, merchandise and lessons

at participating Troon Rewards golf courses. Cardholders can

also access a selection of over 25privateclubs across the U.S.

for $99 USD per round.

• Visa Ininite Privilege Concierge Service On call, 24 hours a

day, seven days a week, the Visa Ininite Privilege Concierge

can help with any Cardholder request, big or small, to help

you get the most from life whenever you travel, shop and use

your Card

19

.

Call toll-free 18558221240 from Canada and the U.S., or

13039671036 from outside Canada and the U.S. Learn

more

at visaininite.ca/privilege

F

or more details on the TD Aeroplan Visa Ininite Privilege Card

beneits and to see all available offers, please

visit

visaininite.ca/privilege

| 25

Emergency support and car rental

beneits.

Emergency Travel Assistance Services

20

.

Help is just a call away with toll-free access in the event of a personal

emergency while

travelling. Emergency Travel Assistance Services can

help you with:

• Translation services in the event of an emergency situation.

• Lost documents and ticket replacement.

• Emergency Cash Transfer in the event of a theft, loss or emergency.

Our Administrator can assist you to obtain a Cash Advance which will

be charged to your Account.

Call 18663741129 in Canada and the U.S, or call collect 4169774425 in

all other countries.

| 26

Save with Avis Rent a Car and Budget Rent a Car.

Save a minimum of 10% o the lowest available base rates

21,22

in Canada and the U

.S.,

and a minimum of 5% o the lowest available base rates

21,22

internationally, on qualifying

car rentals at participating Avis and Budget locations:

Avis:

You can reserve your Avis car rental by visiting avis.com/tdcreditcards

Quote Avis Worldwide Discount (AWD) #C078400 at the time of reservation

and charge the full r

ental to your TD® Aeroplan® Visa Ininite Privilege Card.

Budget:

You can reserve your Budget car rental by visiting budget.com/tdcreditcards

Quote Budget Customer Discount (BCD) #A331700 at the time of reservation and

charge the full rental to your TD® Aeroplan® Visa Ininite Privilege Card.

Insurance coverage

| 29

Explore the insurance coverages included with your

TD

®

Aeroplan

®

Visa Ininite Privilege Card.

Tra

vel Medical

Insurance

23

You have coverage without even having to charge the

trip to your Card! Going away for a day, a week or an

extended vacation is a great way to leave your worries

behind. To help you with emergency medical expenses,

your TD® Aeroplan® Visa Ininite Privilege Card features

Travel Medical Insurance, which includes:

• Up to $5 million of emergency medical coverage when

you are travelling outside of your home province or

territory, whether internationally or within Canada.

• Direct payment to medical service providers, where

possible, for eligible medical emergency expenses

such as physician’s bills, prescriptions and accidental

dental treatment.

• 24/7 emergency medical assistance.

• Coverage for the irst 31 days of your trip if you are

under 65 years of age. If you or your spouse is aged

65 or older, you are covered for the irst 4 days of your

trip. For longer trips, top-up coverage is available for

purchase by calling 18663741129.

| 30

Tri

p Cancellation/Trip

Interruption Insurance

24

Use your Card and/or Aeroplan points to pay for at

least 75% of the cost of the Covered Trip, and you’ll

have coverage for up to $2,500 per insured person

(up to a maximum of $5,000 for all insured persons) if

you need to cancel your travel plans before you leave

because of a covered cause, and up to $5,000 per

insured person (up to a maximum of $25,000 for all

insured persons on the same covered trip) if you need

to come home early due to a covered cause. If you

require additional coverage, you may be eligible to

increase your coverage for an additional premium by

calling 18663741129.

Fligh

t/Trip Delay

Insurance

25

If your trip is delayed for over four hours, you have coverage

up to $1,000 for reasonable and eligible hotel, motel or

restaurant expenses when you use your Card and/or

Aeroplan points to pay for at least 75% of the cost of

your transportation.

Dela

yed and Lost

Baggage Insurance

25

If your baggage is delayed for over four hours, each insured

person on your trip has coverage up to $1,000 for the

purchase of essentials, such as clothing and toiletries.

Coverage is also provided if your baggage is lost by a

common carrier. When you use your Card and/or

Aeroplan points to pay for at least 75% of the cost of the

tickets, each insured person has coverage up to an

overall maximum of $2,500 per trip.

| 31

Common Carrier Travel Accident Insurance

26

You, your spouse and dependent children are eligible for up to

$500,000 in coverage for covered losses while travelling on a

common carrier (for example, a bus, ferry, plane or train) whenever

you charge the full cost of the transportation to your Card and/or

Aeroplan points.

Hotel/Motel Burglary Insurance

27

When you stay at a hotel/motel within Canada or the United States

and use your Card and/or Aeroplan points to pay for at least 75% of

the total cost of your stay, you will receive up to $2,500 of coverage

per occurrence for most personal items stolen from your hotel or

motel room belonging to the Cardholder on the Account and

eligible family members travelling with the Cardholder.

| 32

Mobile Device Insurance

2 7

You get mobile device protection of up to $1,500 in the event

of loss, theft, accidental damage or mechanical breakdown

for eligible mobile devices when you use your Card to pay all

of your monthly mobile bill payments and any upfront costs or

charge at least 75% of the purchase price when paying the full

cost of your new mobile device up front.

Auto Rental Collision/Loss Damage

Insurance

28

Use your Card and/or Aeroplan points to pay for the full cost

of an eligible car rental and decline the rental agency’s

Collision Damage Waiver (CDW) to get coverage at no

additional cost for up to 48 consecutive days. Please note,

some rental agencies may require you to buy the CDW

coverage from them. It is important to contact the rental

agency before reserving a car to verify their policies.

Purchase Security and

Extended Warranty Protection

29

You automatically have access to Purchase Security and

E

xtended Warranty Protection, which includes coverage for

eligible items you’ve purchased with your Card:

• Get repair, replacement, or reimbursement for your

purchases should eligible items be stolen or damaged within

120 days of purchase.

• Double your warranty for up to 24 additional months if the

eligible item came with a manufacturer’s warranty valid in

Canada.

TD Credit Card Payment Protection Plan

30

This optional insurance product is

designed to help you deal

with your TD Credit Card payment obligations in the event of a

covered Job Loss, Total Disability, or loss of Life. To learn more

or to enroll, call 18663159069 or visit td.com/BP

Convenience

| 35

Making life easier in exceptional fashion.

Learn more about the beneits that come with your Card, including dierent ways to use them to

simplify everyday life.

Apply for optional

TD Auto Club Membership

W

ith optional Deluxe or Standard TD Auto Club

Membership

31

, you and your family will enjoy peace of

mind knowing that in the event of a road emergency,

help is just a phone call away. For information and to

enroll, call 18002450297 or visit td.co

m/autoclub

Manage your

Account

Accessing your Account information should always

be clear and easy. Here are the many ways available:

1. Download the TD app at td

.com/app to view your

Account and bank on the go.

2. Sign up for EasyWeb® Online banking at

easyweb.td.com to access and manage your

Account online and sign up for online statements.

3. Access your Account through any of the over

1 million ATMs worldwide.

4. Chat with our TD Credit Cards Contact Centre at

1-8662223456.

| 36

Ways to pay

Use your Card conveniently – however you want to pay for your purchases.

Save time with Apple Pay,

and/or Samsung Pay

These Digital Wallets are accepted in a growing number

of shops, restaurants, and other retailers, making it

convenient and easy to use for your everyday purchases.

To learn more: www.td.com/waystopay

Tap to pay

with Visa

Contactless payments are a secure way to pay for

small-dollar purchases at participating retailers. It’s faster

and more convenient than cash – and your Card never

leaves your hand.

Simplify the way you pay with

TD Mobile Payment for Android

The next time you’re on the go, like on your morning run or

walking the dog, don’t worry about reaching for cash for

your small purchases. Use your Android

TM

smartphone

32

.

With TD Mobile Payment, just link an eligible TD Credit Card

to the TD app and you can pay safely and securely in a few

seconds. Visit td.com/waystopay

Paying online with your TD Visa Card

is easy, smart and secure

Online buying is evolving so you can pay with fewer

clicks. Paying online with your TD Visa Card is easy,

smart, and secure. Just click to pay with your TD Visa

when you see the Click to Pay icon where Visa is

accepted. Enroll now at visa.ca

Card security

| 39

Feeling secure about your Card is just as

important as how your Card makes you feel.

Manage your credit card in the TD app.

Instantly lock your credit card and block international purchases at your ingertips.

Lock or unlock your Card.

Feel more conident if you misplace your credit card by locking your Card in the TD app. When locked,

Pre-Authorized Payments and ATM transactions will still go through, credit card payments will still be

accepted, and you can make transfers. If you ind your Card, it’s just as easy to unlock it.

Block international in-person purchases.

Not travelling? You can block international in-person purchases directly from the TD app. When your

credit card is blocked, in-person purchases outside of Canada like hotels and restaurants will be

declined. Online and recurring payments will still be processed. When you decide to travel, simply

unblock your Card to use it on your trip.

| 40

Shop online and in person

securely with Visa Zero Liability.

Be protected in the event that unauthorized transactions are made on your Card. See your Cardholder Agreement

for complete information on unauthorized transactions and your responsibilities, including your responsibility to

protect your PIN.

Shop with conidence with

Chip and PIN technology.

Chip and PIN technology provides an added level of security through the use of a Personal Identiication Number

(PIN). When choosing your PIN, here are some tips to help keep it as secure as possible:

• Choose a PIN you can remember that’s diicult to guess.

• Don’t use a phone number or birthday.

• Never write down your PIN.

• Protect your PIN and use your hand or body to shield the keypad when you enter your PIN.

• Never let anyone else know or use your PIN or use your Card.

• Make transactions only when and where you feel secure. If in doubt, don’t use your Card.

• Reset your PIN easily and conveniently at a TD Branch or 24/7 at any TD Green Machine (ATM).

| 41

24Hour fraud protection.

Our enhanced protection measures are part of an industry-wide eort to protect you from the

inconvenience of credit card fraud. In the event that our advanced fraud prevention system detects

unusual activity relating to your Account:

• You may receive a phone call from a TD Credit Card customer service representative asking you to

conirm that you, or an Additional Cardholder

, performed a transaction on your TD Credit Card Account.

• During a transaction, a merchant may receive an electronic message requesting that they contact the

TD Credit Card Contact Centre and allow you to speak with one of our customer service

representatives.

• Your Card may be temporarily blocked until we can contact you for veriication.

• You can now automatically receive TD Fraud Alerts to your mobile phone any time we suspect

suspicious activity on your TD® Aeroplan® Visa Ininite Privilege Card.

• You may receive TD Fraud Alerts on your mobile phone any time we suspect suspicious activity on your

TD® Aeroplan® Visa Ininite Privilege Card. Learn more at td.com/fraudalerts

• If you have any questions about fraud protection, please do not hesitate to call our Loss Prevention

Centre immediately and speak to one of our customer service representatives, 24 hours a day, seven

days a week. In Canada and the U.S., call toll-free: 18883473261. Outside Canada and the U.S., call

collect: 4163083763.

| 42

Keeping your Card secure and ready when you are.

Here are some numbers to keep handy in case you ever need

to reach out to us for assistance.

If you

r TD Credit Card is damaged or not working

You can request a replacement Card online through EasyWeb, through the

TD app using your mobile device, or by phone at 18009838472.

If your TD Credit Card has been lost or stolen

You must immediately report this to us by phone at 18009838472. You can

also lock your Card through the TD app.

Fast, reliable access to cash

You can ask for an emergency Cash Advance

33

of up to $5,000 in emergency

funds (subject to your available credit limit) at over one million ATMs worldwide, at

all TD Canada Trust branches and at select inancial institutions around the world.

Getting information when you need it

The TD Credit Card Contact Centre can help you with important information, such

as the location of the nearest Visa member oice for Cash Advances or contact

numbers for embassies and consulates. You can reach them at 18009838472.

| 43

We strive to bring you the exceptional.

Here is a quick reference to all of the tools you have access to, and the people you can contact for any questions,

help, emergencies or advice as you enjoy your new TD® Aeroplan® Visa Ininite Privilege Card.

General card information td.

com/myaeroplanininiteprivilege

Activate your Card 18003679617

TD Credit Card Contact Centre 18009838472

EasyLine telephone banking 18662223456

EasyWeb Online banking easyweb.td.com

Aeroplan call centre In Canada, USA, and the Caribbean, call 18003615373

In the United Kingdom, call 0 871 2207777

In all other areas, call 15143950300

We invite hearing-impaired members using a TTY to call

18003615373 via Bell Relay Service (711)

Aeroplan Proile aircanada.com/myaeroplanproile

Aeroplan Program aircanada.com/aeroplan

Add Additional Cardholders td.com/additionalcardholders

| 44

Link Additional Cardholders to receive access to

applicable Air Canada travel beneits

aircanada.com/linkmycard

Visa Ininite Privilege beneits visaininite.ca/privilege

Visa Airport Companion Program visaairportcompanion.ca

Visa Ininite Privilege Concierge Service In Canada and the U.S., call toll-free

18558221240. Outside Canada and the U.S., call collect

3039671036. Or go to visaininite.ca/privilege

Points + Cash aircanada.com/redeem

Top up Travel Medical Insurance and

Trip Cancellation/Interruption Insurance

18663741129

Emergency Travel Assistance Service In Canada and the U.S., call toll-free

18663741129. In all other countries, call collect 4169774425

TD Credit Card Payment Protection Plan 18663159069 or visit td.com/BP

Avis Rent a Car and Budget Rent a Car avis.com/tdcreditcards

budget.com/tdcreditcards

TD Autoclub Membership 18002450297

Fraud protection In Canada and the U.S., call toll-free

18663741129. In all other countries, call collect 4169774425

We are honoured to share a world of exceptional travel experiences with exceptional Cardholders.

Let the journey begin.

| 47

Interest rates, fees and features are eective as of November 8, 2020, unless otherwise indicated, and are subject to change.

The Aeroplan program is a loyalty rewards and recognition program operated by Air Canada’s subsidiary Aeroplan Inc. Visit aircanada.com/aeroplan for

complete terms and conditions of the Aeroplan program.

1

Purchase of Gas, Grocery, Travel, or Dining or Air Canada Products means a Purchase of gas or gas station services or products or a Purchase of grocery

or grocery items including those at grocery locations, or a Purchase of travel products and services including hotels, lights and vacations booked via a third

party travel agency or website, or a Purchase of dining items including those at restaurants, or a Purchase from Air Canada or of any of AirCanada’s

products and services, each from a merchant classiied through the Visa network with a merchant category code (MCC) that identiies the merchant in the

“gas” or “grocery” or “travel” or “dining” or “Air Canada” category. Aeroplan points are earned on Purchases charged to the Account as follows:

• 2 Aeroplan points (Air Canada Bonus Rate) earned for each $1 in Purchases of Air Canada Products; or

• 1.5 Aeroplan points (Bonus Rate) earned for each $1 in Purchases of Gas, Grocery, Travel or Dining Products; or

• 1.25 Aeroplan points earned for each $1 in all other Purchases.

• Air Canada Bonus Rate and Bonus Rate are earned only on a maximum annual amount of $100,000 of Purchases of Air Canada Products, Gas, Grocery,

Travel or Dining Products.

Please contact TD if you wish to conirm the MCC that applies to a particular merchant, or if the Purchase qualiies as a Purchase of Gas, Grocery, Travel,

Dining or Air Canada Products. If you have earned Aeroplan points on the maximum annual amount of Purchases of Gas, Grocery, Travel, Dining or

AirCanada Products charged to your Account (from January 1 to December 31) or if your Purchase does not qualify as a Purchase of Gas, Grocery, Travel,

Dining or Air Canada Products, you will instead earn the standard rate of Aeroplan points that applies to all other Purchases charged to the Account as

described above. The Air Canada Bonus Rate and Bonus Rate are in place of and not in addition to the standard rate of Aeroplan points earned on all other

Purchases charged to the Account.

2

The Toronto-Dominion Bank is not responsible for any Aeroplan points earned under this “earn points twice” feature of the Aeroplan program when the

Aeroplan Membership Card is presented. See your Aeroplan program for full details at aircanada.com/earn. Feature may be changed, withdrawn or

extended at any time and cannot be combined with any other oer.

3

Threshold Beneit: Aeroplan Elite Status Qualiication Boost (for beneit of Primary Cardholder only) For every $5,000 in net purchases (less any returns

and credits) charged to the credit card Account, Primary Cardholders will receive 1,000 Status Qualifying Miles (SQM) and 1 Status Qualifying Segment

(SQS), to be deposited in their Aeroplan member Account at the end of the next credit card Account billing period. Please allow up to 1 week after your

credit card Account statement date for the deposit to appear. SQM and SQS are not redeemable towards Aeroplan rewards and only count toward

| 48

Aeroplan Elite Status qualiication. SQM do not count towards Million Mile Status. Additional Cardholder(s) are not eligible to receive SQM or SQS through

this beneit; however, all net spend by Additional Cardholder(s) will count towards the Primary Cardholder’s spend. The Cardholder may earn unlimited

bonus SQM and SQS during an Elite Status qualiication period. All Aeroplan Elite Status conditions apply and can be reviewed at

aircanada.com/elite-termsandconditions

4

Primary Cardholder remains liable for all charges to the Account, including those made by any Additional Cardholder.

5

Primary TD Cardholders will often require fewer Aeroplan points to redeem for light rewards through the Aeroplan program than Aeroplan Members who

do not hold an Aeroplan co-branded Credit Card. Preferred pricing for light rewards applies only to light rewards with Air Canada, not on other airlines.

The Toronto-Dominion Bank is not responsible for the Aeroplan program and light rewards’ points pricing provided under this program. Visit

aircanada.com/aeroplan for full details. Feature may be changed, withdrawn or extended at any time and cannot be combined with any other oer.

6

Number of destinations based on the published 2019 route network of Air Canada and its airline partners. Due to travel restrictions, government

recommendations and passenger demand resulting from the impact of COVID19, available destinations may vary.

7

Preconditions/General T&Cs The Aeroplan number of the person accessing the beneit must be included in the qualifying reservation, and the name on the

airline reservation must be identical to the name on the Aeroplan Account of the traveller. For Additional Cardholders’ ability to access available beneits,

their Aeroplan number must be linked to a valid credit card Account as veriied by the bank. Linking can be done by visiting

www.aircanada.com/linkmycard. Please allow up to 72 hours after the credit card is approved, or the Aeroplan number of the Additional Cardholder is

linked to the Additional Cardholder credit card, for these beneits to be activated. Aeroplan member Accounts of the Primary Cardholder and Additional

Cardholder(s) must be in good standing at time of light for airline beneits to apply. Airline beneits will no longer be available upon Account closure,

regardless of reason for closure, or if the credit card product is changed. Aeroplan membership and beneits are subject to the Aeroplan Program

Terms & Conditions (aircanada.com/aeroplan-termsandconditions) and any applicable Air Canada terms and conditions relating to a beneit, as

determined by AirCanada in its sole discretion and as may be changed from time to time.

8

Complimentary Air Canada Maple Leaf Lounge Access A Primary Cardholder and Additional Cardholder(s) are each entitled to complimentary access to

Air Canada Café and any Maple Leaf Lounge located in Canada and the United States, including International Maple Leaf Lounges in Canada and the

United States when travelling on an international itinerary. Access excludes Air Canada Signature Suites and lounges operated by third parties, such as

Star Alliance member airlines. Primary Cardholder and Additional Cardholder(s) are each entitled to oer one (1) guest complimentary access to the same

eligible Maple Leaf Lounge and Air Canada Café through December 31, 2023. Any guest entering a Maple Leaf Lounge and Air Canada Café must be

| 49

accompanied by a Primary Cardholder or Additional Cardholder. Additional guest(s) may enter the Maple Leaf Lounge upon paying an applicable fee. For

greater certainty, a Primary Cardholder or Additional Cardholder who holds Aeroplan Elite

TM

Status, may additionally take advantage of the lounge access

beneits available to them as part of the Aeroplan Elite Status program. For more information on Aeroplan Elite Status, please visit aircanada.com/elitebeneits.

Access to Maple Leaf Lounges and Air Canada Café is only available in conjunction with a same-day ticket when departing on a light marketed or operated

by Air Canada, Air Canada Rouge, under the Air Canada Express brand, or any Star Alliance member airline. Anyone under the age of majority entering a

Maple Leaf Lounge must be accompanied by an adult with access to the lounge. Age of majority is determined by the jurisdiction in which the Maple Leaf

Lounge is located. Beneit may only be used as described, and otherwise cannot be transferred. Access is subject to space availability. Use of Maple Leaf

Lounge is subject to applicable Maple Leaf Lounges Terms and Conditions.

9

Free First Checked Bag A Primary Cardholder or Additional Cardholder, and up to eight (8) other passengers travelling on the same reservation (up to a

maximum of nine (9) travellers), are each entitled to a free irst checked bag up to 23kg/50lbs. Beneit only applies when checking in with Air Canada, for a

light operated by Air Canada, Air Canada Rouge or under the Air Canada Express brand. Beneit is not available if check-in is with another airline. If the irst

checked bag is already complimentary (for example, as a result of Aeroplan Elite Status or fare purchased), there is no additional checked bag beneit that

will be provided. Free irst checked bag beneit may not be applied retroactively, and no refunds will be issued. Service charges for additional/oversized/

overweight baggage may apply. For more information on baggage restrictions, please visit aircanada.com/baggage

10

Priority Airport Services A Primary Cardholder or Additional Cardholder, and up to eight (8) other passengers travelling on the same reservation (up to a

maximum of nine (9) travellers), are each entitled to Priority Check-in (where available), Zone 2 Priority Boarding and Priority Baggage Handling. Beneits

only apply when checking in with Air Canada, for a light operated by Air Canada, Air Canada Rouge or under the Air Canada Express brand. Beneit is not

available if check-in is with another airline. To access this beneit, the Primary Cardholder or Additional Cardholder may be required to show their qualifying

credit card to the Air Canada agent.

11

Priority Same Day Airport Standby and Upgrades A Primary Cardholder or Additional Cardholder, and up to eight (8) other passengers travelling on the

same reservation (up to a maximum of nine (9) travellers), are each entitled to Priority Airport Standby, and a higher priority for upgrade requests to a

premium cabin. Priority airport standby and upgrade clearance are available on day of travel when travelling on a fare that allows for airport standby or

upgrades, and upon satisfying the applicable condition, such as payment of fees or use of upgrade instrument(s), such as eUpgrade credits. Beneit only

applies for lights operated by Air Canada, Air Canada Rouge, or under the Air Canada Express brand. Priority on standby and upgrade lists is determined

by several factors, including, but not limited to, holding Aeroplan Elite Status, an eligible Aeroplan-branded credit card, and other rules as determined by

AirCanada in its sole discretion and as may be changed by Air Canada from time to time. See aircanada.com/elite-termsandconditions for applicable

Aeroplan Elite Status and eUpgrade conditions.

| 50

12

Annual Worldwide Companion Pass Primary Cardholders will receive one (1) Companion Pass after spending more than $25,000 on net purchases (less any

returns and credits) in the 12 months prior to Card renewal date. The pass will be deposited into the Aeroplan Account up to 10 weeks after your Cardholder

renewal date. The pass entitles a companion to accompany Primary Cardholder for a ixed base fare, when Primary Cardholder books a published economy

fare on a light marketed and operated by Air Canada, Air Canada Rouge or under the Air Canada Express brand. Passes are valid for 12months from the

date issued. The pass is valid towards a new booking only, and not valid on existing reservations. Bookings must be made directly with Air Canada, via

aircanada.com, the Air Canada Mobile App, or through the Air Canada call centre (“Air Canada Reservations”). Valid for one round-trip for a companion when

travelling on the same itinerary and booked at the same time as Primary Cardholder. Maximum one companion pass may be used per booking. If one-way

travel is booked, the full base fare will be charged, the pass will be deemed fully used and the return portion of travel is forfeited. Total pricing varies based on

itinerary booked. Primary Cardholder may use the pass only once on their choice of travel (i) within Canada and continental United States (excluding Hawaii)

for $99 CAD base fare (ii) to/from Hawaii, Mexico, Central America, and the Caribbean for $299 CAD base fare, (iii) to/from South America, Europe, Middle East,

and Africa for $499 CAD base fare, and (iv) to/from Asia, Australia, and New Zealand for $599 base fare. Companion will be responsible to pay all applicable

taxes, fees, charges and surcharges that apply above the companion’s base fare. All travel must originate or terminate in Canada or the United States.

Valid for travel at any time with no blackout periods. Also valid against the purchase of fares on sale. Companion will be booked into same fare brand as

Primary Cardholder and will receive all applicable beneits and services associated with that fare brand. The pass may not be used with premium cabin fares,

or in conjunction with Aeroplan light rewards, Flight Pass, group travel bookings, Air Canada Vacations bookings, or any other discounts or promotion codes.

The pass must be redeemed at time of purchase, and if multiple companion passes are available for the Aeroplan number, the pass that would expire irst will

be used. Booking must be made before the pass expiry date; travel may occur after the pass expiry date subject to light schedule availability at the time of

booking. Pass may only be used as described, cannot be transferred and has no monetary or exchange value. Changes or cancellations are allowed

according to the fare rules of the fare purchased. Changes and cancellations must be made at the same time for both guests, and failure to do so may result

in a forfeit of the companion pass. If during a change or cancellation the pass is reinstated in the Primary Cardholder’s Account, the original expiry date will

take eect and the pass may then be considered expired. In the event of a change or cancellation, travellers are required to pay all applicable fees based on

the fare type purchased for each ticket, plus the dierence in fare, if applicable, and all applicable taxes, fees, charges and surcharges that apply above the

base fare. Companions who are members of Aeroplan or other partner frequent lyer programs are eligible to accumulate points and/or miles for the ticket

issued in exchange for the companion pass according to conditions of the fare brand purchased. Aeroplan Elite Status beneits and upgrades are applicable

if the traveller holds appropriate status and the fare purchased allows. Air Canada reserves the right to apply additional fees for bookings made via

AirCanada Reservations. Unused passes will automatically be cancelled on the date the credit card is closed, regardless of reason for closure, or if the credit

card Account is changed to a dierent product. Terms and conditions of the air transportation services on Air Canada are subject to the General Conditions

of Carriage & Taris (aircanada.com/conditionsofcarriage) at the time of redemption.

| 51

13

Rollover of Status Qualifying Miles Primary Cardholders who also hold Aeroplan Elite Status will be able to roll over up to a maximum of

200,000 Status Qualifying Miles (SQM) from the prior qualiication year to the next qualiication year. This beneit applies when the member qualiied for

Aeroplan Elite Status by earning the required Status Qualifying Miles or Status Qualifying Segments (SQS), as well as the required Status Qualifying Dollars

(SQD), in the prior qualiication year. If the member has been granted complimentary status, as determined by Air Canada, that is higher than the status

they would have earned via their Status Qualifying balances, the rollover amount will be based on the status they would have earned otherwise (if any), and

not the granted status. SQM rolled over from the previous qualifying year will apply towards status qualiication for the following qualifying year. Rollover

SQM will be deposited directly into the member’s Aeroplan Account no later than March 30 of any given year, provided the member earned at least

Aeroplan 25K Status based on their Status Qualifying balances from the prior qualifying year. Rollover does not apply to SQS or SQD. Beneit is only

available to Primary Cardholders and does not apply to Additional Cardholders. In the event the credit card is changed to a dierent product or the Account

is closed, regardless of reason for closure, any SQM rolled over as a result of this beneit will be removed from the Aeroplan Account, and any status earned

as a result of these rolled over Status Qualifying Miles may also be rescinded. SQM do not count towards Million Mile Status and are not redeemable

towards Aeroplan rewards. Where a Primary Cardholder is eligible to roll over SQM under another Aeroplan credit card, the total cumulative roll over of all

SQM towards Aeroplan Elite Status cannot exceed the maximum of 200,000 SQM. All Aeroplan Elite Status conditions apply and can be reviewed at

aircanada.com/elite-termsandconditions

14

Rollover of eUpgrade credits Primary Cardholders who also hold Aeroplan Elite Status will be able to roll over up to a maximum of 50 eUpgrade credits

received in the prior status year to the next status year. eUpgrade credits issued on a promotional basis, as well as those already rolled over from a previous

beneit year, are not eligible for this beneit. Rollover eUpgrade credits will be deposited directly into the member’s Aeroplan Account no later than March 30

of any given year, provided the member holds Aeroplan Elite Status at that time, and held Aeroplan Elite Status in the previous beneit year. If the credit card

is changed to a dierent product or the Account is closed, regardless of reason for closure, any unused, rolled over eUpgrade credits will be forfeited and

removed from the member’s eUpgrade Account. Beneit is only available to Primary Cardholders and does not apply to Additional Cardholders. Where a

Primary Cardholder is eligible to roll over eUpgrade credits under another Aeroplan credit card, the total cumulative roll over of all eUpgrade credits cannot

exceed the maximum of 50 eUpgrade credits. All eUpgrade conditions apply and can be reviewed at aircanada.com/eupgrade-termsandconditions

15

The Account will receive a statement credit up to a maximum of $100 CAD for the amount posted to the Account for a NEXUS application fee regardless of

NEXUS application approval. There is a maximum of four (4) NEXUS statement credits available when a qualifying NEXUS application fee is posted to the

Account in any given 48 month period and the number of available NEXUS statement credits will be equal to the number of Cardholders on the Account

when a qualifying NEXUS application fee is posted to your Account. The 48 month period starts when the irst qualifying NEXUS application fee is posted to

| 52

the Account. To be eligible for the statement credit, the Account must be in good standing at the time the NEXUS application fee is charged and posted on

the Account. NEXUS means the expedited border control program oered jointly by the Canada Border Services Agency and the U.S. Customs and Border

Protection. The terms of the NEXUS program are established by NEXUS, please visit www.cbsa-asfc.gc.ca/prog/nexus/term-eng.html. The Toronto-Dominion

Bank and its ailiates are not responsible for the NEXUS program.

16

You must be an eligible Visa Ininite Privilege Cardholder with a valid Canadian issued Visa Ininite Privilege card to take advantage of the VisaIninite

Privilege beneits and services. Certain beneits and services require enrolment. Oers and beneits are non-transferable and discounts cannot be combined

with any other oer or discount. Neither Visa nor The Toronto-Dominion Bank is responsible for any claims or damages arising from use of any beneits or

services provided by a third party. Visa reserves the right to modify or cancel oers or beneits at any time and without notice. All oers, beneits and

services made available through Visa are subject to complete terms and conditions, including third party suppliers’ terms and conditions, available through

the Visa Ininite Privilege Concierge at 18558221240, and as set out on visaininite.ca/privilege. The Visa IninitePrivilege Privacy Notice applies to all

beneits and services that require enrolment through, or are otherwise provided by, the VisaIninite Privilege Concierge or the Visa Ininite Privilege website

or mobile app. The collection, use and disclosure of Cardholders’ personal information by third party suppliers of services and beneits to Visa Ininite

Privilege Cardholders are subject to such third parties’ own privacy policies.

17

Cardholders with a valid Canadian issued Visa Ininite Privilege Card have access to participating lounges within the Visa Airport Companion Program

(“Program”), hosted and managed by Dragonpass International Ltd. Cardholders must enroll for this beneit either through the Visa Airport Companion App

(available to download for free) or on the Program Website (visaairportcompanion.ca) using a valid Canadian issued Visa Ininite Privilege Card. Upon

enrollment, 6 complimentary lounge visits will be available for the Cardholder per membership year; the complimentary visits can be used by the

Cardholder for themselves and for their accompanying guests at participating lounges. All additional visits beyond the complimentary visits are subject to a

fee of $32 USD (subject to change) per person per visit. Applicable lounge access charges will be billed to the Visa Ininite Privilege Card connected to the

Cardholders’ Program membership. Unless suspended or cancelled, the Program membership and any included complimentary lounge visits (if applicable)

will automatically renew annually on the anniversary date (e.g. when the Cardholder enrolled for the Program). To view a full list of participating airport

lounges, their facilities, opening times and restrictions Cardholders can visit the Program App and Website for more information. Cardholders who

participate in the Program are subject to the DragonPass Terms of Use, Terms of Service and Privacy Policy and Visa’s Privacy Notice. To view the full Terms

and Conditions for the Program, please visit the Program App or Website. The Program services and beneits are provided by DragonPass and applicable

third party oer providers and neither Visa nor The Toronto-Dominion Bank is responsible.

| 53

18

You must be an eligible Visa Ininite Privilege Cardholder with a valid Canadian-issued Visa Ininite Privilege Card to take advantage of the Visa RSVP Rewards

Beneit (“Beneit”), provided by Northland Properties Corporation (“Northland”). Cardholders must enroll for the RSVP Rewards program (“RSVPRewards”) at

rsvprewards.com/sign-up using their eligible Visa Ininite Privilege Card to qualify for the Beneit; existing RSVP Rewards program members who are eligible

Cardholders should call 1.800.726.3626 for instructions on how to obtain the Beneit. Once enrolled, eligible Cardholders will receive automatic Diamond

Status in the RSVP Rewards program. Current tier beneits can be found at rsvprewards.com/terms-conditions and are subject to change. The Card number

used for enrollment in the Beneit may be validated for continued eligibility for the Beneit on an annual basis. If you cease to be an eligible Cardholder, the

automatic status gained from the Beneit may be removed. Cardholders who enroll for the Beneit are subject to the RSVP Rewards’ Terms and Conditions

and Privacy Policy as well as the Visa Privacy Notice. The Beneit is non-transferable and may be discontinued at any time. The Visa RSVP Rewards Beneit is

provided by Northland and neither Visa nor The Toronto-Dominion Bank is responsible for any claims or damages arising from using the RSVP Rewards

program or the Beneit.

19

The goods and services Cardholders request or otherwise choose to obtain through the Visa Ininite Privilege Concierge Service are provided by various

third-party service providers unrelated to Visa or The Toronto-Dominion Bank. Neither Visa nor The Toronto-Dominion Bank endorses, reviews or qualiies

these service providers. Neither Visa nor The Toronto-Dominion Bank makes any representations or warranties (either express or implied) about and

assumes no responsibility or liability for these service providers or the goods and services that may be obtained through the Visa Ininite Privilege Concierge.

Neither Visa nor The Toronto-Dominion Bank is responsible for any claims or damages arising from use of any beneits or services provided by a third party.

Neither Visa nor The Toronto-Dominion Bank can guarantee the successful fulillment of Cardholders’ requests in all instances. There is no fee for the

Concierge’s services, however Cardholders are responsible for the cost of any goods or services (including any related fees or costs) authorized by the

Cardholder and purchased by the Visa Ininite Privilege Concierge on the Cardholder’s behalf. All costs will be charged directly to the Cardholder’s

VisaIninite Privilege card.

20

Provided by our Administrator under a service agreement with TD Life Insurance Company. This is not an insurance beneit but assistance services only.

21

Provided by Avis Rent A Car System LLC. Program terms are subject to change without notice. Certain blackout dates may apply. Oer subject to other

terms and conditions.

22

Provided by Budget Rent A Car System, Inc. Program terms are subject to change without notice. Certain blackout dates may apply. Oer subject to other

terms and conditions.

| 54

23

Underwritten by TD Life Insurance Company. Medical and claims assistance, claims payment and administrative services are provided by our Administrator.

Beneits, features and coverages are subject to conditions, limitations and exclusions, including a pre-existing condition exclusion, that are fully described in

the Certiicate of Insurance included with your TD Credit Cardholder Agreement. Note that this insurance oers dierent beneits, with dierent terms and

conditions than the optional Travel Medical Insurance that may be medically underwritten and is available for purchase to all TD customers, with which you

may be eligible to top up. The day of departure from and the day of return to your province or territory of residence each count as one full day. 31-day

coverage if you’re under 65 and 4-day coverage if you’re 65 or older.

24

Underwritten by TD Life Insurance Company (for medical covered causes) and TD Home and Auto Insurance Company (for non-medical covered causes). To

be eligible for this insurance, at least 75% of your trip cost must be paid for using your TD Credit Card and/or Aeroplan Points. Beneits, features and coverages

are subject to conditions, limitations and exclusions, including a pre-existing condition exclusion, that are fully described in the Certiicate of Insurance

included with your TD Credit Cardholder Agreement. Note that this insurance oers dierent beneits, with dierent terms and conditions than the optional

Trip Cancellation and Trip Interruption Insurance that is available to all TD customers.

25

Underwritten by TD Home and Auto Insurance Company. To be eligible for this coverage, at least 75% of your trip cost must be paid for using your TD Credit

Card and/or associated Aeroplan Points. Beneits, features and coverages are subject to conditions, limitations and exclusions that are fully described in the

Certiicate of Insurance included with your TD Credit Cardholder Agreement.

26

Underwritten by TD Life Insurance Company. To be eligible for this coverage, your trip must be paid for in full using your TD Credit Card and/or Aeroplan

points. Beneits, features and coverages are subject to conditions, limitations and exclusions that are fully described in the Certiicate of Insurance included

with your TD Credit Cardholder Agreement.

27

Insurance coverages are underwritten by American Bankers Insurance Company of Florida (ABIC) under Group Policy TDA112020. Beneits, features and

coverages are subject to conditions, limitations and exclusions that are fully described in the Certiicates of Insurance included with your

TD Credit Cardholder Agreement. ABIC, its subsidiaries, and ailiates carry on business in Canada under the name of Assurant®. ®Assurant is a registered

trademark of Assurant, Inc.

28

Underwritten by TD Home and Auto Insurance Company. Car rentals must be charged in full to the Card and/or associated Aeroplan points, cannot exceed

48 consecutive days and the rental agency’s Collision Damage Waiver (CDW) coverage must be declined by the Cardholder. Please note, in some

| 55

jurisdictions, rental agencies may require you to purchase the CDW coverage from them – it is important to call before booking your car rental to conirm

their insurance requirements. Refer to the Auto Rental Collision/Loss Damage Insurance section of your TD Credit Cardholder Agreement for rental

exclusions and further details.

29

Underwritten by TD Home and Auto Insurance Company. To be eligible for this coverage, at least 75% of the item cost must be paid for using your

TD Credit Card. Beneits, features and coverages are subject to conditions, limitations and exclusions that are fully described in the Certiicate of Insurance

included with your TD Credit Cardholder Agreement.

30

Life coverage is underwritten by American Bankers Life Assurance Company of Florida and Job Loss and Total Disability coverages are underwritten by

American Bankers Insurance Company of Florida. The Toronto-Dominion Bank receives a fee from each insurer with respect to premium collection.

Complete terms of coverage are in the Certiicate of Insurance you will receive upon enrollment. Eligibility requirements, limitations and exclusions apply,

and vary by beneit.

31

TD Auto Club Membership provided by AXA Assistance Canada Inc., an independent third-party service provider. The Toronto-Dominion Bank and its

ailiates accept no responsibility in respect of these services.

32

Selected Android mobile devices are eligible for TD Mobile Payment. The mobile device must be enabled with Near Field Communication (NFC) technology

(contactless). You must also have occasional access to a cellular data network or Wi-Fi connection. See the FAQs for more details at td.com/waystopay

33

Cash Advance is subject to available credit. Fees apply to each Cash Advance and Cash Advances accrue interest at the Cash Advance rate that applies to

your Account from the date the Cash Advance is made.

All trade-marks are the property of their respective owners.

For Air Canada and Aeroplan trade-mark ownership details, see: td.com/aeroplancards

Apple, the Apple logo, iPhone and iPad are trademarks of Apple Inc., registered in the U.S. and other countries. Apple Pay and Touch ID are trademarks of

Apple Inc.

Samsung and Samsung Pay are registered trademarks of Samsung Electronics Co., Ltd.

™ Android and Google Play are trade-marks of Google Inc.

™ NEXUS is an Oicial mark and/or trademark of Her Majesty the Queen in Right of Canada, used under license.

* Trademark of Visa International Service Association and used under license.

® The TD logo and other trade-marks are the property of The Toronto-Dominion Bank and its subsidiaries.

| 57

Bon Voyage.

May your next travels

take you where you

want to go.

| 58