BT Group plc

Annual Report

2019

BT Group plc Annual Report 2019

N on-Financial Reporting Information Statement

Our integrated approach to reporting means that the requirements

of the Non-Financial Reporting Directive are addressed throughout

the Strategic report. For ease of reference, information pertaining to

each of the matters addressed by the new regulation can be found

on the following pages: Human rights (page 25 ); Our people (page

22 ); Social (page 24 ); Environmental (page 26 ); Anti-corruption and

bribery (page 32 ).

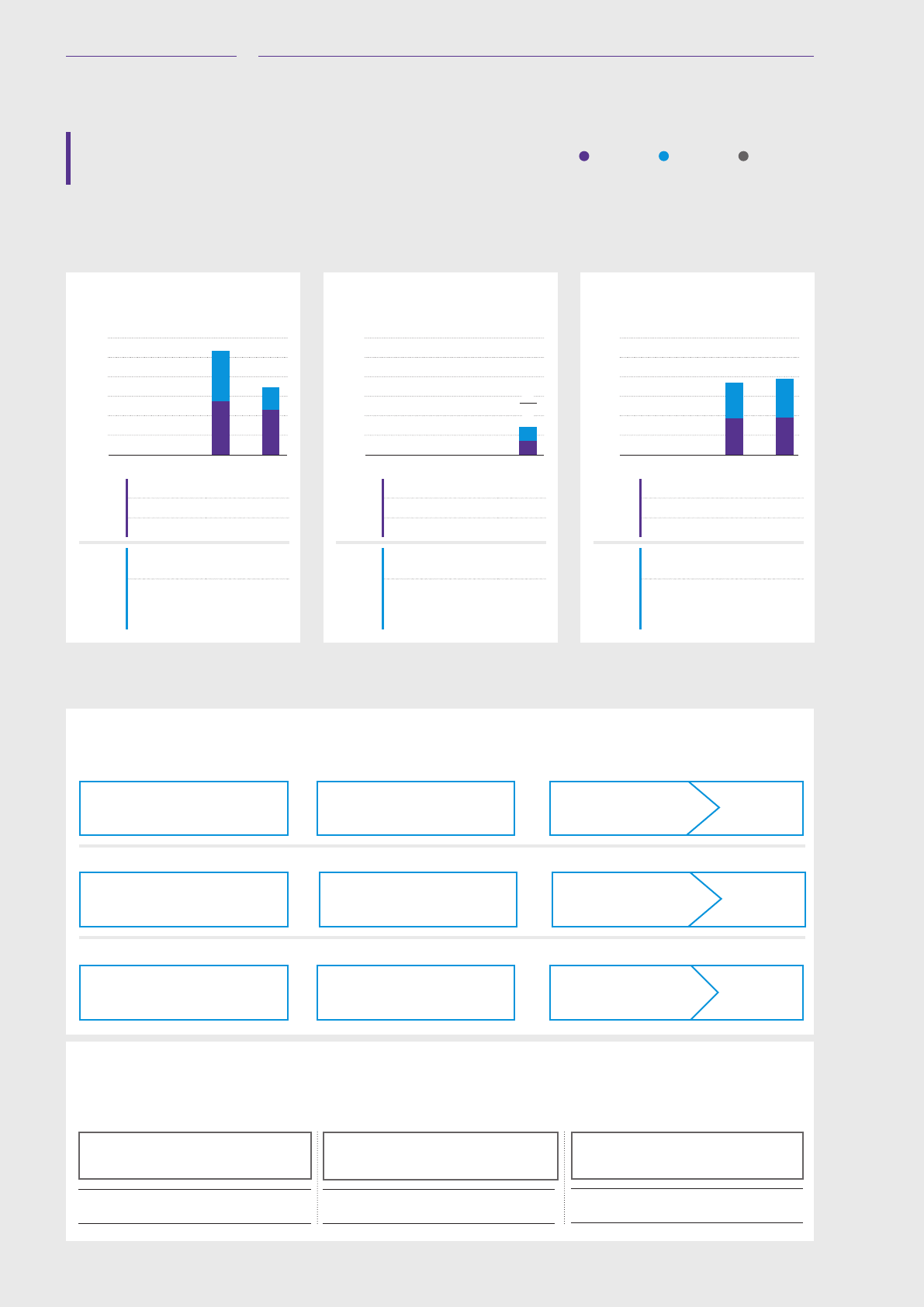

At a glance

We help build better digital

lives and businesses, and

support the UK as a world-

class digital economy.

Our purpose

We use the power of

communications to

make a better world.

… focused on

sustainable growth…

p 30

p 34

… supported by a strategy

with three refreshed

priorities …

O ur strategy

• Diff erentiated customer experience.

• Best converged network.

• Simplifi ed, lean and agile business.

p 14

… and being a

responsible business …

Non-fi nancial

performance

Our performance

as a sustainable

and responsible

business.

Governance

Corporate

Governance

is critical to

delivering our

strategy.

p 32

p 55

… to achieve

our goal.

Our goal

Drive sustainable

growth in value.

… a strong culture with

shared values …

People and

culture

Making BT

a brilliant

place to work.

Values

• Personal

• Simple

• Brilliant

Key performance

indicators

Group

performance

In a rapidly

changing

industry …

Market context

We understand and respond

to market opportunities and

challenges.

p

8

… we have a clear

business model …

Business model

We provide customers with

communications and connectivity

services.

p 12

p 22

p 22

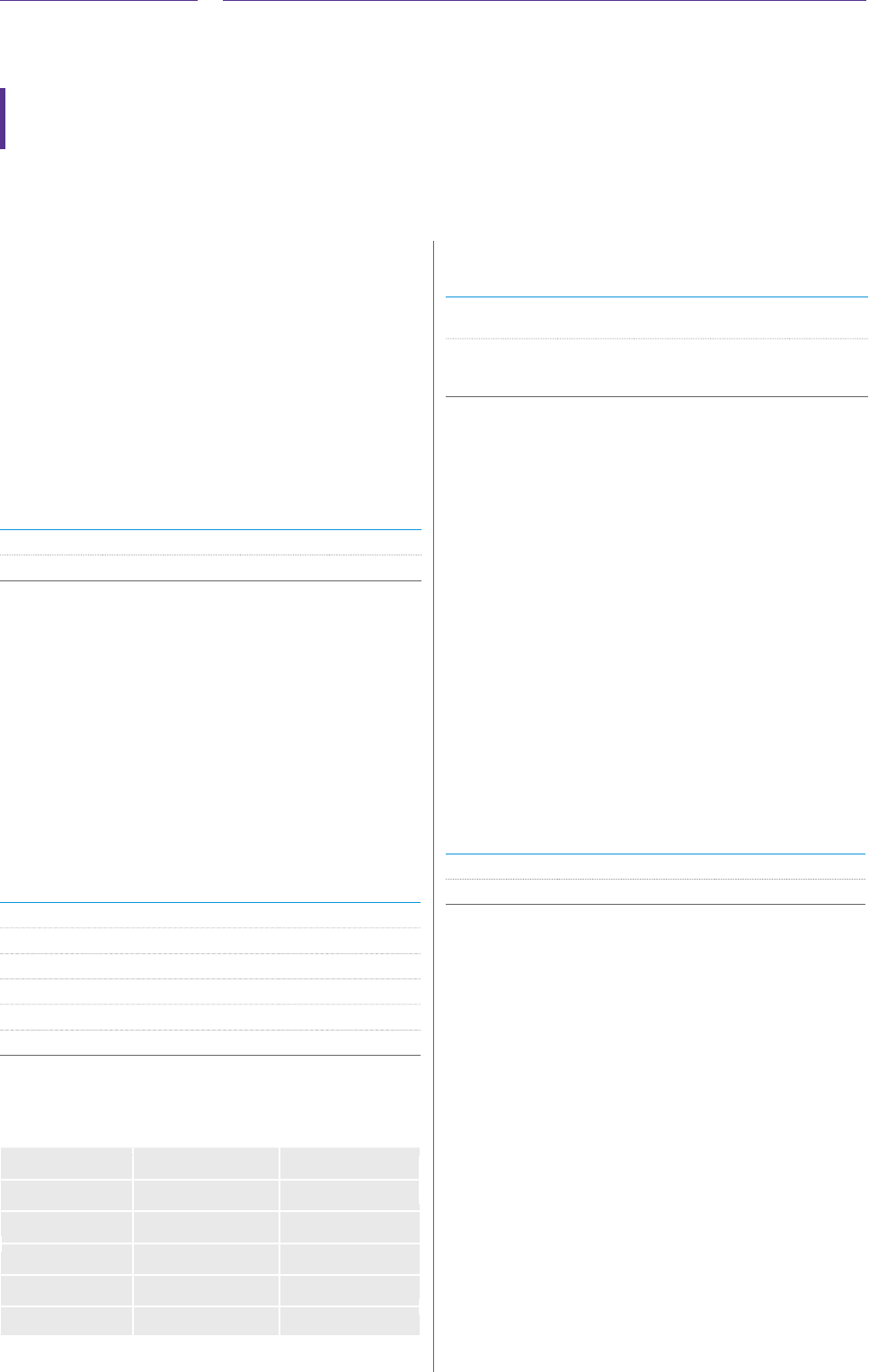

Contents

Strategic report

A message from our Chairman 2

A message from our Chief Executive 3

About BT 4

Executive Committee 6

Market context 8

Our business model 12

Our strategy 14

Strategic progress 16

Our stakeholders 22

Our key performance indicators 30

Group performance 34

A message from the Openreach

Chairman 42

Our approach to risk management 44

Our principal risks and uncertainties 46

Our viability statement 54

Governance 55

Financial statements 100

Additional information 185

1

BT Group plc Annual Report 2019 Strategic report

Governance

Financial statements

Additional information

Look out for these t hroughout

the report:

Reference to another page in the report

Reference to further reading online

Critical accounting estimates

and key judgements

More information

btplc.com

bt.com/annualreport

Digital impact and sustainability report

btplc .com/ digitalimpactandsustainability

This Strategic report was approved

by the Board on 8 May 2019.

By order of the Board

Rachel Canham

Company Secretary & General Counsel, Governance

8 May 2019

Please see the cautionary statement regarding

forward-looking statements on page 190 .

Pages 1 to 54 form the Strategic report. It includes

Our business model, Strategic progress, Group

performance and Our principal risks and uncertainties.

The Governance section on pages 55 to 99 forms the

Report of the Directors.

2

BT Group plc Annual Report 2019

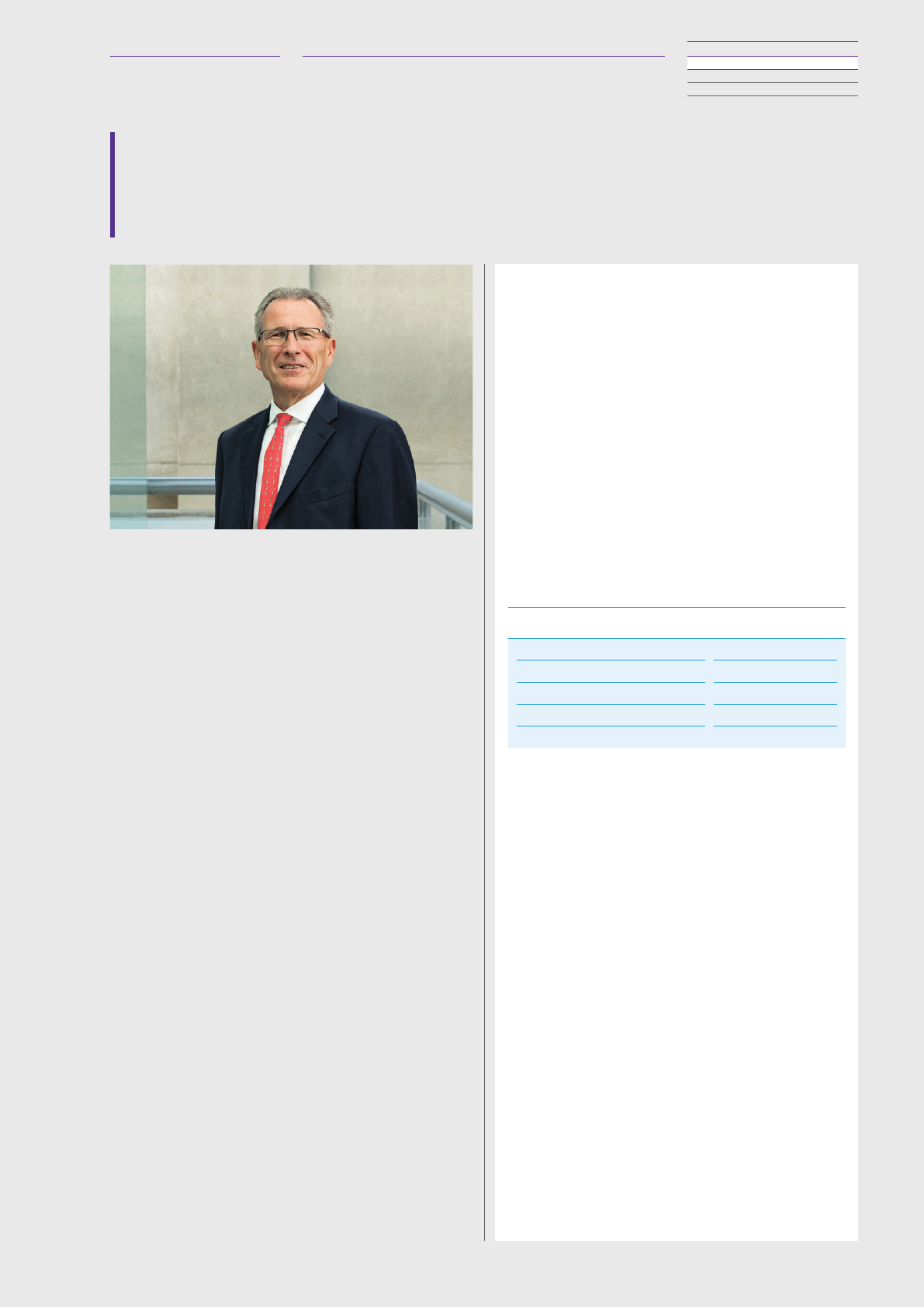

I am pleased to report that we have

over the last year overcome numerous

challenges to deliver a set of solid fi nancial

results. More importantly, we have made

good progress on delivering our strategy,

focused around diff erentiated customer

experience, our best converged network,

and creating a simple, lean and agile

business. We have continued to deliver the

vital connectivity and services that families

and businesses in the UK and beyond need

to fl ourish.

BT has a critical role at the heart of the

UK’s digital future, and our substantial

investments in fi xed and mobile networks

make an essential contribution. The new

converged propositions we launched this

year are the start of the services of the

future. Within BT we are strengthening

our focus on enabling the digital skills of

our people, customers and communities,

thereby further contributing to the UK’s

digital economy.

We will be launching 5G in 16 cities this

year. We will also increase our investment

in fi bre-to-the-premises (FTTP), while

working with the Government and Ofcom

to create the right conditions to go further

and faster. We are pleased with our closer

relationships with these key stakeholders

as we unite around the common goal of

building the UK’s FTTP network.

In May 2018 we agreed the 2017 triennial

funding valuation for the BT Pension

Scheme. This allows us to move ahead with

greater fi nancial certainty.

Our solid profi t and normalised free cash

fl ow not only provide the foundation for

investment in our strategic priorities but

allow us to reward shareholders. We are

paying the same dividend as last year at

15.4 p per share. We also expect to hold

the dividend unchanged in respect of the

2019/20 fi nancial year given our outlook

for earnings and cash fl ow. The Board

remains committed to our dividend policy,

which is to maintain or grow the dividend

each year whilst taking into consideration

a number of factors including underlying

medium term earnings expectations and

levels of business reinvestment ( which

would include the consideration of

accelerated FTTP investment).

I am satisfi ed we are making progress

at pace. The coming year will see BT

continuing its transformation to become

a simplifi ed, lean and agile business.

Across the business I see a commitment to

streamlining processes, governance and

organisational structures; simplifying lines

of responsibility; and helping people make

better decisions.

As a Board, we are leading by example.

I recently carried out a review of the

structure, composition and operation

of our committees to speed up decision

making and improve overall governance.

As a result, we have reduced the number

of board committees and clarifi ed lines of

responsibility. Further details are described

in the Governance report on page 55 .

I would like to welcome non-executive

directors Matthew Key and Allison Kirkby

to the Board. They both bring valuable

experience of the communications and

technology sectors.

Gavin Patterson stepped down as chief

executive at the end of January and I would

like to thank him for his contribution to the

business over his 1 5 years with the company.

He led BT with vision and dedication through

a challenging time and started the necessary

process of transforming our business for the

demands of modern society. We wish him

well for the future.

I would like to extend a warm welcome

to our new chief executive Philip Jansen.

Philip is a proven leader with outstanding

experience in managing large, complex

businesses and has the right combination

of skills and experience to take BT into the

future. Philip has made an excellent start as

chief executive and I am confi dent that he

will have the full support of all our people as

we embark on the challenging but exciting

next chapter of this great company.

This is a very important time for BT and

the UK’s digital economy. I look forward to

working with Philip and his team as they

develop our strategy and accelerate the

reshaping of BT to deliver future success.

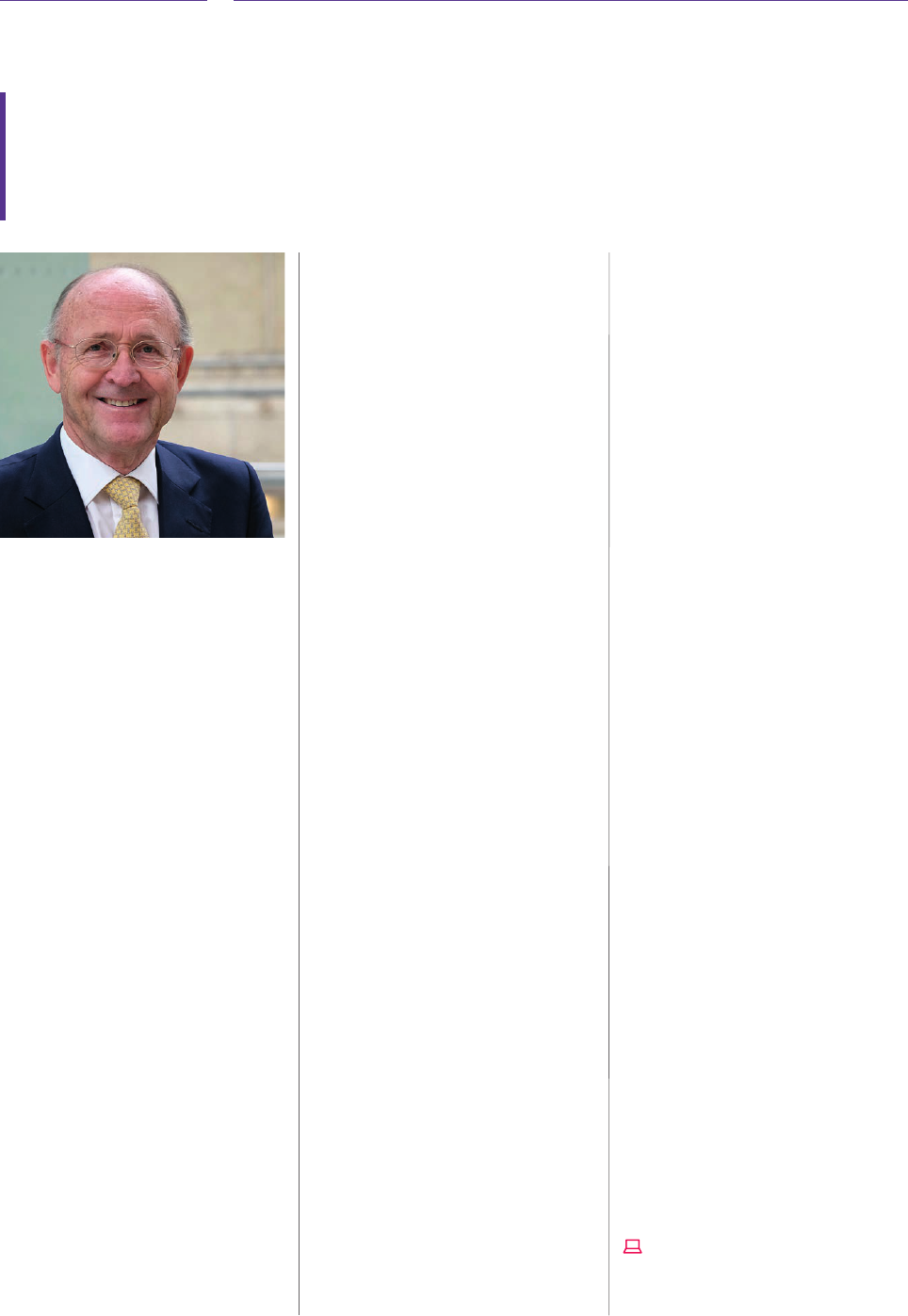

Jan du Plessis

Chairman

8 May 2019

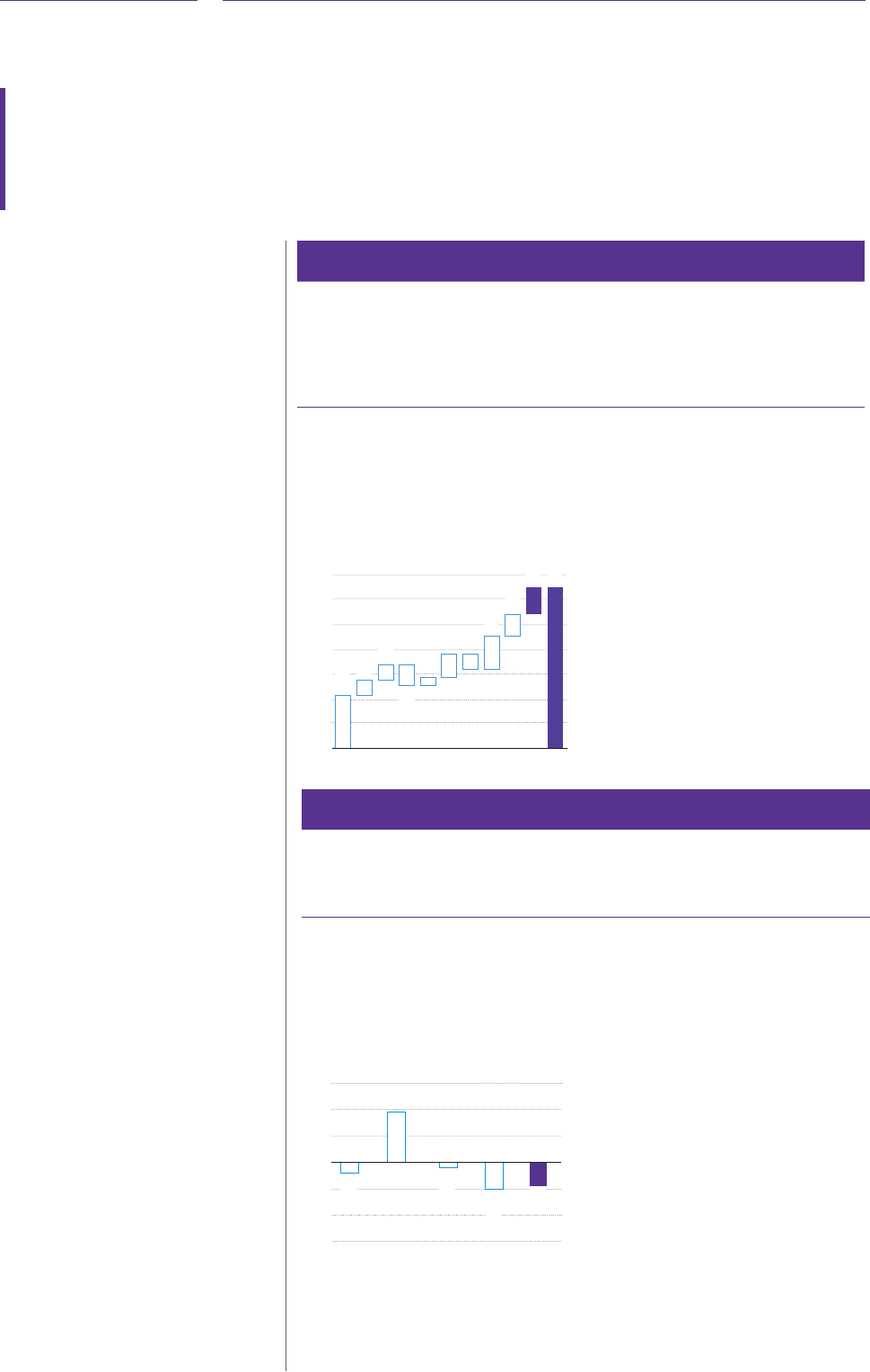

Full year d ividend per share

15.4 p

Revenue

£23 .4 bn (1) %

Profi t after tax

£ 2. 2bn + 6 %

We have made good progress on

delivering our strategy, focused

around diff erentiated customer

experience, our best converged

network, and creating a simple,

lean and agile business.

A message from

our Chairman

3

BT Group plc Annual Report 2019 Strategic report

Governance

Financial statements

Additional information

My fi rst priority on joining in January was

to meet as many BT colleagues as possible,

and I have seen fi rst-hand the energy and

commitment they bring to doing the right

thing by our customers. As we build the BT

of the future, this dedication will be essential

for transforming the company and improving

the service we provide to our customers.

Many of our people talk to customers every

day and can provide great insight into

how they think. The way our customers

see the world and our role in their lives

and businesses is changing. In the coming

year we will focus on developing a better

understanding of what customers value

about BT in each of our market segments.

BT is already making signifi cant investments

in our key markets and we have a very

strong market position, but we need to

invest more in our core areas to drive

future growth. Constant innovation is key

to keeping our business moving forward.

Our increasing investment in fi bre and 5G

programmes is vital to our future success.

Our relationship with the UK Government

and Ofcom continues to improve. We’re

working in a pragmatic, straightforward

and collaborative way. We want to shape

the regulatory environment so that it

is clear and predictable, enabling BT to

succeed by delivering sustainable value that

r e fl e cts what customers and society want.

Our core priorities around customer

experience, building the best converged

network and transforming our operating

model underpin how we will compete and

drive sustainable growth.

Everything we do should start with the

aim of delivering a diff erentiated customer

experience. We are already making

progress with this . W e introduced our fi rst

converged products, BT Plus, for consumers

and 4G Assure, for small businesses, which

ha ve seen strong take-up . In the coming

year there will be additional investment to

improve our propositions, off er great value

for money and increase consumer loyalty.

We will also invest to maintain our network

leadership position. We already have the

best mobile and fi xed networks and in the

coming year we will launch 5G across 16

UK cities and accelerate our rollout of FTTP.

Although important points still need to be

agreed, our dialogue with the Government

and Ofcom is constructive and we are

increasingly confi dent in the environment

for investment in the UK. As a result w e

are increasing our aim of reaching 3 million

homes to 4 million by March 2021 and

15million by the mid-2020’s, subject to

conditions being right .

BT has made progress during the year

towards creating a simplifi ed, lean and

more agile business. We will make further

improvements in the coming year to

speed up decision making and the pace

of work, making use of the latest digital

technologies. Our people recognise we are

too complex and want us to go faster in our

transformation. Employee engagement is

high, with a 77% engagement outcome

for colleagues participating in our

recent people survey. The results were

generally encouraging, and demonstrate

our collective desire to embrace the

changes required to make BT a brilliant

place to work and give our customers an

outstanding experience.

I am pleased to see how much our people

contribute to the community and am proud

that BT encourages this work. One area I

want us to really lead on is improving digital

skills – for our colleagues, customers and

families across the UK and well beyond. BT is

uniquely qualifi ed to help people navigate the

opportunities and challenges of our digital

age. Enabling these skills will help people

adapt to new ways of working and create

future customer demand for our products.

We’re committed to respecting human and

digital rights – we launched an overarching

human rights policy, and we’re partnering

with others to combat modern slavery.

We continue to tackle environmental

challenges, having recently announced our

ambition to be a net zero carbon emissions

business by 2045.

BT has delivered solid results for the year ,

and this is due to the commitment of our

colleagues. The markets we are in remain

highly competitive and w e continue to

expect market dynamics, cost infl ation and

legacy product declines and the changing

regulatory environment to impact our

results in the short term, however, we are

confi dent that our plans will deliver good

returns over the medium term and improve

the quality and performance of the business.

As a result, for 2019/20, we expect

adjusted revenue to be down around 2%.

This is mainly as a result of the challenging

market conditions, regulatory pressure

in both fi xed and mobile markets, and

the ongoing impact from our decision to

de-emphasise lower margin products,

particularly in our enterprise businesses.

Along with the fl ow through of lower

revenue, we expect our opex investments

to result in Group adjusted EBITDA for

2019/20 being in the range £7.2bn –

£7.3bn. While we will sustain these opex

investments into 2020/21, we continue

to expect Group adjusted EBITDA for

2020/21 to be above that for 2019/20.

We are raising our reported capital

expenditure guidance (excluding BDUK

clawback) for 2019/20 to be in a range of

£3.7bn – £3.9bn. We expect normalised

free cash fl ow for 2019/20 to out-turn in

the range £1.9bn – £2.1bn.

I look forward to working alongside our

colleagues to build the new BT and I am

optimistic and energised for the future.

Philip Jansen

Chief Executive

8 May 2019

I am delighted to be the new

chief executive of BT. We play

a n important role in UK society

and provide mission-critical

services all around the world. It is

a privilege to lead such a special

company, with a great history and

a very exciting future. BT creates

value for a large and diverse

group of stakeholders.

A message from

our Chief Executive

4

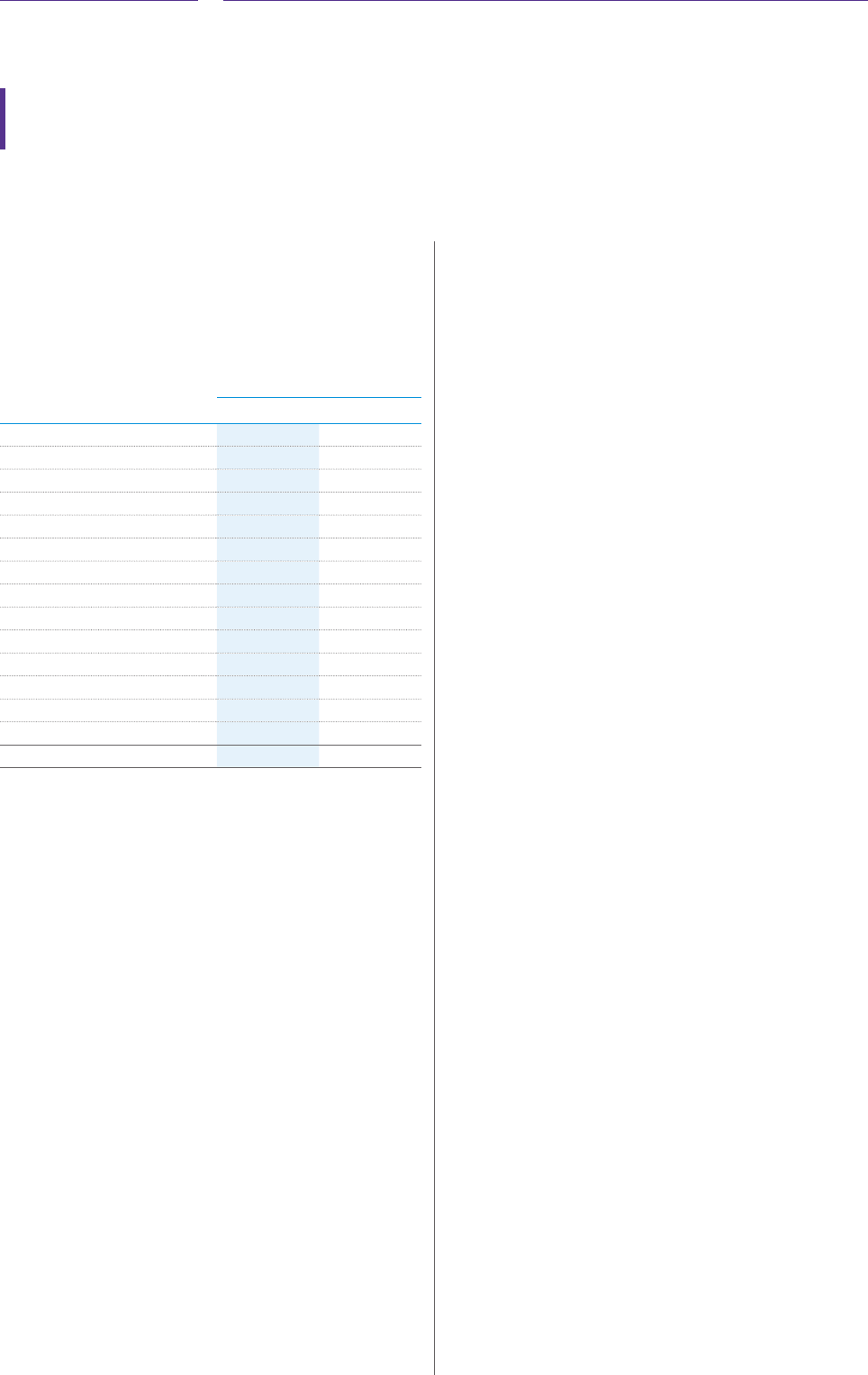

BT Group plc Annual Report 2019

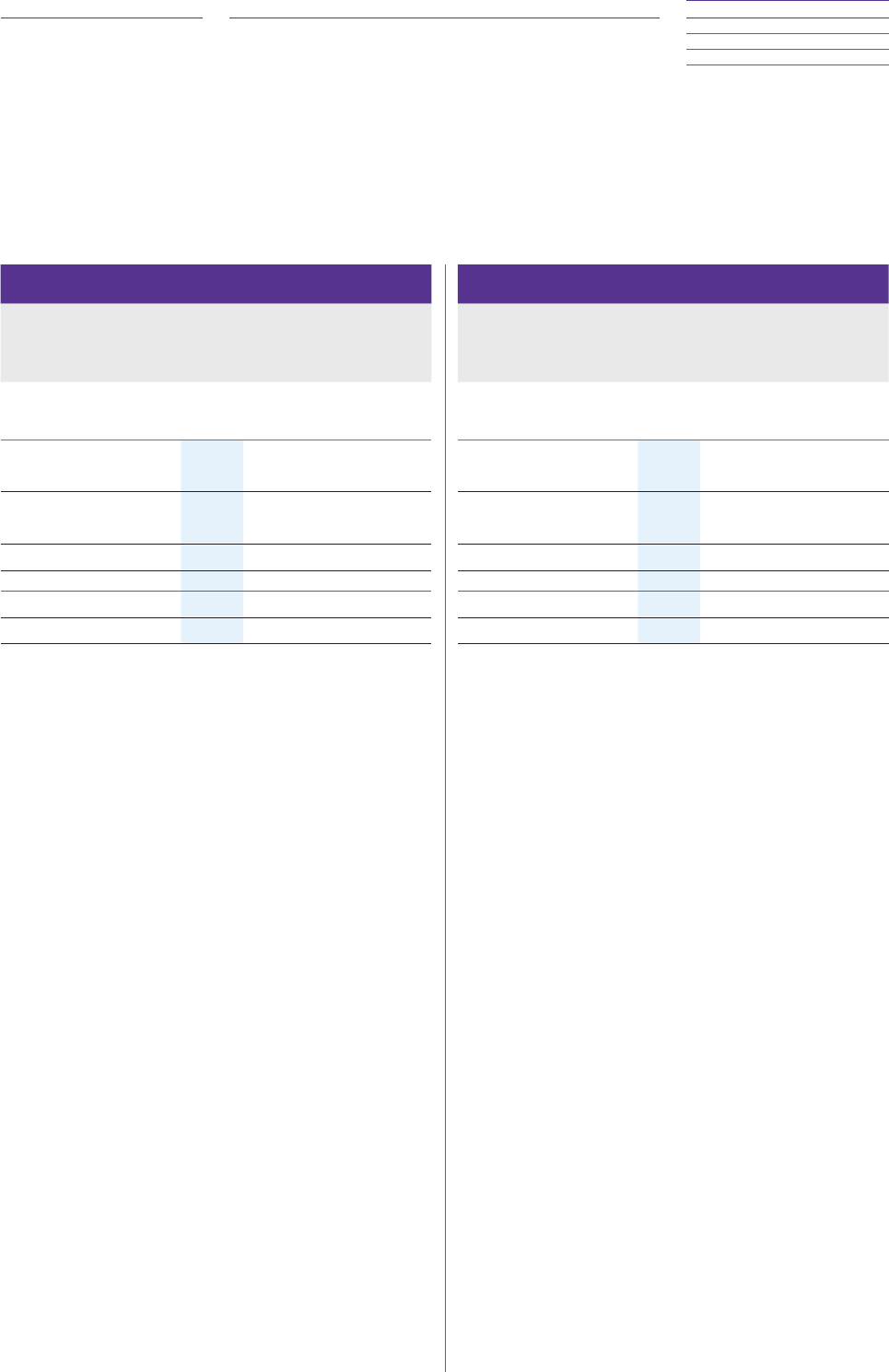

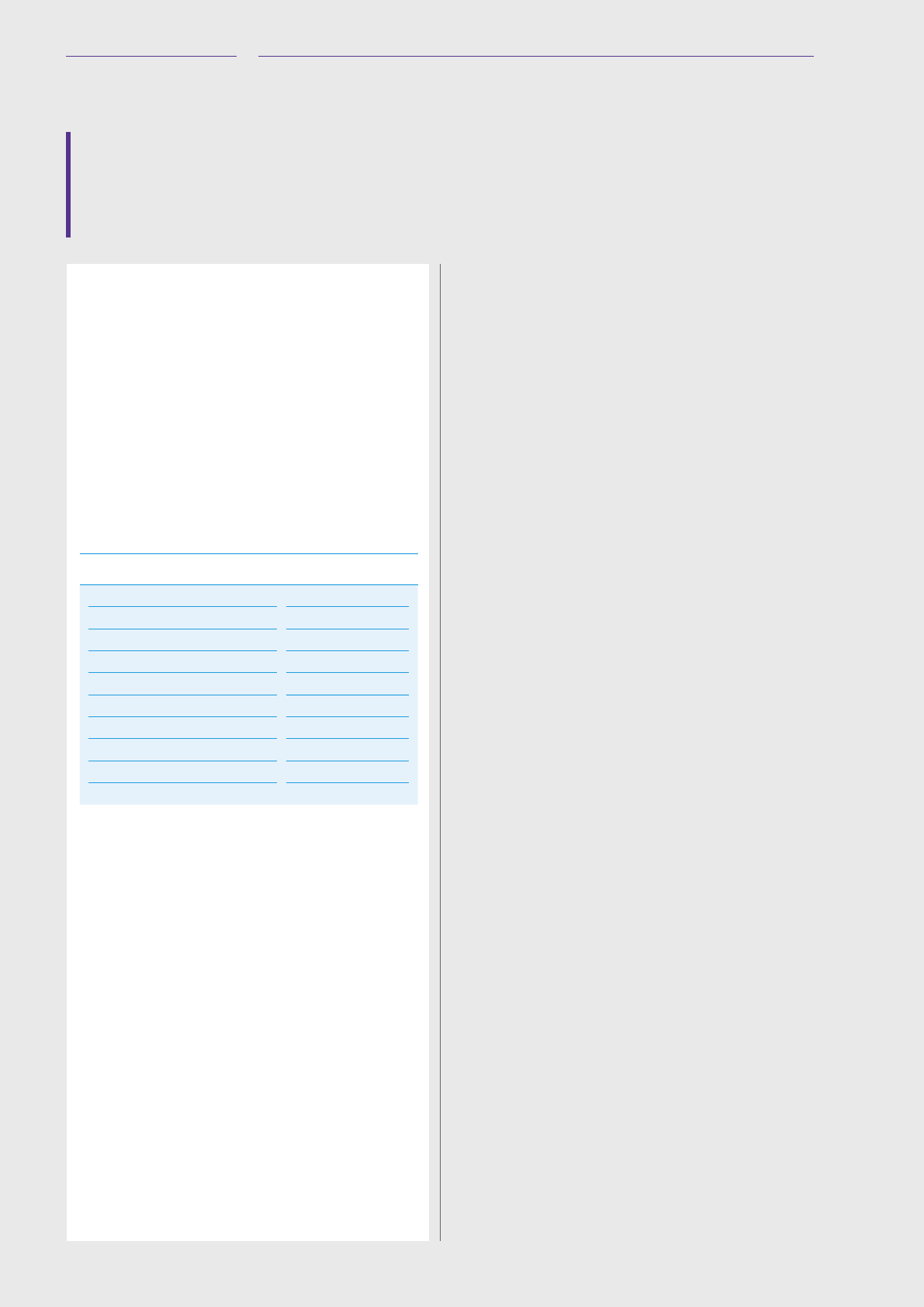

About BT

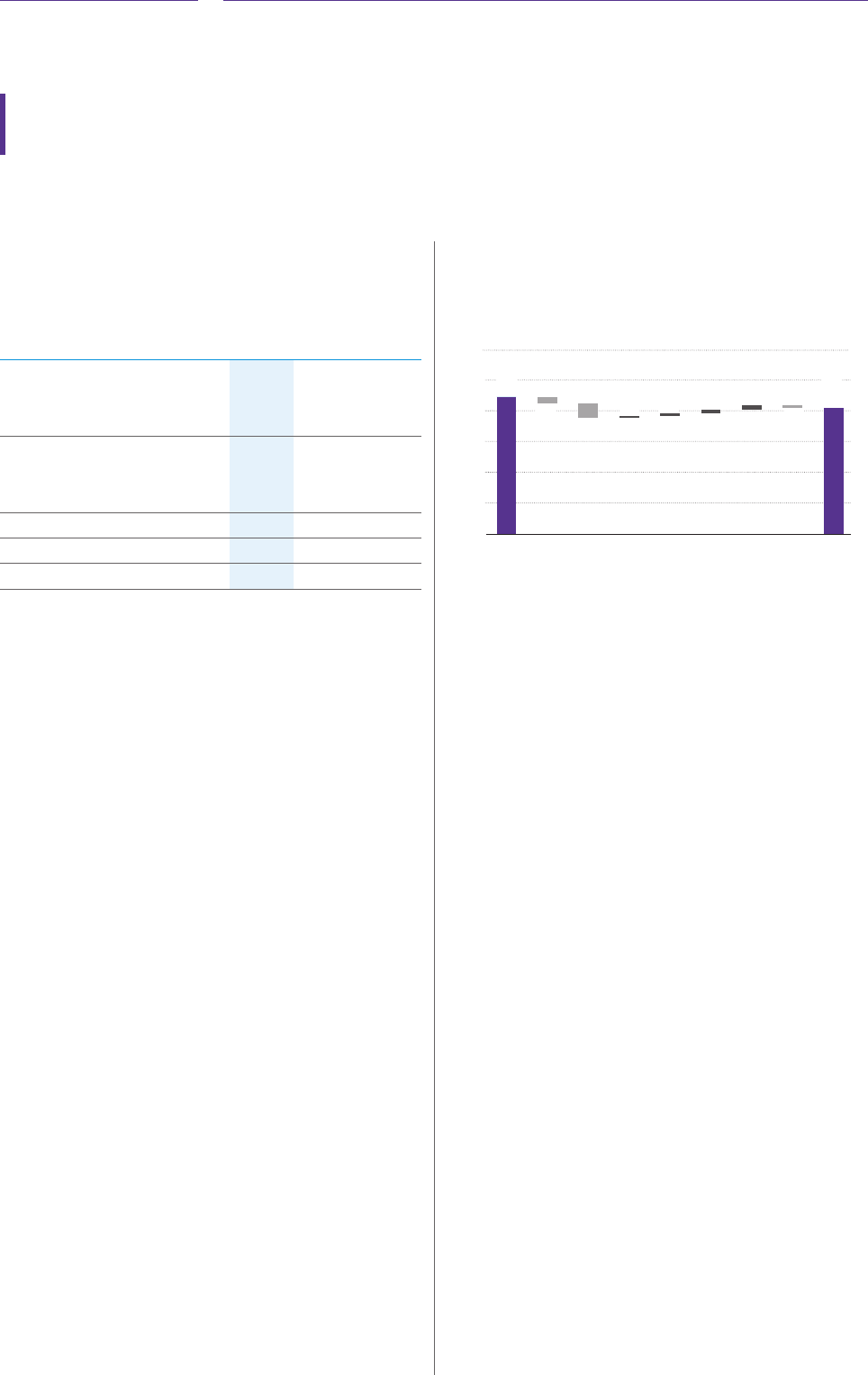

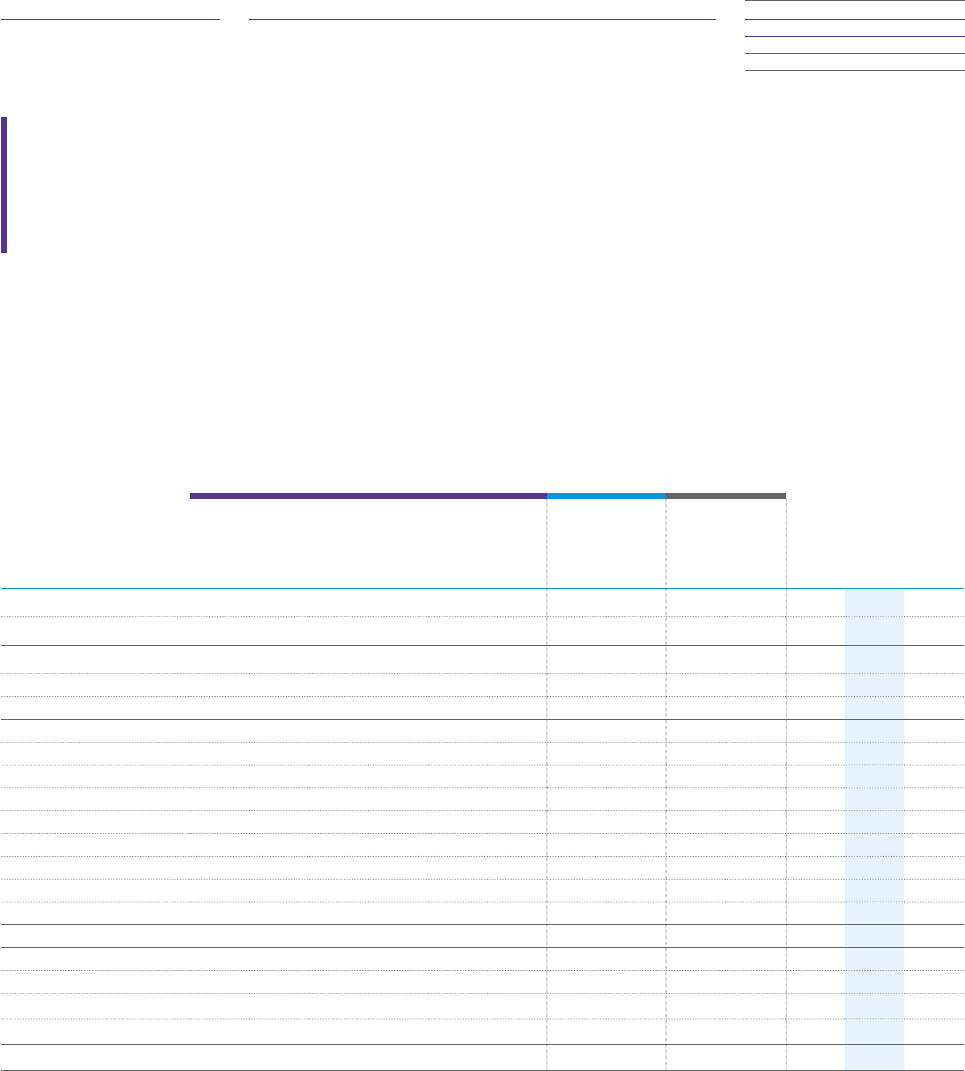

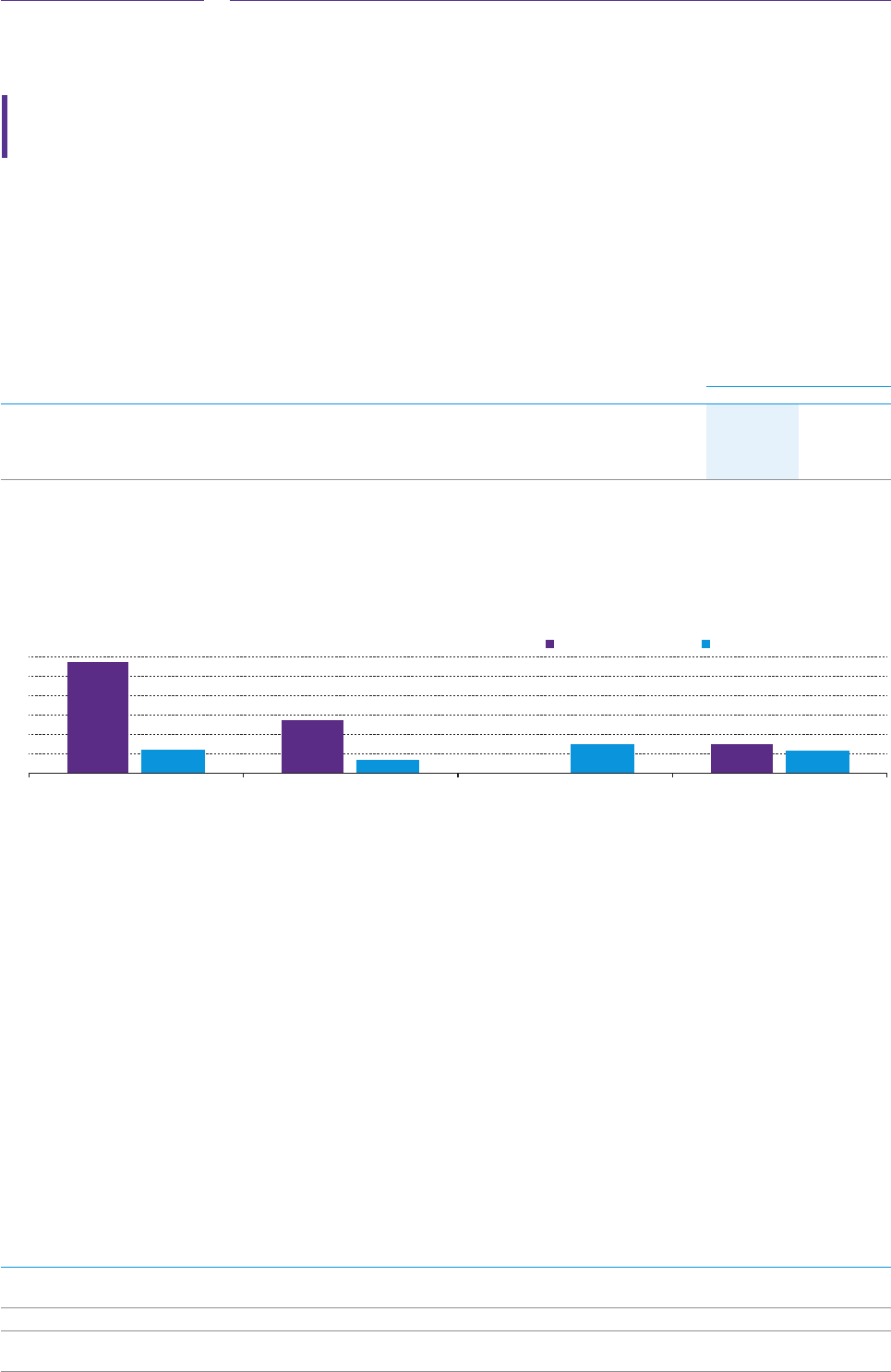

Revenue

£23.4bn (1)%

Prot before tax

£2.7bn +2%

Basic earnings per share

21.8p +6%

Net cash inow from

operating activities

£4.3bn (14)%

Change in underlying

a

revenue

(0.9)%

Adjusted

b

EBITDA

£7.4bn (2)%

Adjusted

b

earnings per share

26.3p (6)%

Normalised free

cash ow

c

£2.4bn (18)%

Capital expenditure

d

(excluding BDUK clawback)

£3.8bn +8%

Who we are

We’re one of the world’s leading

communications services companies.

We’re based in the UK but we serve

customers in 180 countries.

What we do

We develop and sell communications

products and services and build

and operate networks that are

an essential part of modern lives,

businesses and communities.

How we’re organised

BT is organised into two types of

units: customer-facing units that sell

products and services and corporate

units that support the whole group.

Financial highlights

For more information on our

nancial performance see page 34.

4

BT Group plc Annual Report 2019

Alternative performance measures

We assess the performance of the group using a variety of performance measures. These measures are not all dened

under IFRS and are therefore termed ‘non-GAAP’ measures. We present a reconciliation from these non-GAAP

measures to the nearest prepared measure in accordance with IFRS on pages 185 to 187. The alternative performance

measures we use may not be directly comparable with similarly titled measures used by other companies

.

a

Underlying revenue excludes specic items, foreign exchange movements and disposals.

b

Items presented as adjusted are stated before specic items. See page 185 for more information.

c

After net interest paid, before pension decit payments (including the cash tax benet of pension

decit payments) and specic items.

d

Additions to property, plant and equipment and software in the period less proceeds from disposals.

5

BT Group plc Annual Report 2019 Strategic report

Governance

Financial statements

Additional information

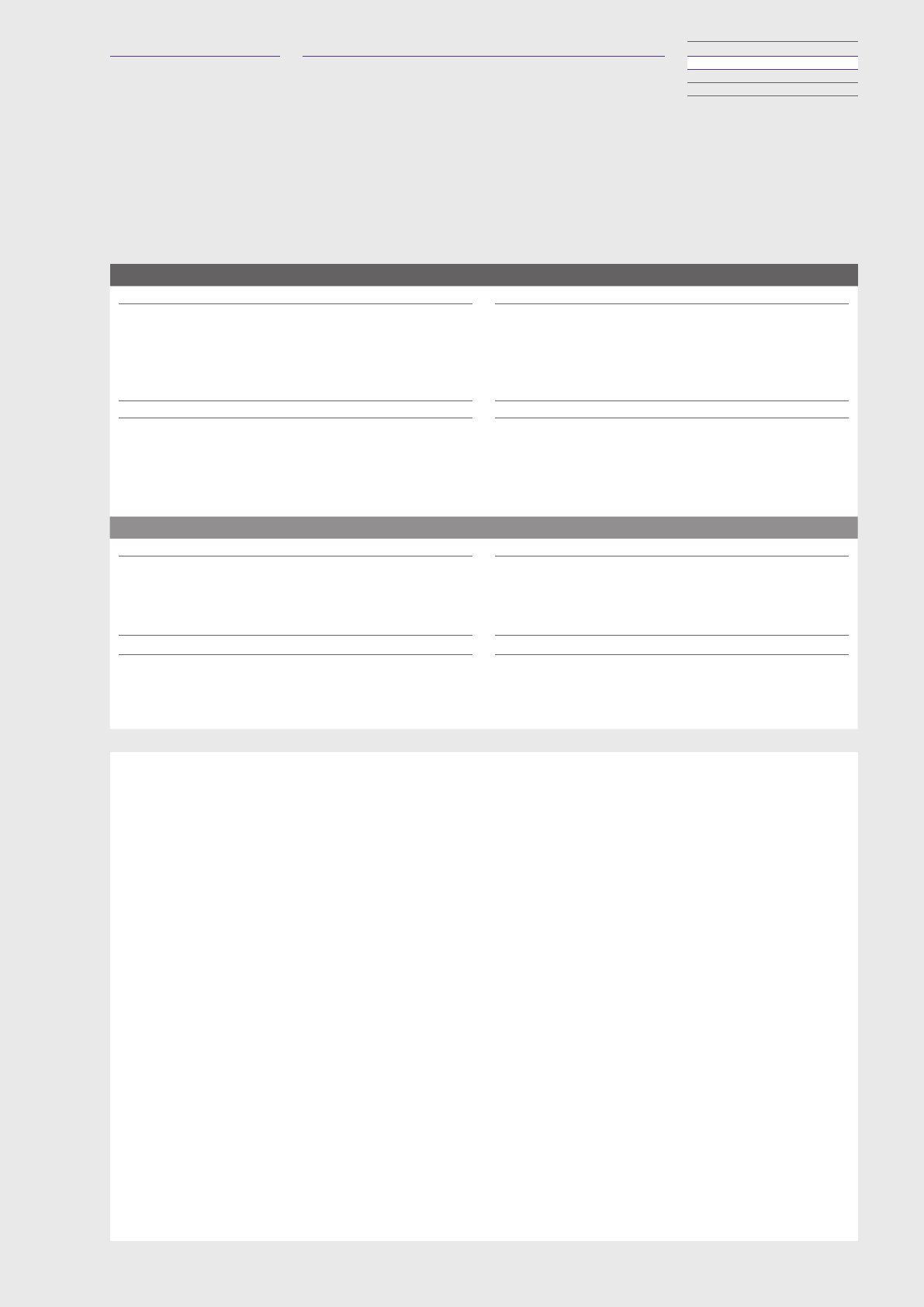

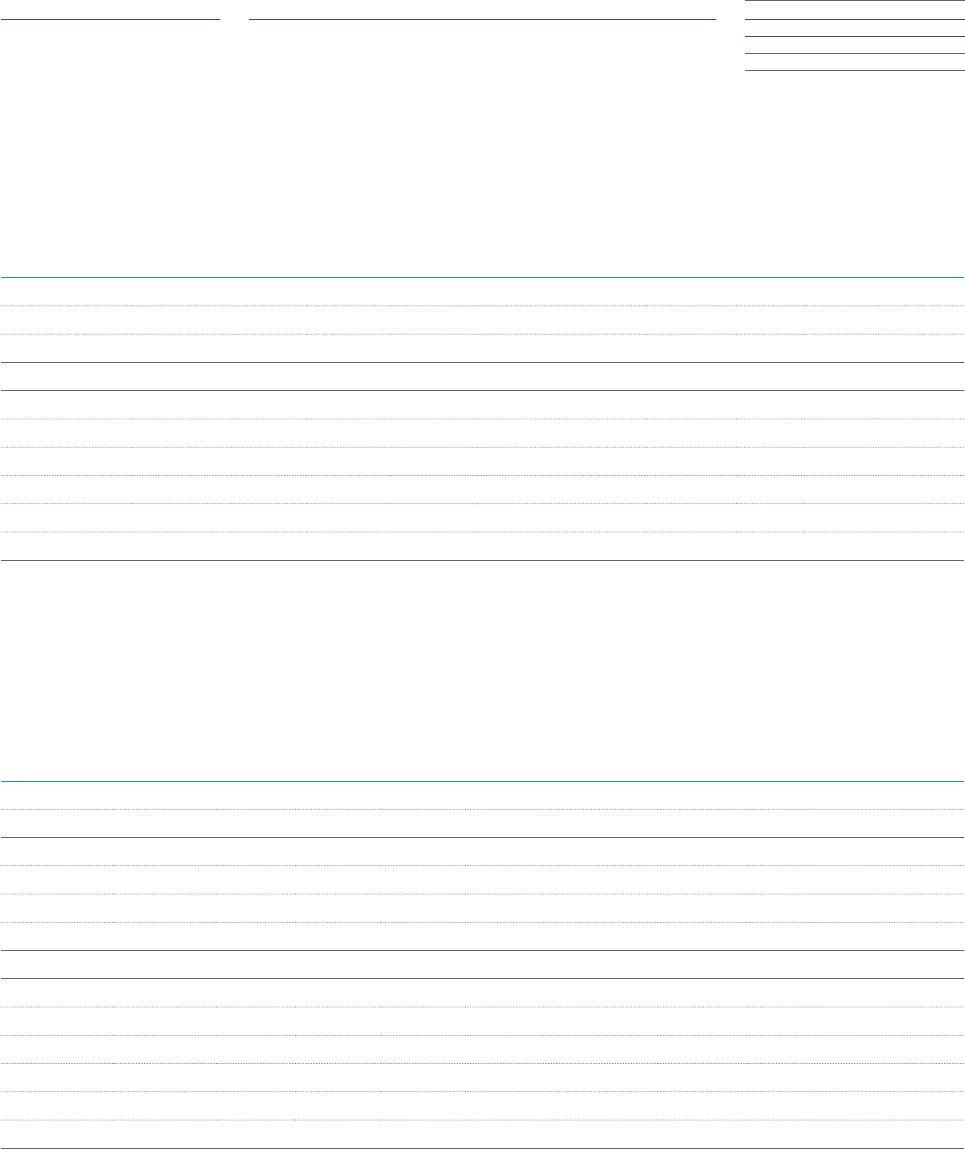

Openreach

We build and operate the xed network

that connects the UK’s homes and

businesses. We are responsible for

providing wholesale ‘last mile’ xed access

from premises to exchanges, and installing

and maintaining the bre and copper

communications networks.

Led by

Clive Selley

CEO, Openreach

Consumer

Across our three brands – BT, EE and

Plusnet – we connect customers to

information, entertainment, friends

and family, at home and on the move.

Between them, the three brands serve

the whole of the UK, providing mobile,

broadband, home phone and TV services.

We buy access to xed-line and broadband

infrastructure from Openreach, and we

use EE’s mobile network to provide mobile

phone services.

Led by

Marc Allera

CEO, Consumer

Enterprise

We sell communications and IT services to

businesses and public sector organisations

in the UK and Ireland. We also provide

network products and services to

communications providers operating in

Great Britain. We’re focused on four main

product markets: xed voice, mobile,

converged connectivity and networked

IT services.

Led by

Gerry McQuade

CEO, Enterprise

Global Services

We are a leading enterprise

communications provider, serving

enterprise customers in 180 countries.

We provide managed network and

IT infrastructure services, enabling

customers’ digital transformations.

Led by

Bas Burger

CEO, Global Services

Strategy and Transformation

We are responsible for developing and

setting corporate, network and product

strategies for the group. We also drive

pan-BT transformation programmes.

Led by

Michael Sherman

Chief strategy

and transformation ocer

Technology

We are responsible for designing,

building and operating BT’s core and

mobile networks, platforms and IT

systems in the UK and globally. We also

work with the customer-facing units

to develop and roll out products and

services for their customers.

Led by

Howard Watson

Chief technology

and information ocer

Corporate functions

The remaining corporate units carry out

central activities on behalf of the group.

We benet from shared expertise and

economies of scale. They include: Finance,

HR, Legal and Company Secretarial,

Compliance, Corporate Aairs, Property,

Facilities, Procurement, Regulatory Aairs

and Group Business Services.

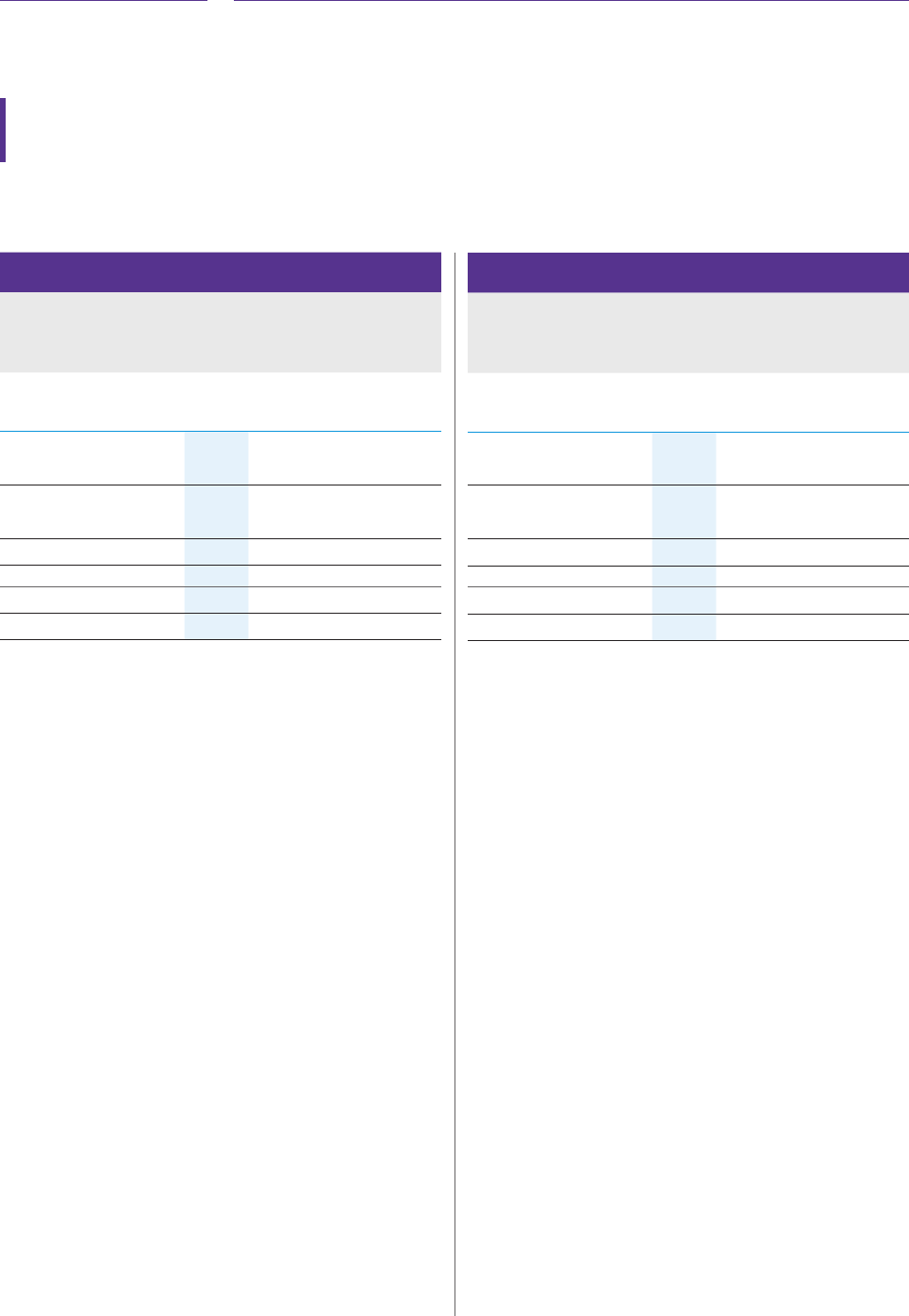

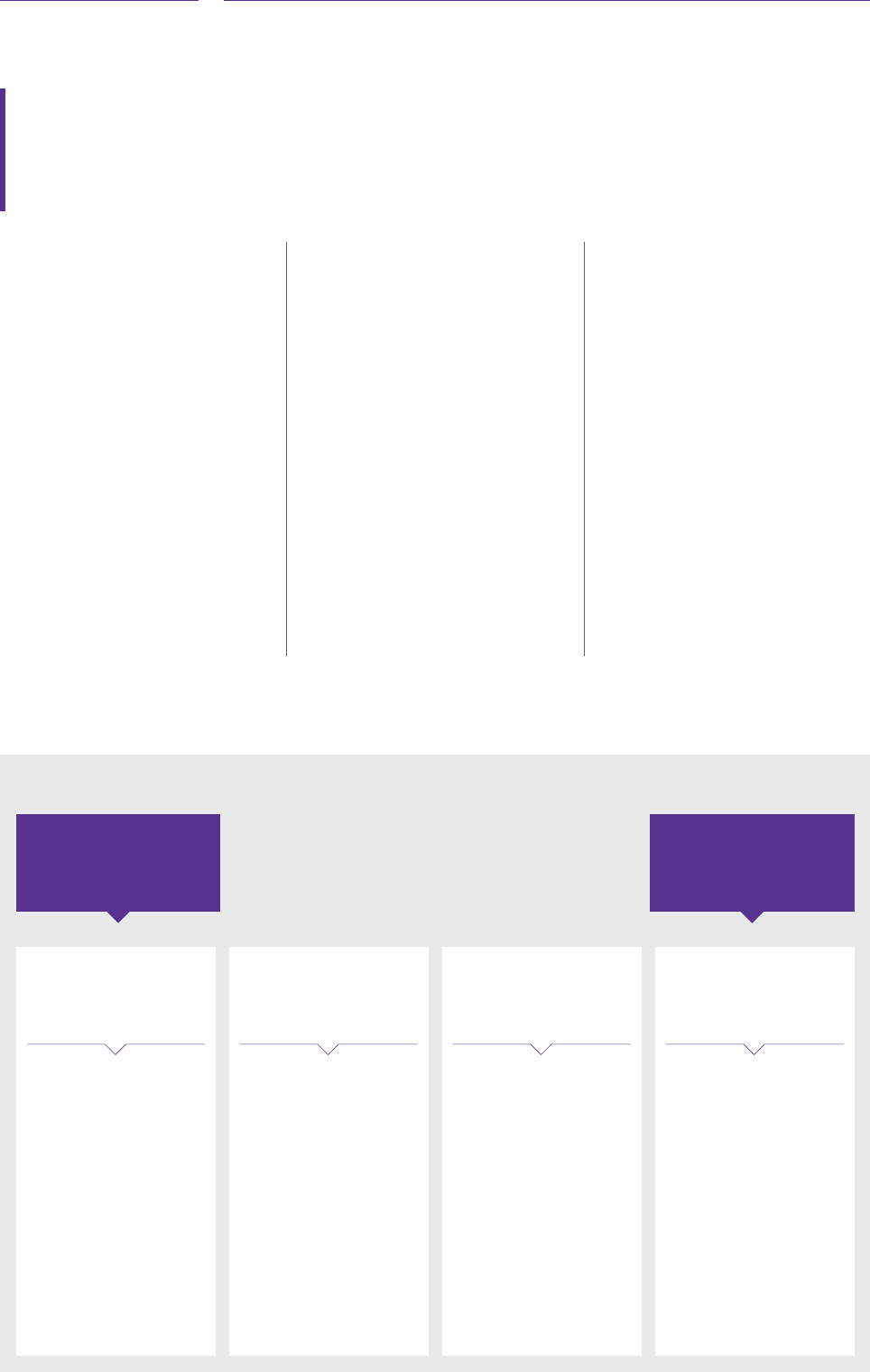

Our customer-facing units Our corporate units

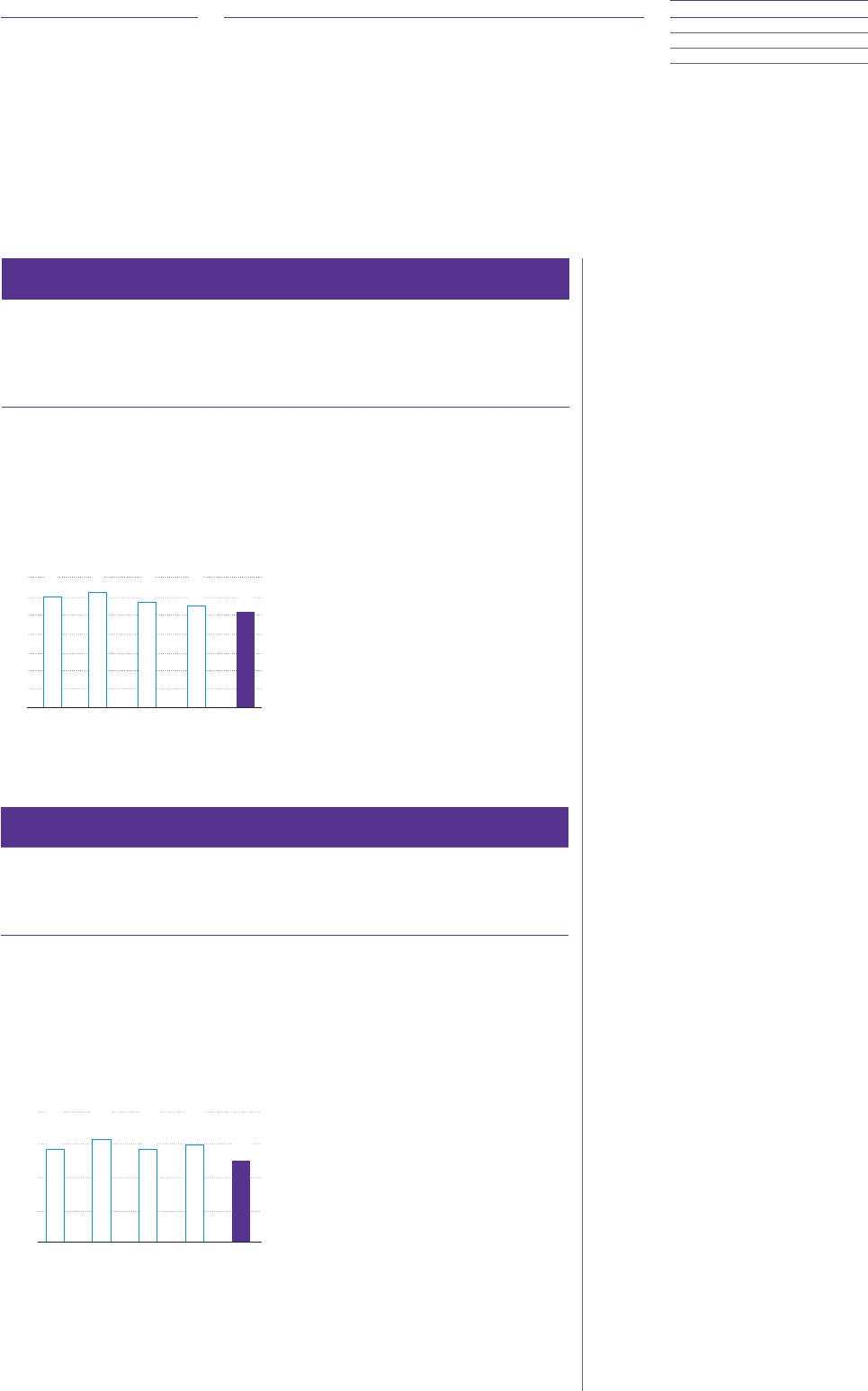

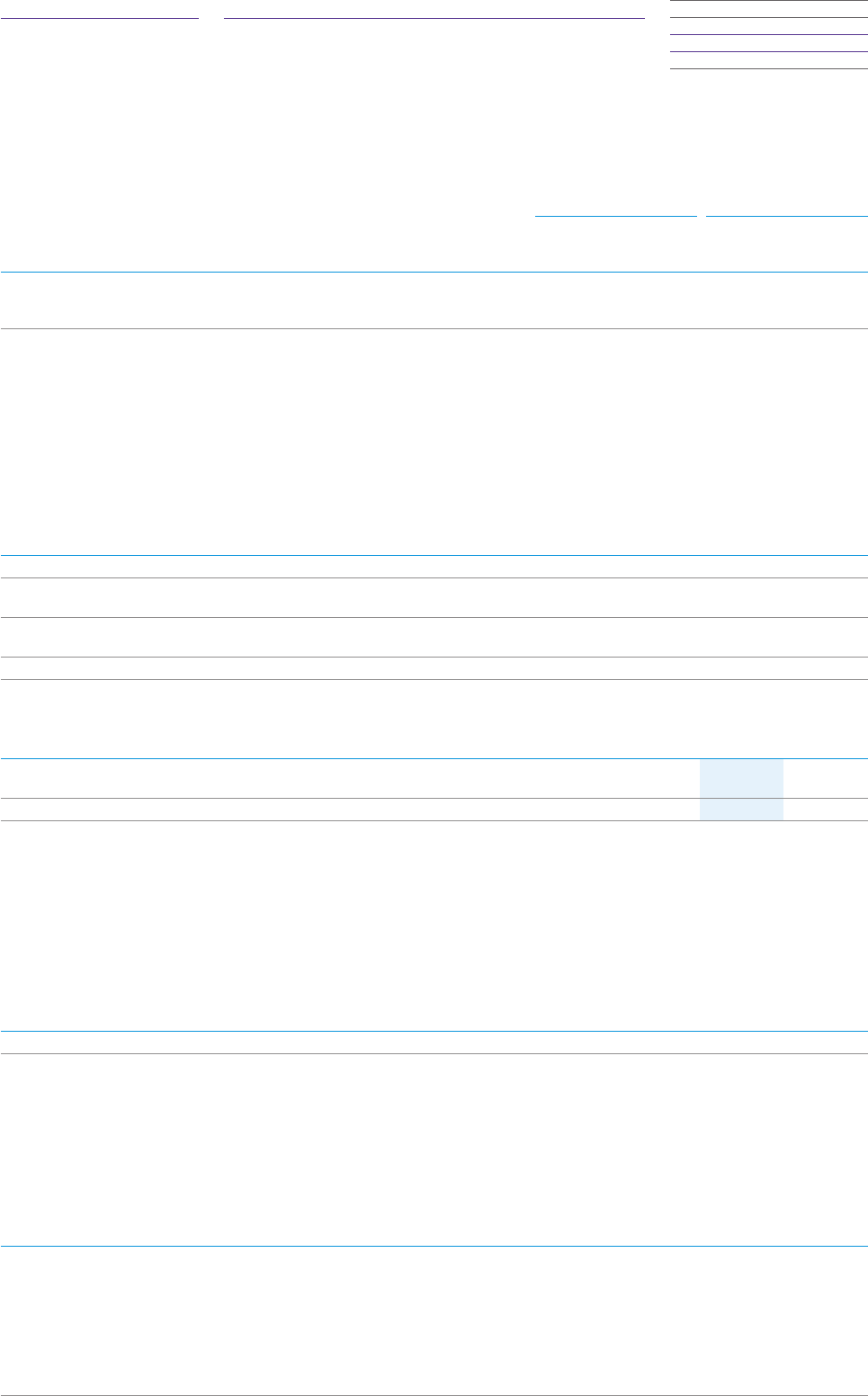

External revenue

£10,588m +3%

Percentage of

group revenue

45%

External revenue

£4,735m (6)%

Percentage of

group revenue

20%

External revenue

£2,200m (3)%

Percentage of

group revenue

10%

External revenue

£5,933m (4)%

Percentage of

group revenue

25%

5

BT Group plc Annual Report 2019 Strategic report

Governance

Financial statements

Additional information

76

BT Group plc BT Group plcAnnual Report 2019 Annual Report 2019 Strategic report

Governance

Financial statements

Additional information

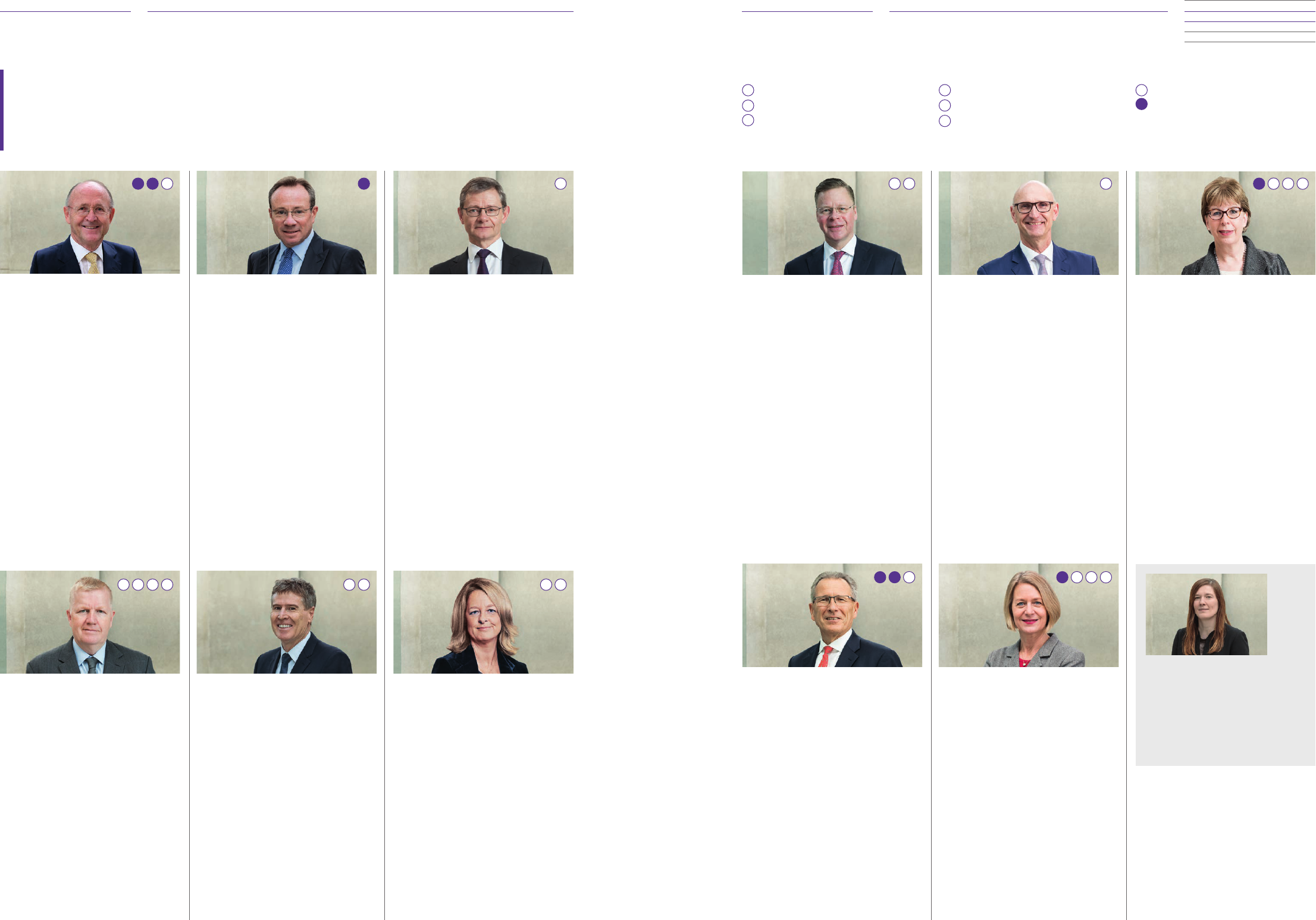

The

Executive Committee

provides input and

recommendations

to support the chief

executive in exercising

the authority delegated

by the Board to run the

business of the group

day -to -day. It meets

weekly and is chaired by

the chief executive.

The

Executive Committee

assists the chief executive in:

• developing the group

strategy and budget for

the Board’s approval

• executing the strategic plan

once agreed by the Board

• providing assurance to the

Board in relation to overall

performance and risk

management.

All decisions are taken by

the chief executive, or his

delegate, in keeping with

the principle of single point

accountability.

Clive Selley

Invitee, CEO, Openreach

Clive was appointed CEO, Openreach in

February 2016. He was formerly CEO, BT

Technology, Service & Operations, CEO

BT innovate & design and before that

president, BT Global Services portfolio

& service design. The CEO of Openreach

cannot be a member of the

Executive

Committee

under the provisions of the

Commitments. Clive attends

Executive

Committee

meetings as appropriate.

Philip Jansen

Chief executive

Appointed as chief executive in February 2019

and on the Board since January 2019.

Philip joined BT from Worldpay where he had

been CEO since April 2013. Before that he

was CEO and then chairman at Brakes Group

between 2010 and 2015. Philip spent the

previous six years at Sodexo where he was group

chief operating offi cer and chief executive,

Europe, South Africa and India. Prior to that he

was chief operating offi cer at MyTravel Group

from 2002 to 2004 and managing director of

Telewest Communications (now Virgin Media)

from 200 0 to 2002, after starting his career at

Procter & Gamble.

Simon Lowth

Chief fi nancial offi cer

Appointed to the Board as chief fi nancial offi cer

in July 2016.

Simon was CFO and executive director of

BG Group before the takeover by Royal Dutch

Shell in February 2016. Previously Simon was

CFO and an executive director of AstraZeneca,

and fi nance director and executive director of

ScottishPower. Prior to that, Simon was a director

of McKinsey & Company.

Gerry McQuade

CEO, Enterprise

Appointed CEO, Wholesale and Ventures in March

2016 and became CEO, Enterprise in May 2018.

Gerry was formerly chief sales and marketing

offi cer at EE responsible for the business,

wholesale and product development areas which

he had overseen since the merger in 2010 of

Orange and T-Mobile. He joined the board of

Orange in January 2008, and prior to Orange

he was a founding director of Virgin Mobile.

Ed Petter

Corporate aff airs director

Appointed November 2016.

Ed was formerly deputy director of corporate

aff airs at Lloyds Banking Group . Prior to that he

held corporate aff airs roles at McDonald’s Europe,

McKinsey & Company and the Blue Rubicon

communications consultancy, having previously

worked as a news producer and editor at the BBC.

Cathryn Ross

Regulatory aff airs director

Appointed January 2018.

Cathryn was formerly chief executive of Ofwat,

the independent economic regulator for the

water and waste water sector in England and

Wales. Cathryn is an experienced regulatory

and competition economist and has worked

across a number of diff erent sectors advising on

economic, regulatory and competition issues.

Howard Watson

Chief technology and information offi cer

Appointed February 2016.

Howard was formerly chief architect and

managing director, global IT systems and led the

technical teams behind the launch of BT Sport

in 2013.

Howard joined BT in 2011 and has 30 years

of telecoms experience having spent time at

Telewest Communications (now Virgin Media)

and Cartesian, a telecommunications consultancy

and software company.

Michael Sherman

Chief strategy and transformation offi cer

Appointed May 2018.

Michael is responsible for developing BT’s long-

term strategy and guiding pan-BT business

transformation. Prior to BT, Michael was a

partner and managing director at Boston

Consulting Group for 11 years. Before that,

Michael spent eight years as an executive at

Viewlocity, an enterprise software company.

Alison Wilcox

HR director

Appointed July 2015.

Alison was formerly regional HR director for

Vodafone Europe and before that, r egional HR

d irector for Vodafone’s Africa, Middle East and

Asia Pacifi c footprint. Alison joined Vodafone in

2006 as group director of leadership following

a career in consulting.

Marc Allera

CEO, Consumer

Appointed February 2016 as CEO, EE and

became CEO, Consumer in September 2017.

Marc was previously chief commercial offi cer for

EE from 2011 to 2015. Marc spent ten years

at Three UK as sales and marketing director and

subsequently chief commercial offi cer. Prior to

that, Marc was general manager of Sega UK

and Europe.

Sabine Chalmers

General counsel

Appointed April 2018.

Before joining BT, Sabine was chief legal and

corporate aff airs offi cer and company secretary

of Anheuser-Busch InBev for 12 years. She also

held various legal leadership roles at Diageo.

Sabine is qualifi ed to practise law in England

and Wales and New York State.

Bas Burger

CEO, Global Services

Appointed June 2017.

Bas was formerly president, BT in the Americas,

BT Global Services. Bas joined BT in 2008 as

CEO Benelux.

Before joining BT, Bas was executive president

and a member of the management committee of

Getronics NV, where he ran global sales, channels

and partnerships, developing the company’s

international business. He was also CEO and

managing director of KPN Entercom Solutions.

Executive Committee

Rachel Canham

Company secretary & general

counsel, governance

Rachel is company secretary of BT

Group plc. She joined BT in 2011 as a senior

commercial lawyer before becoming chief

counsel for mergers & acquisitions in 2013.

Rachel was appointed company secretary &

general counsel, governance in November

2018. Rachel attends all

Executive

Committee

meetings.

8

BT Group plc Annual Report 2019

8

BT Group plc Annual Report 2019

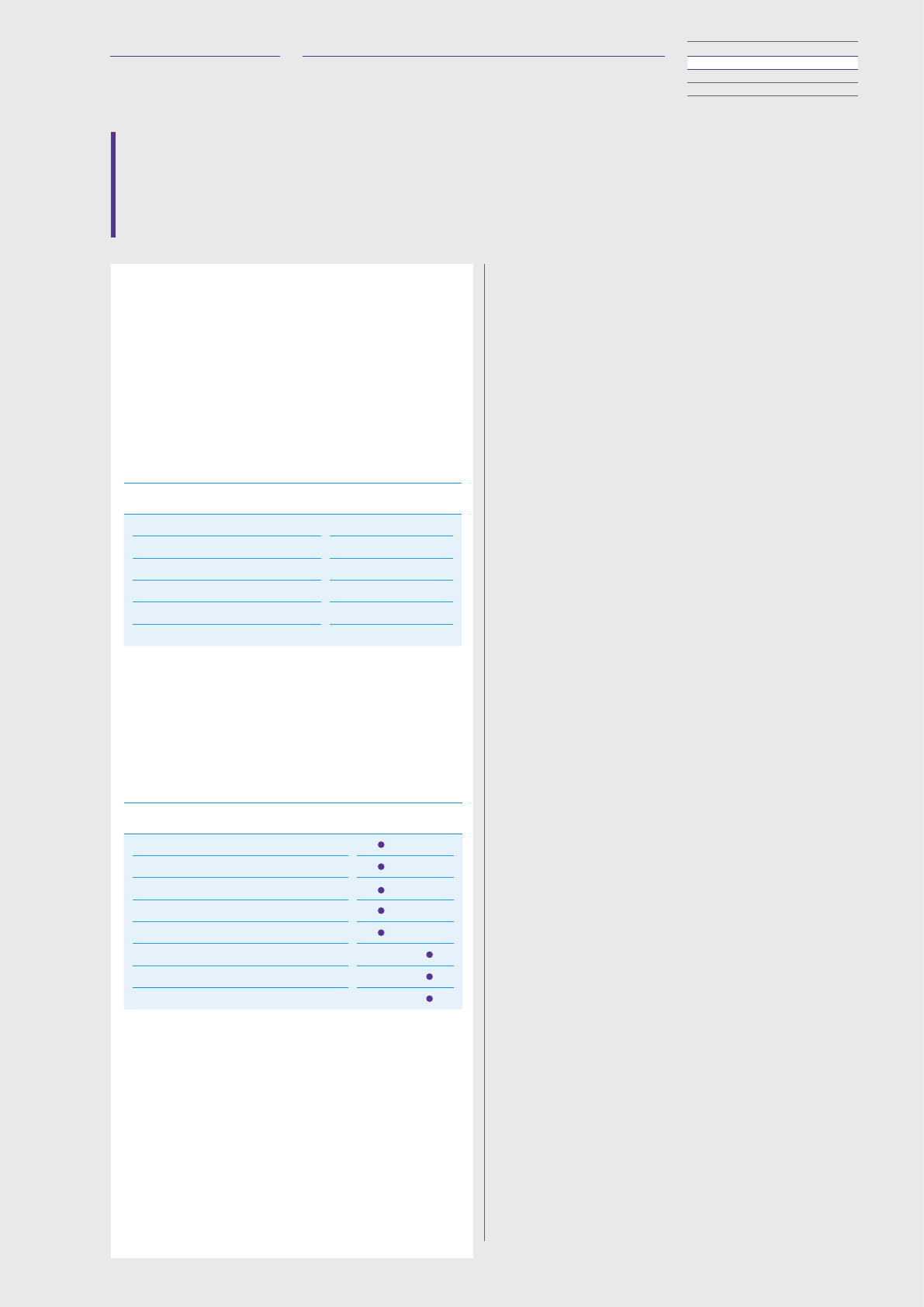

Service providers Our markets

Our brands

UK xed

connectivity

UK Mobile TV and content

Converged

connectivity

and services

Global

telecoms services

Fixed

infrastructure

BT

EE

Plusnet

Openreach

Selected competitors

primary oering

Amazon Prime Video

Apple TV

CityFibre

Giga

Hyperoptic

Netix

O2

Orange Business Solutions

Sky

TalkTalk

Three

Virgin Media

Vodafone

Please note that these are primary oerings. We acknowledge that our competitors also have secondary oerings in some of our markets in addition to the above.

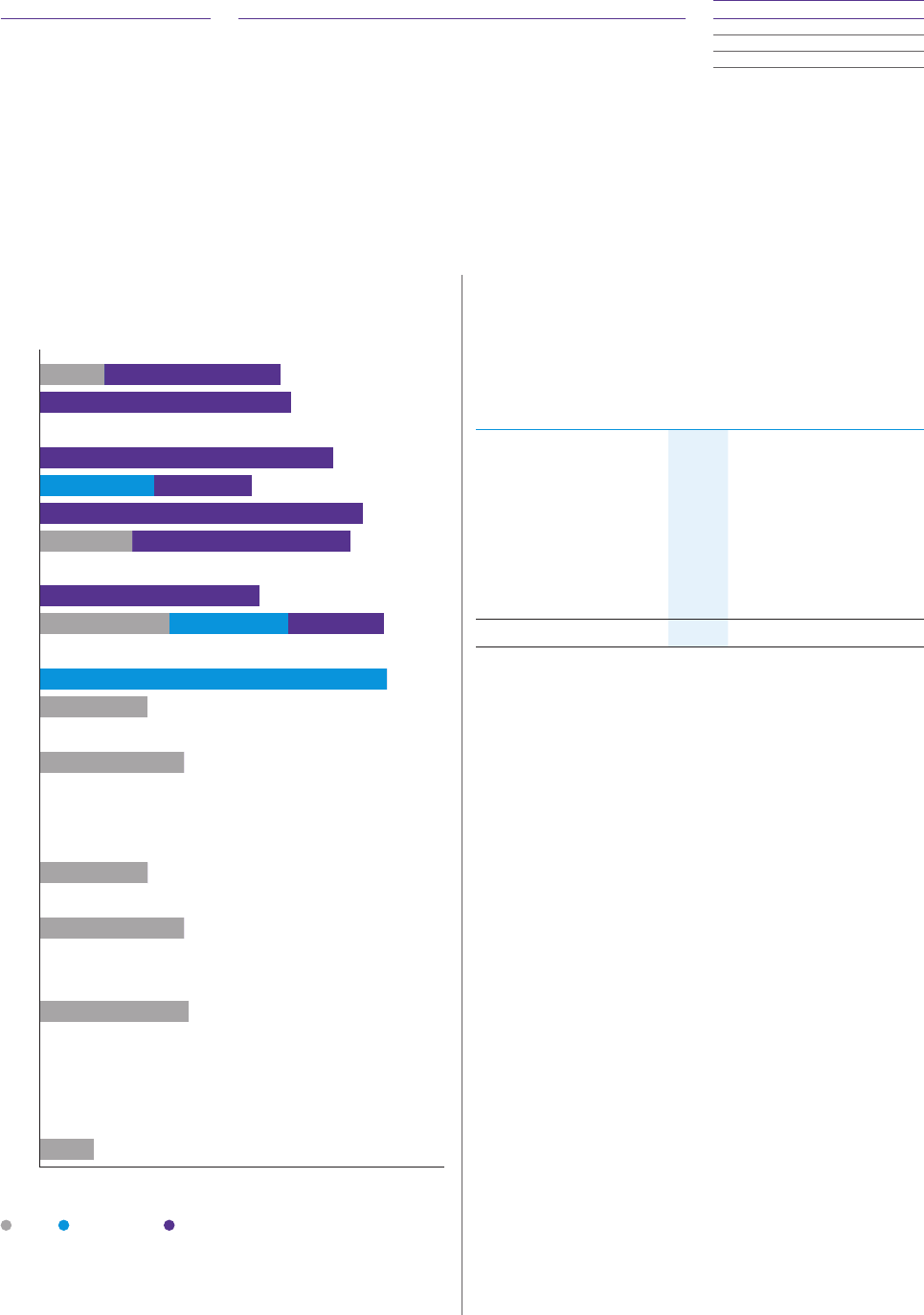

Market context

By understanding market trends in our own industry and in others

that aect us, we can take advantage of opportunities as they arise

and act more quickly to reduce any risks to our business.

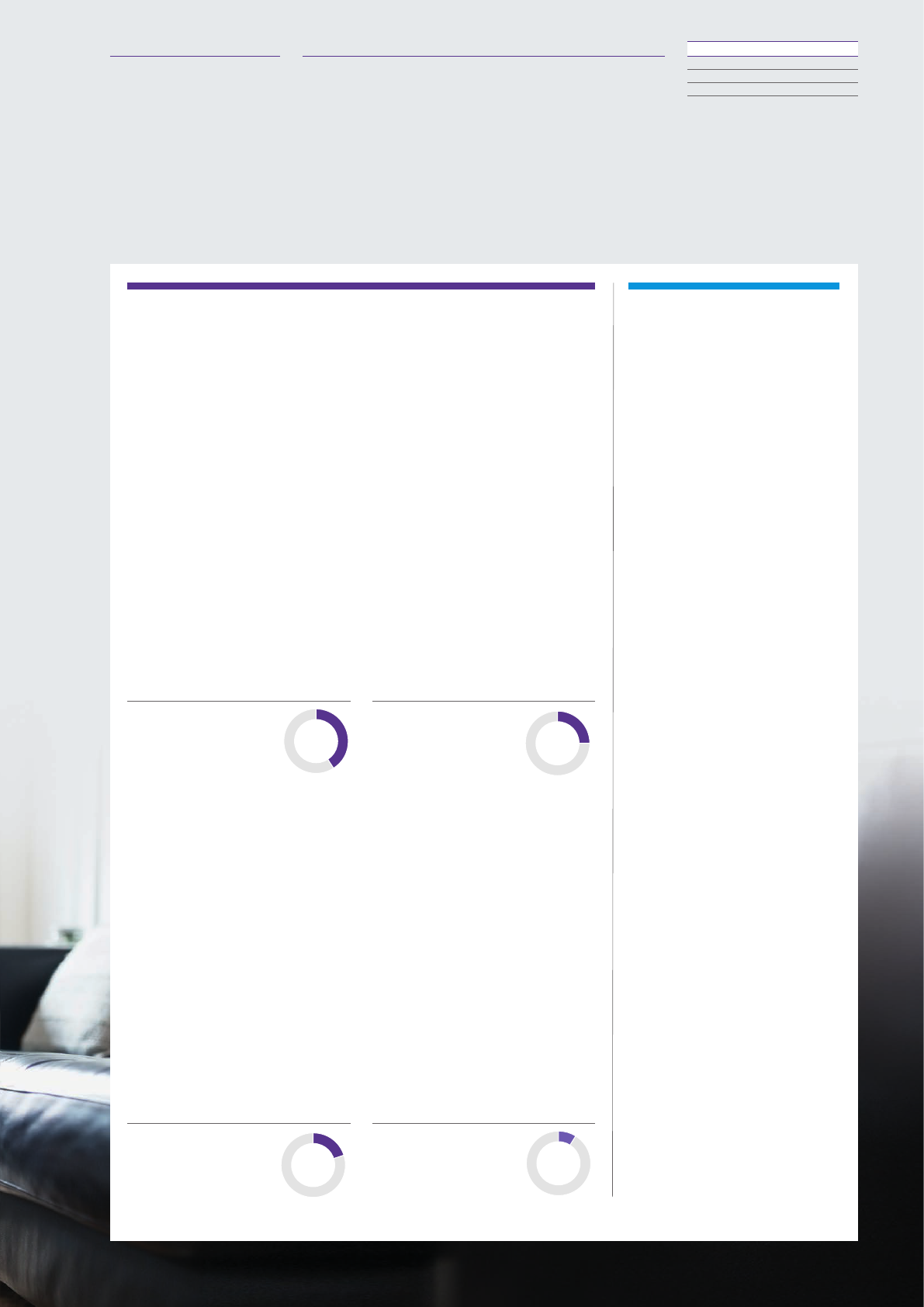

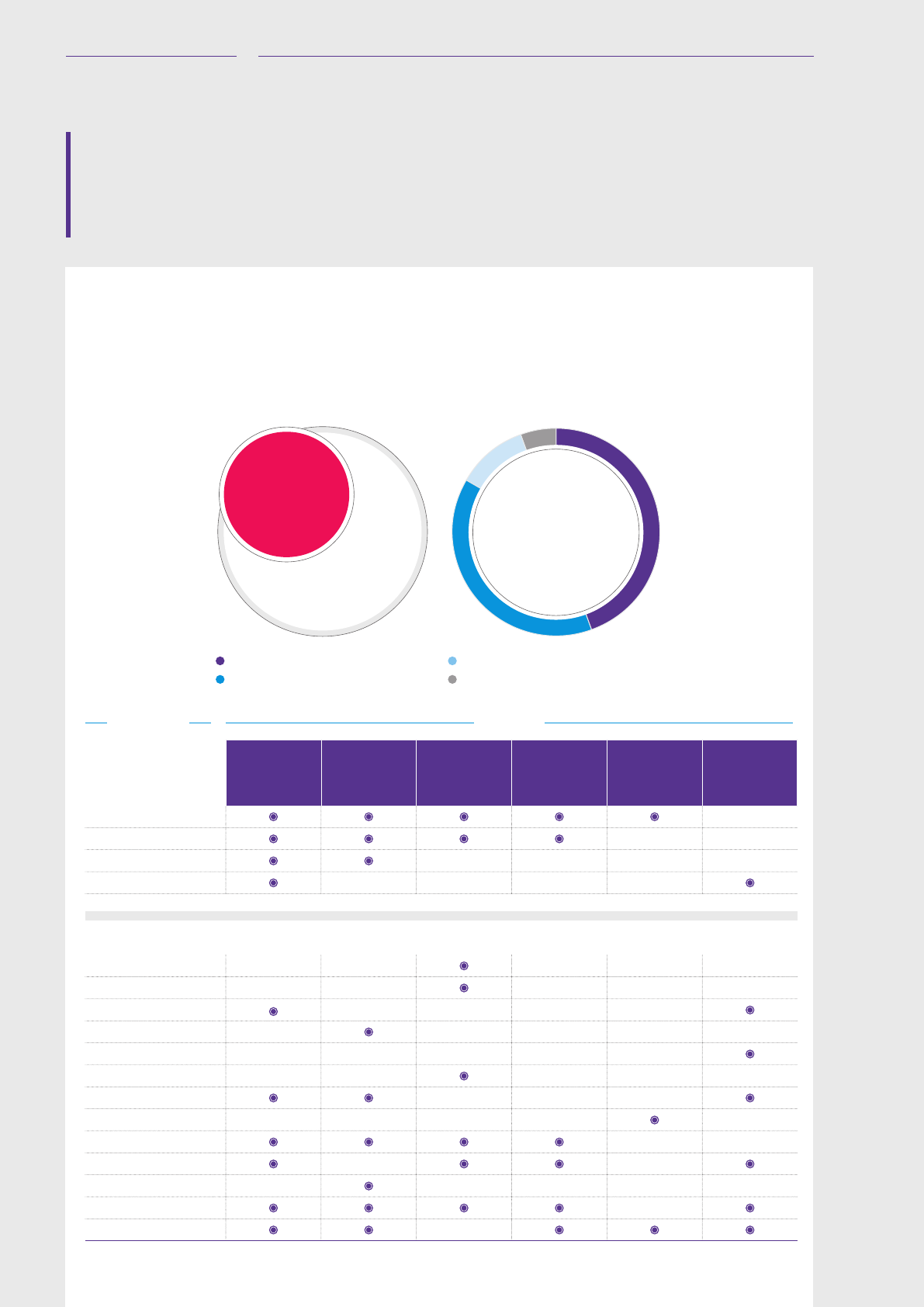

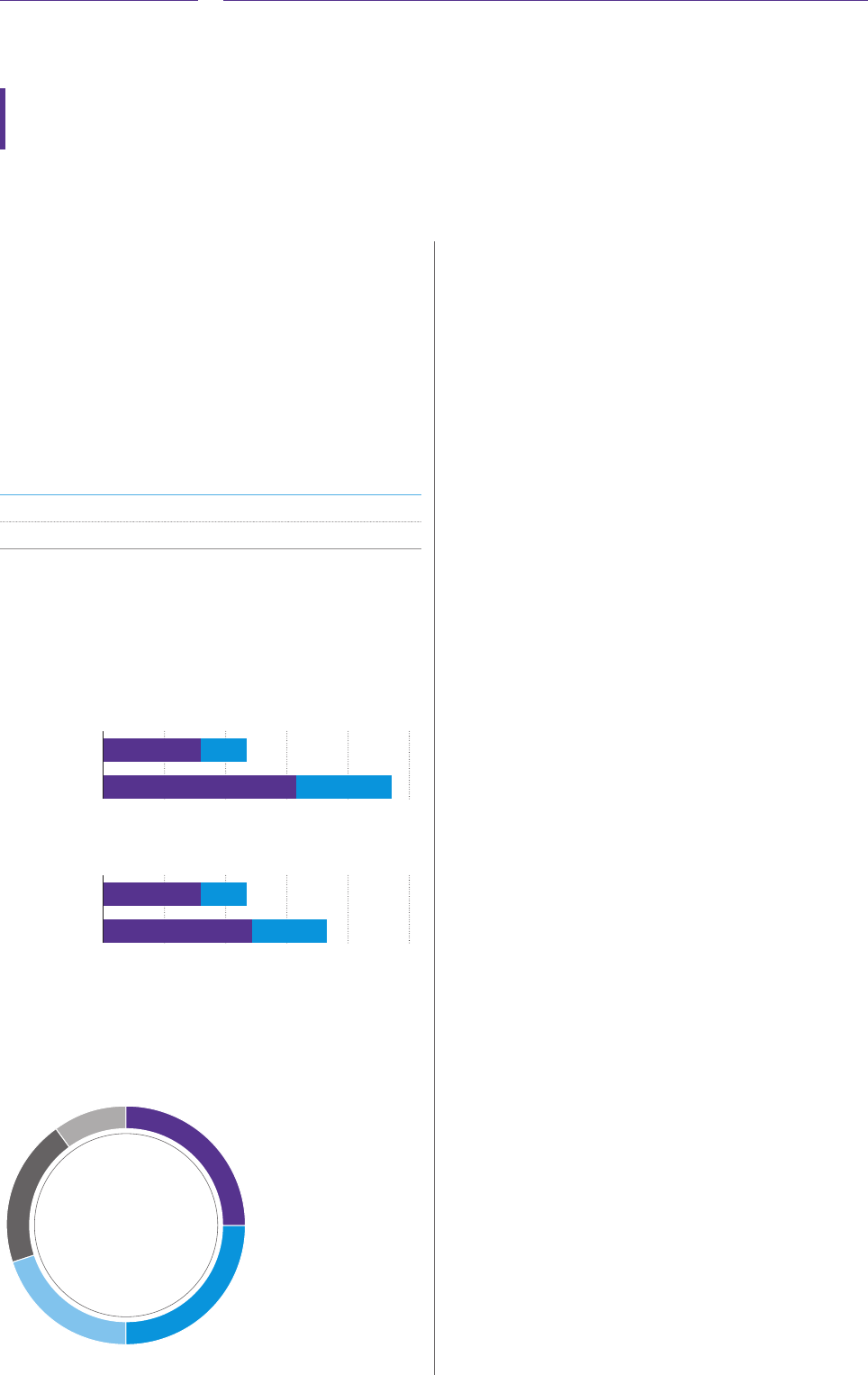

Our share of UK households

(Number of households)

Homes with EE relationship 8m

Homes with BT relationship 7m

Homes with a relationship with both BT & EE 2m

Homes with a relationship with Plusnet 1m

27m

Number of

homes in the UK

15m

BT UK share

15m

BT UK share

9

BT Group plc Annual Report 2019 Strategic report

Governance

Financial statements

Additional information

UK mobile

Providing mobile

connectivity to

consumers, businesses

and MVNOs.

This market includes any data or voice services

on mobile devices. It is a major segment of our

business.

We use EE’s mobile network to provide mobile

phone services across our three brands to the

whole of the UK.

Both Consumer and Enterprise sell mobile

services in this market.

Another aspect of the mobile market is

wholesaling to Mobile Virtual Network

Operators (MVNOs) in the UK, where Mobile

Network Operators oer wholesale mobile

connectivity.

Historically, the mobile market has largely

been driven by handset launches. Less

innovation and dierentiation mean

consumers are keeping their handset for

longer and visiting stores less often. This trend

is leading to increased uptake of SIM-only

plans in the market. We also see market

volume growth coming from consumers

buying extra SIMs and devices and using

more data.

Businesses are increasingly letting their

people use their own smartphones at work.

Despite that, they are continuing to buy

large data bundles to support their people’s

increasing mobile data use, for example in

areas such as collaboration.

The UK currently has more than 100 MVNOs

and we are one of the leading providers of

MVNO services.

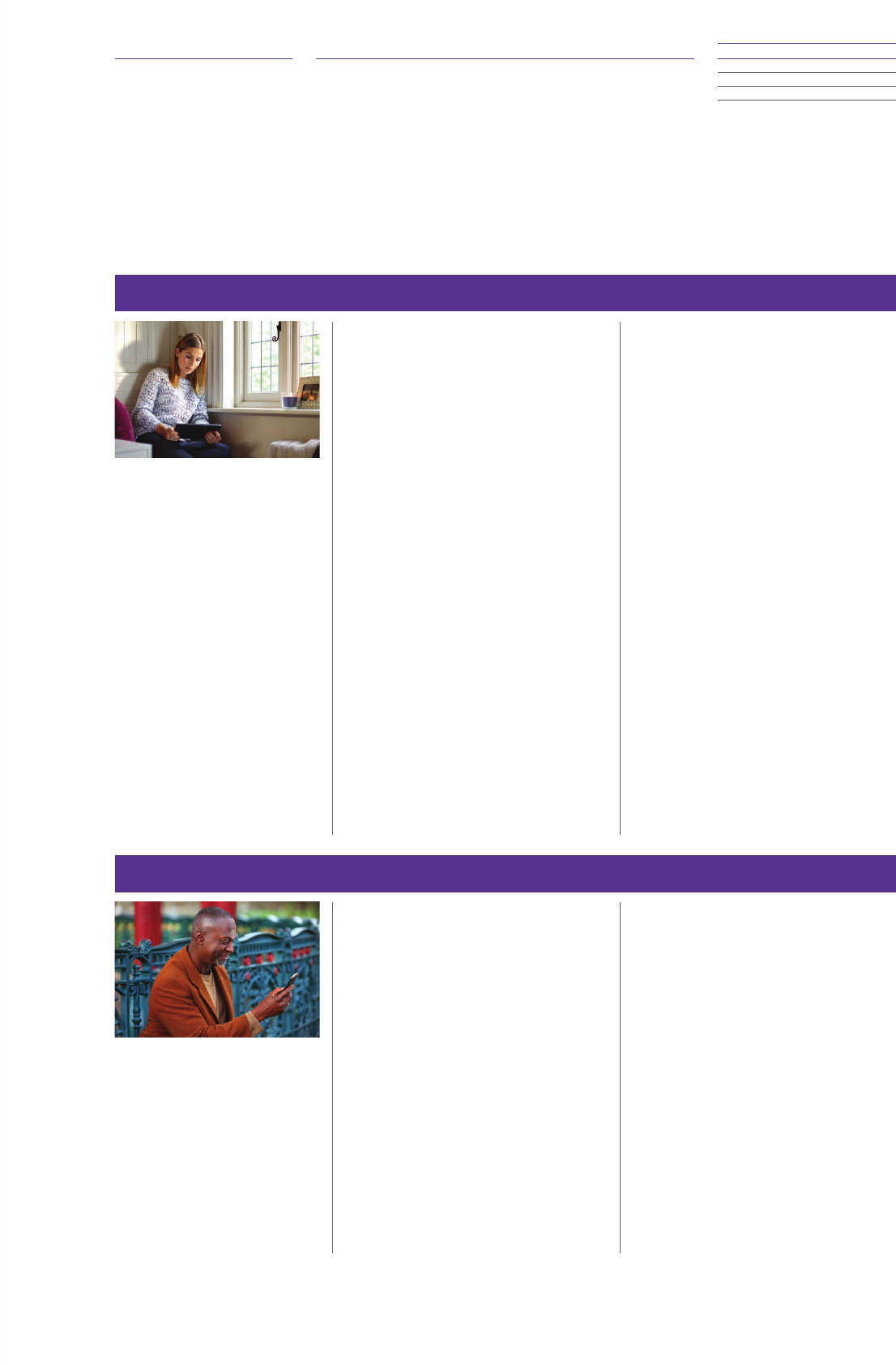

UK xed connectivity

Providing xed

broadband services to

consumers, businesses

and communications

providers.

We connect customers to information,

entertainment, and friends and family,

at home.

Fixed connectivity includes providing

connectivity directly to homes or businesses

and is our biggest market by revenue. It

includes voice telephony, internet access and

the provision of dedicated lines for business

and public sector customers.

Within Enterprise, we have three main types

of customers with dierent communications

needs:

• Small and Medium Enterprise customers,

who we dene as having fewer than

100 employees, often rely heavily on

communications services and look for more

consumer-style products.

• Corporate customers, who often have more

complex needs, and who are increasingly

buying more security and cloud-based

products.

• Public Sector and Major Business customers,

who look to buy both xed and mobile

services in multi-year contracts and who

can demand very high security.

We also serve communications providers who

want to buy solutions to sell on to their end

customers.

This segment is experiencing a technology

migration from the legacy Public Switched

Telephone Network (PSTN) to Internet

Protocol (IP). The UK Government actively

supports this.

In Consumer, xed internet connectivity is

increasingly essential to our individual and

household customers, with each using an

average of 240GB a year. In 2018, nine in

ten people had access to the internet in their

home. Many adults claim to spend as much as

24 hours per week online, more than twice as

much as in 2007.

Price competition on phone calls and

broadband continues to be intense. Therefore,

revenue opportunities in this segment focus

on increased demand for higher speed and

better-quality products, driven by consumers

and businesses using more data.

10

BT Group plc Annual Report 2019

Market context continued

TV and content

Providing TV content

to customers.

We sell TV content in our Consumer division

under our BT and EE brands.

We also wholesale BT Sport to other providers.

The UK has a well-established free-to-air TV

service, on top of which consumers buy many

premium content packages including live

sport, which continues to be a staple in most

UK homes.

In comparison to ‘cord-cutting’ where

consumers abandon TV packages in favour

of a range of over-the-top (OTT) streaming

media oers, we are seeing some evidence of

‘package-thinning’ as an emerging feature

of the market. This is where customers buy

the most basic package to get TV access and

accentuate this with on-demand OTT content.

These trends are aecting traditional

providers in limiting their ability to sell

premium monthly content subscription

packages.

Converged connectivity and services

Providing converged

products and services

to customers.

With our xed and mobile networks, we are

well positioned in the converged connectivity

and services market.

We have launched BT Plus, the UK’s rst

converged bre and 4G plan that gives

customers BT’s fastest speeds in and out of the

home with a unique Keep Connected Promise,

all on one simple bill.

We launched 4G Assure for our business

customers, providing 4G connectivity if their

xed broadband service was not available.

The UK is in the early stages of convergence –

the bundling of xed, mobile and TV services

into a single service.

Convergence can increase customer lifetime

value, as those taking converged oers tend

to be more loyal.

Greater connectivity and new devices will

lead to new possibilities for technology

convergence. As an example, people can

already answer their front doors and adjust

their central heating remotely using Internet

of Things (IoT) technology.

Applications like smart homes and connected

cities are no longer ideas beyond the horizon

– they are here and are already part of many

major economies.

11

BT Group plc Annual Report 2019 Strategic report

Governance

Financial statements

Additional information

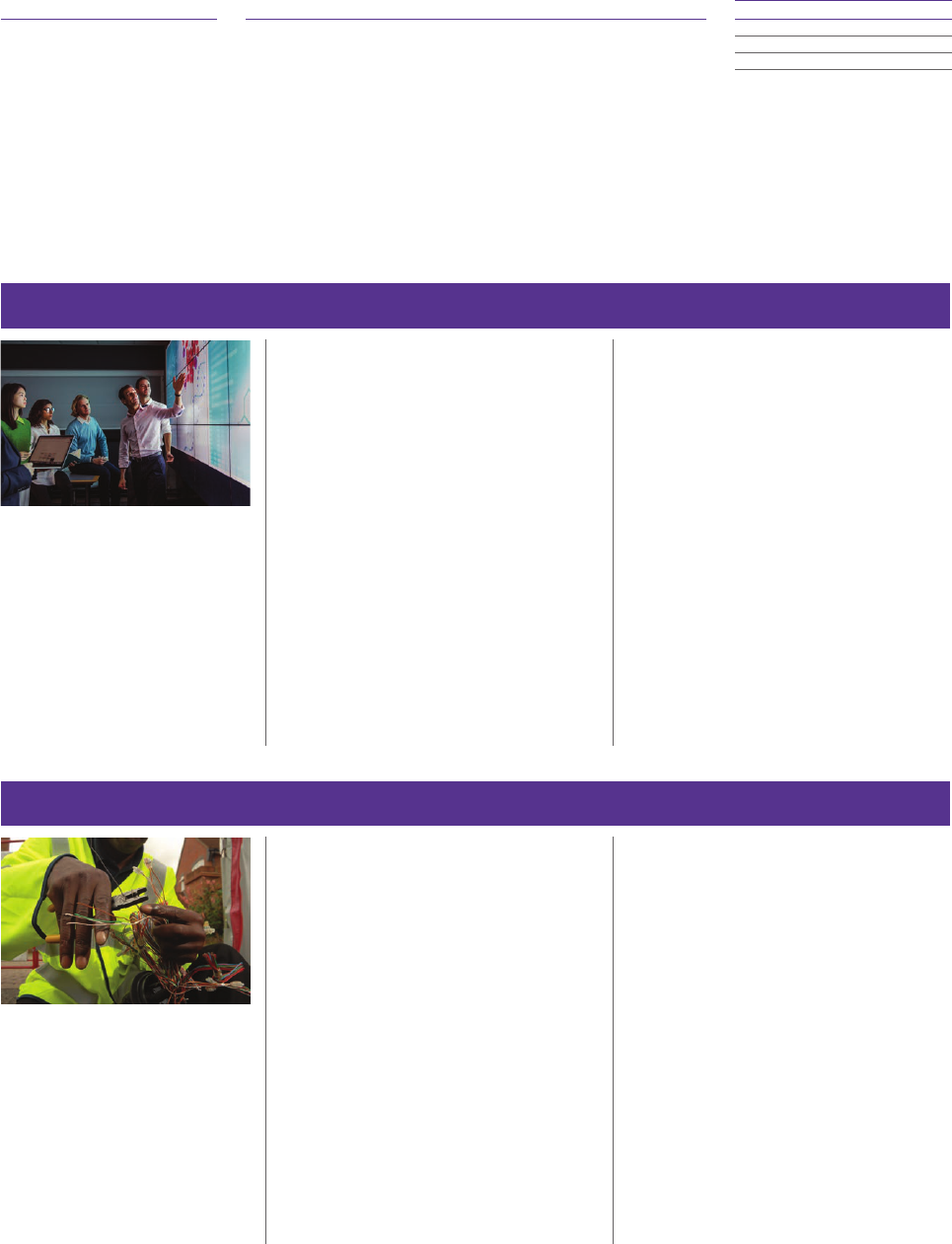

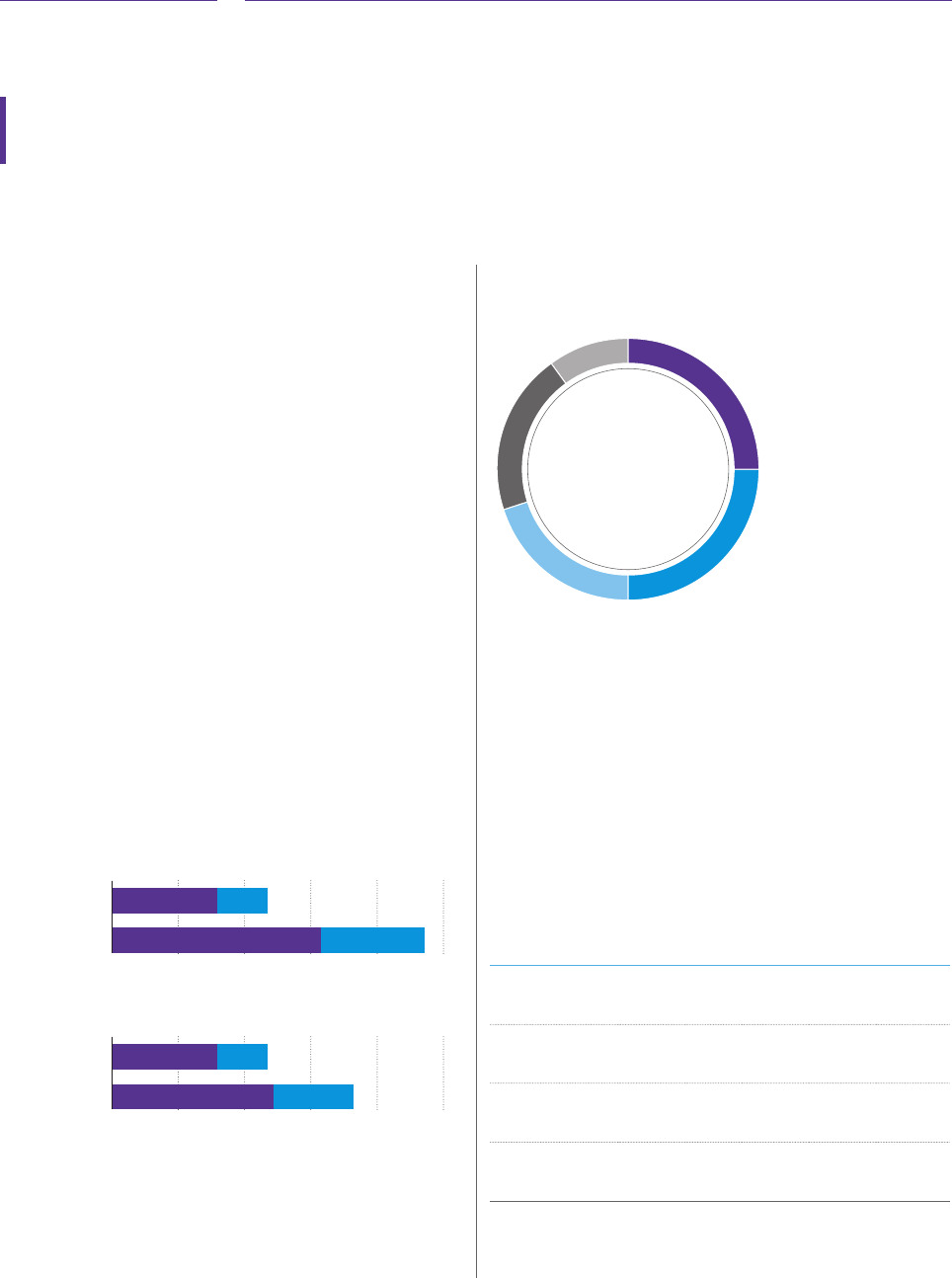

Global ICT services

Providing ICT services to

global enterprises.

The global ICT services market includes

security, network and IT services and is highly

competitive, with many players. It includes

local markets – often dominated by incumbent

communications providers – and the global

enterprise-grade xed line services market.

Global Services operates in this market,

leveraging the strengths of the BT network

and capabilities, to deliver the tailored service

that customers need.

The demands of business customers are

changing. For example, they are moving

from traditional voice services to digital

voice services – from MPLS (Multi Protocol

Label Switching) to services such as SD-WAN

(Software-Dened Wide Area Networks).

They are also increasingly focused on solving

security challenges.

Companies value partners with the knowledge

to help them on this journey. They rely on

their technical expertise and scale to help

them benet from advanced services, in

multiple regions, across infrastructures with

mixed technologies and standards.

Fixed infrastructure

Providing network

access to

communications

providers.

In just under half of the xed infrastructure

market, Openreach is the main provider to

communications providers, who then oer

services to their home and business customers.

In the rest, we overlap with our biggest cable

and bre competitors.

Openreach is deploying new technologies such

as Fibre to the Premises (FTTP) and Gfast to

improve the performance and quality of its

network. It also provides regulated access to

its passive network assets (ducts and poles) to

support network build by other providers.

The UK has a large xed access network

consisting of bre and copper communication

networks. Openreach operates in the UK’s

regulated, xed access market and trades

mainly with communications providers. It is

responsible for providing services over the

local access network, sometimes referred to as

the ‘last mile’, installing and maintaining the

bre and copper communications networks

that connect homes and businesses.

1312

BT Group plc BT Group plcAnnual Report 2019 Annual Report 2019 Strategic report

Governance

Financial statements

Additional information

Our business model is centred

around providing customers with

communications and connectivity

services, while delivering great

experiences and maintaining

long- term relationships.

Our customers and what we off er them

Our customers are consumers, businesses,

multinational corporations, public sector

organisations and other communications

providers.

We sell fi xed-voice, broadband, mobile and TV

to UK consumers, with a range of ancillary products

and services such as handsets and insurance. For

our UK and global business customers, our services

range from phone and broadband to complex

managed networks, IT services and cyber security.

We also sell wholesale access products and services

to UK communications providers.

Customers primarily buy through monthly,

recurring subscriptions or contracts, which provide

us with ongoing and predictable revenue. This is

comple mented by pay-as-you-go mobile services.

Individuals, households and SMEs pay for

standalone or bundled services, typically on 12- to

24-month contracts. In addition, large enterprise

customers – both domestic and international – buy

managed services on multi-year contracts.

Wholesale contracts range from one month for

regulated products, to fi ve years or more for

major managed services deals.

To create lasting revenue and profi t, we focus on

providing a diff erentiated customer experience,

measured through Net Promoter Score (NPS

a

),

which has improved over 11 consecutive quarters.

a

Group NPS measures Net Promoter Score in our retail business

and Net Satisfaction in our wholesale business.

Information linked to our business model

About BT – we explain how we’re organised

and how and where we operate on page 4 .

Strategy – our strategy supports our business

model and is on page 14 .

Principal risks and uncertainties – we describe

these and how we manage them on page 46 .

Viability statement – our directors’ assessment

of our prospects and viability is on page 54 .

Governance – we describe how we govern

our business from page 55 .

Remuneration – the directors’ remuneration

report is from page 73 .

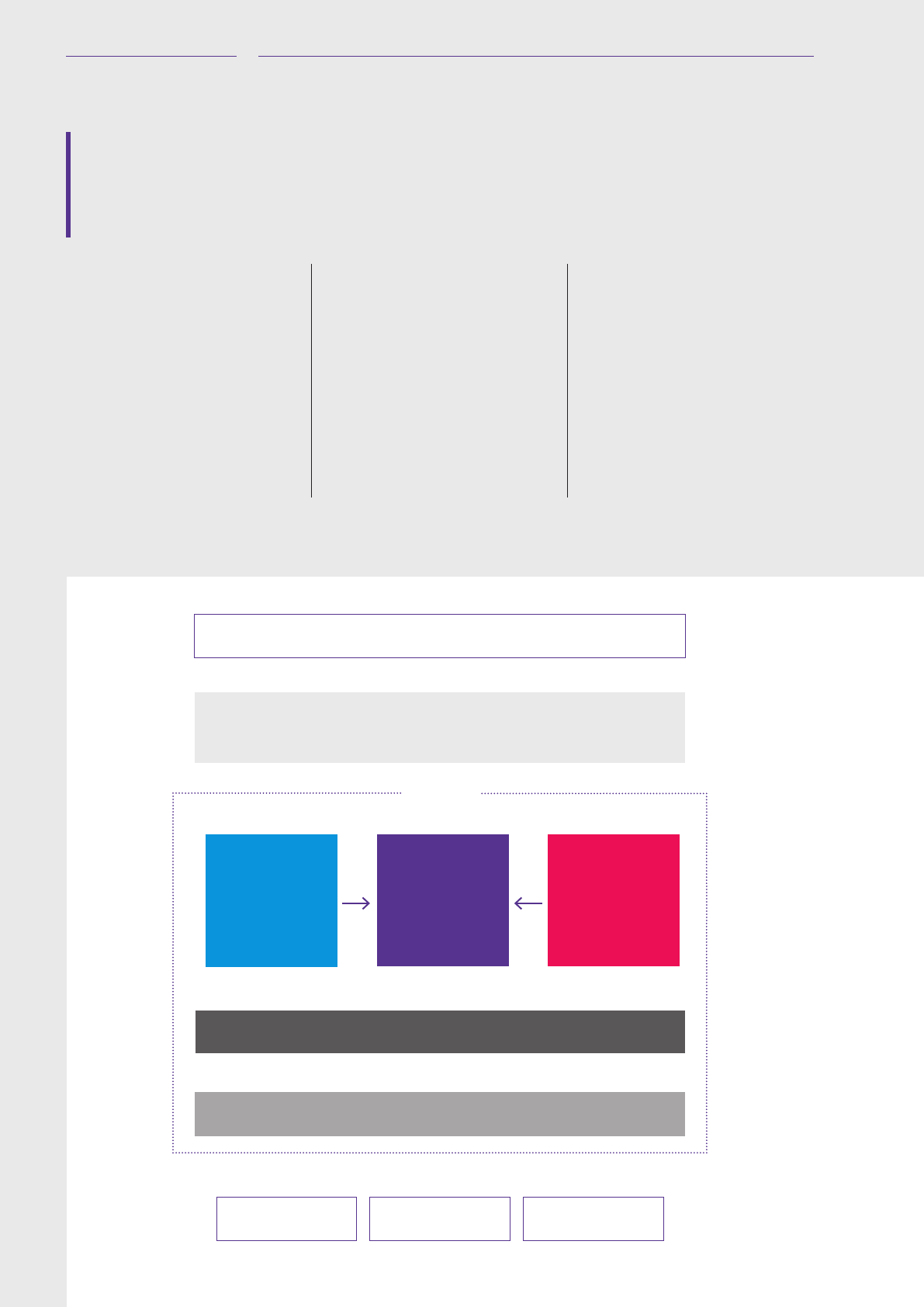

Our organisation

Cu sto mers

Corporate units

Strategy and

Transformation

Technology

Consumer Enterprise

Global Services Openreach

Corporate

Functions

We build

We build fi xed and mobile

connectivity across the UK,

creating the UK’s leading

network.

We innovate

We use our customer insight

and technical skills to create

new connectivity- based

products and solutions.

We se ll

Through our brands, we sell

products and services to build

trust, create value and

generate loyalty.

We operate

We operate fast, secure and

reliable fi xed and mobile

networks that deliver what

our customers need.

What we do

Our purpose

To use the power of communications to make a better world .

Our goal

Drive sustainable growth in value. Lead in converged connectivity

and services, seize new business opportunities and deliver industry -

leading effi ciency.

Stakeholder outcomes

Our business

model

1312

BT Group plc BT Group plcAnnual Report 2019 Annual Report 2019 Strategic report

Governance

Financial statements

Additional information

International Integrated

Reporting Council’s capitals

This key provides a mapping to the ‘capitals’ of

the IIRC’s Integrated Reporting (IR) Framework.

You can fi nd out more at the iirc.org

F

Financial

H

Human

M

Manufactured

I

Intellectual

S

Social

N

Natural

What sets us apart

We have a unique combination of people, technology, content, networks

and other physical assets that sets us apart and supports us in adding value:

F

Financial strength

Our cash fl ows provide us with the funding

to make long-term investments. This year we

invested £ 2 .1bn in our network and generated

£ 2.4bn normalised free cash fl ow, to support

investment in future years.

H

Our people

The commitment, expertise and diversity of

our people are key to our success. We have

106,700 employees, 84,300 of whom are

in the UK.

S

Our customer base

The size, scope and breadth of our customer

base gives us an advantage over our

competitors. We have a total of around

26.8million consumer customers, 1.1

million UK business customers and 4,100

multinational customers.

M

Networks and physical assets

We maintain a substantial core network

with key fi xed and mobile assets, such as our

superfast fi bre broadband footprint of 27.5

million homes and businesses and our mobile

spectrum assets.

I

Our brands

We own three retail brands: BT, EE and Plusnet.

We also own the Openreach brand which serves

communications providers.

M

Retail footprint

In the UK we have more than 600 retail stores,

giving us the largest retail footprint of any

mobile network operator.

I

Innovation

This year we spent £643 m on research and

development enabling us to stay at the

forefront of a rapidly changing world. We have

a portfolio of more than 5,000 patents and

applications, with 10 3 patent applications for

inventions fi led in 2018/19. As an example we

are currently market leaders in the rollout of 4 G

and intend to lead the market to 5 G.

N

Partners

Our business model relies on partners

and suppliers.

£2.4bn

Normalised free

cash fl ow

106,700

Total number

of employees

28 m

Total number of

customers worldwide

27.9m

Homes and businesses

with superfast fi bre

broadband

600

Retail stores

throughout the UK

1 00

Number of countries

we have suppliers in

Our brands

£ 643 m

R& D spend

5. 4 %

Improvements in Right

First Time performance

3. 4m

BT Call Protect

customers

Customers

2m

Children reached

through the Barefoot

Computing programme

87%

Electricity used from

renewable sources

worldwide (UK now

at 100% directly

purchased)

Communities and society

77 %

Employee engagement

outcome

1,400

Agency workers

converted to

permanent

Colleagues

£13.4 bn

Spent with

suppliers

67%

With top 1 00

suppliers

Suppliers

10.78 p

Proposed fi nal dividend

per share

1 5.40 p

F ull year dividend

per share

Shareholders

1,800

UK public sector

customers

Government

14

BT Group plc Annual Report 2019

14

BT Group plc Annual Report 2019

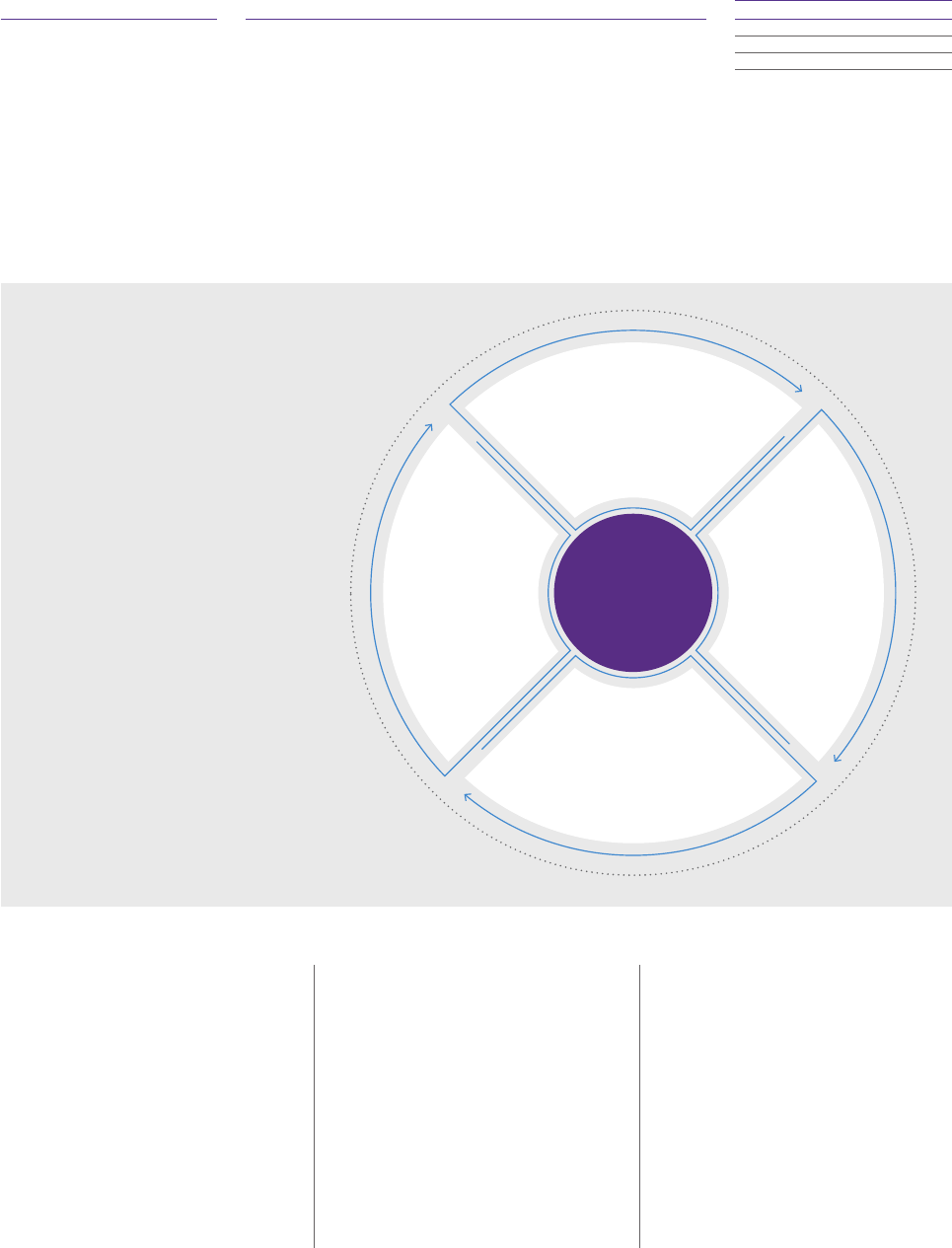

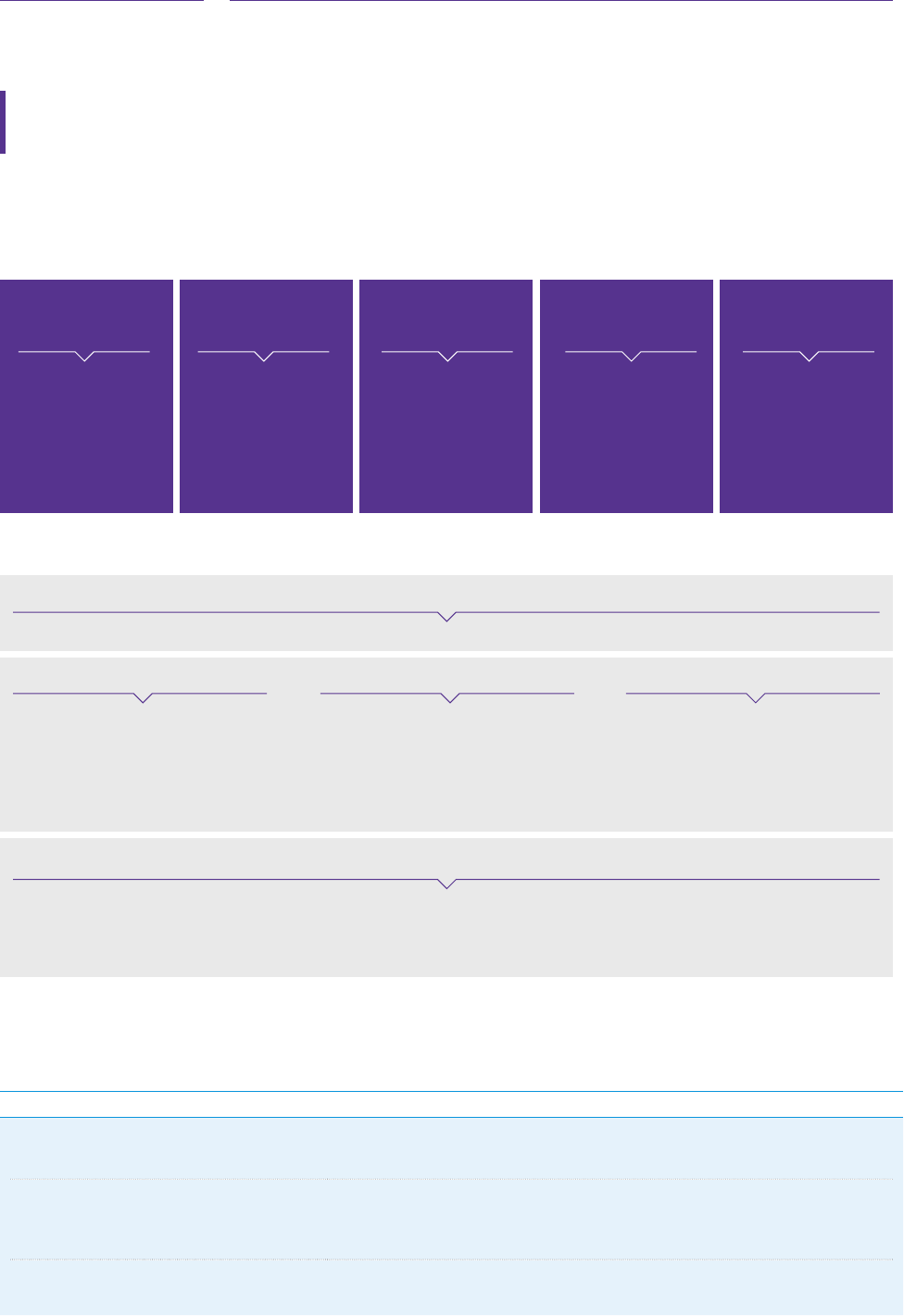

Our strategy is to lead in

converged connectivity and

services, capitalising on new

business opportunities and

delivering industry-leading

operational eciency. This is

to support our goal of

delivering sustainable

growth in value.

Our markets are transitioning but they are

still based on the universal need to connect

and communicate, a need which has never

been more essential.

Creating experiences for our customers that

truly dierentiate us from our competitors is

at the centre of our strategic framework.

Everything we do with respect to building

the best converged network, and becoming

a simpler, leaner and more agile business,

needs to ultimately support our strategy to

deliver great customer experience.

We have underpinned our strategy to full

the needs of two other critical stakeholder

groups – our people and the communities in

which we do business. For our people, our

strategy is to make BT a brilliant place to

work. For the communities we operate in,

our strategy is to be a valued partner in

helping to build better digital lives.

Our strategy

Our purpose

Our goal

Customer

Colleague

Community

Our strategy

Our values

To use the power of communications to make a better world

A brilliant place to work

A valued partner helping build better digital lives

Drive sustainable growth in value

Lead in converged connectivity and services, seize new business opportunities

and deliver industry leading eciency

Personal Simple Brilliant

Best

converged

network

Dierentiated

customer

experience

Simplied,

lean and agile

business

15

BT Group plc Annual Report 2019 Strategic report

Governance

Financial statements

Additional information

For more information

see page 18.

For more information

see page 16.

For more information

see page 20.

Customers want fast, secure,

seamless and reliable connectivity

to enable their digital lives and

businesses. Therefore we must

deliver the best converged

network in the UK through our

rollout of FTTP and 5G.

Consumers and businesses have

more choice than ever about

how they communicate and

the company they choose to

buy from. We want to deliver a

brilliant experience to encourage

existing customers to stay with

us and do more with us, and to

encourage potential customers to

switch to us. We aim to oer easy,

personalised experiences across

our channels and deliver seamless

digital services.

Markets today are more

dynamic and competitive and

we operate in a complicated and

regulated space. We are creating

a simplied and lean business

with agile ways of working. This

means continually modernising

our organisation, changing how

we work to do things better for

less cost, and simplifying our

products, processes and systems.

Strengths and opportunities

Our long-standing relationships with home

and business customers give us a platform

for continued investment.

Our investments result in long-lasting

assets. This includes nationwide networks,

where we are investing in the critical physical

components – such as cabling, switches and

routers – of the digital economy of the near

future. Our strategy supports the building of

a robust network that will underpin the

growth of the digital economy, and

enhanced connectivity in all parts of the UK.

Our network also creates a robust physical

foundation for many uses in next generation

technologies which need the best

connectivity. We will own the foundation

and therefore be in an unrivalled position.

We see signicant opportunities in the

advancement of Articial Intelligence

(AI) and machine learning, for new

communications methods, such as virtual

and augmented reality, and for connected

devices. All of these opportunities require

great connectivity, which we will need to

support.

As a major player in the UK communications

market we have a responsibility to do the

right thing for the UK and make sure we

operate within a fair regulatory framework

and clear ethical boundaries. But being a

player with substantial resources and a large

and diverse customer base also gives us a

real strategic advantage.

In global markets we are often a challenger

to the incumbent, presenting an opportunity

to innovate and move faster to deliver secure

hybrid network solutions that support our

customers’ migration to new digital

technologies.

For more on the risks that aect us

see page 46.

BT Group plc Annual Report 2019

15

Strategic report

Governance

Financial statements

Additional information

Dierentiated

customer

experience

Best

converged

network

Simplied,

lean and agile

business

16

BT Group plc Annual Report 2019

3.

Strategic progress

Delivering a dierentiated customer experience

Creating an outstanding customer experience for all our

customers, backed by the best network, is central to

our long-term growth and future success. We are

making progress but we want to go further.

Everyone at BT is responsible for

providing a brilliant customer experience.

We want our customers to enjoy using

the products, services and support

channels that we provide.

We measure customer experience in two

dierent, but complementary, ways:

customer experience (based on Net

Promoter Score) and how often we get

things Right First Time (RFT).

We regularly review the priorities of both

our consumer and business customers,

and will be evolving our RFT metric for

2019/20 to reect this.

Our evolved measure, Keeping Our

Promises, is focused on us meeting the

commitments we make and providing

a more reliable service.

NPS has increased over 11 consecutive

quarters, with this year’s overall score 6.5

points better than last year’s. RFT was

up 5.4%.

These improvements are largely due to

our consistent approach over the past

three years, focusing on:

42

We have met or exceeded all of Ofcom’s

42 Minimum Service Level targets on

copper and broadband services

<1.8%

We now miss less than 1.8% of

engineeringappointments

1. Delivering a consistent

and reliable service

600 shops

Customers can now talk to us face-

to-face in more than 600 EE shops

45Mbps

Average broadband speeds for BT

consumer customers is 45Mbps

2. Loyalty and value

90%

More than 90% of Samsung mobile

phones were repaired on the same day

SD-WAN

Launched innovative converged

business products such as SD-WAN

3. Products that t our

customers’ needs

180

Next generation SD-WAN is

available in 180 countries

First

First foreign communications provider

to be awarded a licence in China

4. Enabling digital

global business

17

BT Group plc Annual Report 2019 Strategic report

Governance

Financial statements

Additional information

1. Delivering a consistent

and reliable service

The communications we enable are so

essential to our customers that delayed

orders, faults or service disruptions can cause

signicant distress. This year, therefore, our

investments included:

• speeding up our ultrafast bre rollout

(FTTP), passing an average of c14,000

new premises every week in 2018/19.

• hiring over 4,000 new contact centre

agents, and switching 800 from agency

contracts to full time, helping cut call

centre wait times for business customers

by a third and for EE broadband customers

by a half.

• increasing the proportion of all BT brand

Consumer service conversations handled

in the UK to around 83%, and working

towards a target of 100%. All BT Plus, EE

and Plusnet calls are handled in the UK

• improving our eChat service, which is now

used by one in ve BT brand Consumer

customers for service queries.

• increasing our intake of engineering

apprentices by around 1,700.

We are innovating to improve the experience

of our customers. For example, we are using

remote visual assistant technology to help

our call centre agents and our engineers

provide expert advice more quickly.

Openreach’s proactive maintenance meant

we had 2% fewer copper network faults than

in 2017/18, Global Services transformation

has enabled 71% of service incidents to be

proactively detected. Openreach provided

99% of all customers with their rst

appointment date for a new service within

12 days, an improvement from 92% in

2017/18. Customer complaints to Ofcom

reduced by a third for both BT’s consumer

broadband and EE’s mobile customers when

measured on a year-on-year basis.

Like many businesses, our complexity is still

a challenge. But making our portfolio smaller

and simplifying our processes will cut the

cost and inertia that leads to poor customer

experience.

Service progress around BT

• We have met or exceeded all of Ofcom’s 42

Minimum Service Level targets on copper

and broadband services.

• We now miss less than 1.8% of

engineering appointments, 23% fewer

than last year.

• Average Ethernet provisioning times went

down 7.6% compared to last year.

• Enterprise won two golds at the UK

Customer Experience Awards.

2. Loyalty and value

We want to reward customer loyalty by

focusing on value for money.

There will be no price increases for our BT

brand consumer broadband, line rental and

mobile products in 2019.

We want to do more than just stop customers

leaving. We want to build more loyalty across

all our brands, by focusing on value for money.

We want customers to increasingly get more

for their money – whether that is faster

broadband speeds or better mobile coverage.

Loyalty and value progress around BT

• Customers can talk to us face-to-face

in more than 600 EE shops about BT

broadband and TV and EE products and

services, with a full BT service planned for

the end of 2019/20.

• Average broadband speeds for BT’s

Consumer customers have improved 10%

to 45Mbps.

• We now have nearly 3.4 million customers

using our Call Protect product, preventing

more than 220 million unwanted calls

since launch in January 2017.

3. Products that t our

customers’ needs

Our BT Plus convergence proposition includes

mobile replacement, guaranteed minimum

speeds and double mobile data allowances

for customers.

BT Plus launched in May 2018 and has

around one million subscribers. Complete

Wi-Fi subsequently launched as an enhanced

version of the service and the take up has

been encouraging. BT Sport saw a 4%

audience increase for English Premier League

games and an 18% increase for Champions

League coverage.

We also launched BT’s new Stay Fast

Guarantee to improve customer experience

and reduce churn. We’ll optimise connection

performance for new and re-contracting

customers and then monitor and proactively

manage connection quality, oering £20

compensation if we cannot x speed issues.

We launched EE Smart Plans to expand our

dierentiation and drive value through more

for more oers. The handset plan came with

Swappable Benets to increase value and

encourage migration from SIM only, whilst

both handset and Smart SIM plans oer a

Service Pack including annual device health

checks, accessory vouchers and extended

device warranties.

Openreach launched a new volume-

related discount oer for communications

providers to help them boost their

customers’ adoption of higher-speed

and more reliable broadband services.

We have also started migrating customers

to our all-IP digital platform. This brings

opportunities for a range of richer

experiences and propositions – from smart

home technologies for consumers to

sophisticated voice services for SMEs.

Products progress around BT

• We have launched innovative converged

products for businesses such as BTNet,

SD-WAN and cloud solution collaboration

with Microsoft Azure.

• In TV, we are now a content super-

aggregator with Netix and Amazon Prime

already available, and Sky (via NOW TV) on

its way later in 2019.

• We launched a trial of fast mobile phone

delivery through Enjoy on EE (within the

M25) – oering customers delivery and

set-up of their smartphone as quickly as

two hours from placing their order.

• We launched a trial same-day repair

service with Samsung where more than

90% of repairs were xed on the same day

and 80% in the same hour.

• We launched 4G Assure for our business

customers, providing 4G connectivity if

their xed broadband service was not

available. Half of new SME business orders

now take this product.

4. Enabling digital

global business

Our Global Services unit is refocusing on

truly global customers. We are oering a

smaller portfolio of repeatable, scalable

cloud-of-clouds solutions – supported by

market-leading security – to give customers

exibility, choice and control. We are also

making processes smoother with self-service

tools and automation.

Digital global business progress around BT

• Next generation, SD-WAN services are

now available in 180 countries and we

have launched two new Cisco and Meraki-

based solutions.

• We were the rst to market with

Riverbed’s ‘Visibility as a Service’, which

allows customers to view and manage

their application trac.

• To help our customers migrate to the

cloud, last year we added Google and IBM

to the partners we already support on our

Cloud Connect Platform.

• Last year, a BT joint venture was awarded

domestic operating licences within China.

This is a major step towards allowing us to

better serve our multinational customers.

18

BT Group plc Annual Report 2019

Strategic progress

Building the best converged network

The converged network we are creating

is a long-term, sustainable asset. The investments

we make today are the foundation of tomorrow’s

digital services and our future revenue.

Our aim is to bring together our mobile,

broadband and wi- networks to

lead the market for converged digital

services, while reducing our network

costs by switching o assets like legacy

PSTN by 2025.

Our technology focus areas have stayed

the same over recent years, aligned

to meeting our customers’ needs to

connect and communicate. These are:

12.2m

We have 12.2m bre

broadband customers

3.2m

Number of homes and businesses

in the UK passed by our ultrafast bre

1. Superfast and ultrafast bre

16

We will launch 5G in 16 UK

cities in 2019

84%

The percentage of 4G geographic

coverage in the UK

2. Current and future mobile

First

EE is the rst UK network to support

all major smart home ecosystems

50%

By the end of March 2019 half

of SME broadband sales came

with4G Assure

3. Network integration

19

BT Group plc Annual Report 2019 Strategic report

Governance

Financial statements

Additional information

This year we made good progress, which

will continue next year. More of our

customers took up superfast broadband

products and we increased the pace of

our investments in ultrafast.

Ultimately, our ambition is to lead the UK

to 5G. We are starting to roll out our 5G

network, with 16 UK locations going live in

2019. We are proud of still being the best

network in the UK for current technologies,

such as 4G.

We believe bre is the future xed connection

to homes and we are rolling it out as fast

as possible. We are increasing our aim of

bringing FTTP from three million to four

million properties by the end of March 2021,

and our ambition to go from ten million

properties to 15 million by the mid-2020s,

subject to conditions being right.

To keep us in the lead for mobile, we are

switching 3G signal to 4G and upgrading

4G sites to enable more spectrum and give

customers a better experience. In 2018

we also acquired the spectrum we needed

to start rolling out 5G. There is another

spectrum auction happening in Spring 2020

where we expect to bid for more.

Commercial success increasingly depends on

innovation, which is why we invest in research

and development.

We are constantly looking at new innovations

to deploy – like edge computing to cut

network congestion and speed up

application performance.

This year we invested £643m (2017/18:

£632m) in innovation. Over the last decade

we’ve been one of the largest investors in

innovation in the UK, and globally in the

telecoms sector.

We have a portfolio of more than 5,000

patents and applications, with 103 patents

for inventions led in 2018/19.

1. Superfast and

ultrafast bre

a

We have now rolled out ultrafast bre to

3.2 million homes and businesses. As part

of the Openreach full bre rollout, we are

progressing build in 26 locations and in April

announced a further 12 locations to benet

from FTTP availability. This includes London,

Birmingham, Leeds, Manchester, Bristol,

Cardi, Edinburgh and Liverpool.

Superfast and ultrafast progress around BT

• We have 12.2 million superfast bre

broadband customers, within our footprint

of 27.5 million covering 86.6% of homes

and businesses.

• Our ultrafast bre footprint now reaches

more than 3.2 million homes and

businesses.

• EE will oer ultrafast broadband to

customers in summer 2019.

• We are working with government and

Ofcom on options for a broadband

Universal Service Obligation – to provide

100% of UK homes and businesses with a

minimum speed of 10Mbps by 2020.

2. Current and future

mobile

In August, RootMetrics named EE as the

UK’s best network for the fth year in a row.

Using Ofcom measures, our mobile network

now provides 84% geographic coverage in

the UK. We aim to be the UK’s rst mobile

provider to oer 5G, launching in 16 busy UK

cities in2019.

Mobile progress around BT

• We’ve switched on 5G sites in East London

and are rapidly launching more. We have

also trialled live 5G in Canary Wharf.

• We announced a partnership with OnePlus

on 5G in the UK. EE will be the rst mobile

operator in the world to oer the OnePlus

5G smartphone.

• We continue to increase capacity on 4G

sites, laying the foundation for our 5G

launch, and we have built more than

350 new 4G sites in the last 12 months

to connect previously unconnected rural

communities.

3. Network integration

We are bringing together our market-leading

mobile, broadband and wi- networks into

one converged, digital network to give

customers seamless connectivity wherever

they go. It will be the rst of its kind in the

UK. It is scheduled for completion in 2022

and when it launches it will signal a new era

of connectivity.

Network integration progress around BT

• EE showcased Hybrid Broadband,

combining mobile and xed connections

in one service.

• EE is the rst UK network to support all

major smart home ecosystems – with

partnerships including Google, Apple,

Alexa, Hive and Nest.

• We launched broadband with 4G

Assure for SME customers to keep their

broadband running if the xed connection

is lost. By the end of March 2019 half

of SME broadband sales came with

4GAssure.

• We created a team dedicated to partnering

with innovative converged technology

companies to introduce new content,

smartphones and smart home technology.

• Since EE launched shared data plans

there have been more than three million

data gifts between customers.

a

Superfast bre broadband refers to bre-to-the-cabinet (FTTC). Ultrafast broadband refers to bre-to-the-premises (FTTP) and Gfast.

20

BT Group plc Annual Report 2019

Strategic progress

Creating a simplied, leaner and more agile business

This year we have continued to focus on

modernising our organisation, to put customers

at the heart of what we do.

We simplied our structure by bringing

together our Consumer and EE

businesses and our Business and Public

Sector and Wholesale and Ventures

businesses to create two new customer-

facing units – Consumer and Enterprise.

Our specic focus areas are:

We are changing our culture to bring

it more in line with the dynamic

company we want to be. That includes

changes to the way we manage

performance, our job categories

and inter-team working.

4

Number of customer-facing

units reduced from six last year

67%

Around 67% of our spend is

with our top 100 suppliers

3. Strategic sourcing

£875m

Overall cost savings from our cost

transformation programme are currently

an annualised benet of £875m with

an associated cost of £386m

4,029

Roles removed in the year through

our cost transformation programme

1. Simplifying products,

processes and systems

2. Building a more modern,

productive operation

21

BT Group plc Annual Report 2019 Strategic report

Governance

Financial statements

Additional information

To transform our business we need a simpler,

atter and more modern organisational

structure. This means having broader, more

accountable roles; fewer job levels; market-

aligned pay; and clearer career paths that

support individuals’ development.

Last year we committed to reshaping our

workforce by reducing roles in the UK and

overseas by 13,000 over the next three

years, with a focus on senior and middle

management roles and by getting smarter

about how we operate.

We are on track against our restructuring

plans with reductions in senior management

balanced with hiring in our front lines –

engineers and contact centres. This includes

hiring more apprentices into Openreach to

resource our integrated network and bre

rollout programmes.

In contact centres, we are recruiting more

people to help improve the experience of our

customers when they get in touch with us.

Balancing the reductions in management

roles with the increases in contact centre and

engineering roles will leave a net reduction of

around 7,000 roles by March 2021.

We are working with our people to ensure

those aected by changes are supported

through the change process.

We are one of the biggest private sector

recruiters of apprentices in the UK by a

signicant margin. We are also popular –

last year there were 63,000 apprentice

applications for almost 4,000 places.

We aim to reshape our workplaces to make

working for BT feel more like working for a

modern technology company. We have started

to roll out a more open working culture. This

includes more teams working in the same

buildings to boost productivity, innovation

and inter-team working, supported by a wider

range of collaborative software.

We are also speeding up ways of working.

This means quickly bringing together teams

for specic projects, then dissolving them

when the project has nished. We are also

letting people work in more uid ways,

encouraging more collaboration and cross

functional working than we had before. We

are creating more opportunities for people to

test, learn and try again.

We have around 7,000 properties in the UK

and 1,678 across the rest of the world. We

lease most of our UK properties from Telereal

Trillium, part of the William Pears group. We

signed a sale and lease back arrangement

with them in 2001. Eighty-seven per cent

of our UK properties are operational sites

housing xed and mobile telecoms and

broadband kit. These are retail outlets, oces,

contact centres, depots and data centres. We

also have BT Sport TV studios in London.

To enable these new working practices, we

are creating and investing in more modern,

t-for-purpose oce environments. For

example, we are focusing on around 30

modern, strategic sites to create a more

collaborative, open and customer focused

working culture.

We recently carried out a review of the

structure, composition and operation of our

Board committees to speed up executive

decision making and improve overall

governance. Changes were approved and

implemented by the Board in April 2019.

For further information please see page 56

of the Governance report.

1. Simplifying products,

processes and systems

Our large portfolio of products and services

is complicated for customers and is resource-

intensive to support.

We are starting to simplify our products

and services and streamline our IT systems

and processes. This will reduce additional

work and duplication and help us keep our

promises to customers more quickly and

reliably. It will also give us a springboard to

become the ecient business we need to be

to thrive in the future.

Simplifying operations progress around BT

• We brought together our Consumer and

EE businesses, integrating teams under a

new multi-brand operating model.

• We integrated our Business and Public

Sector and Wholesale and Ventures

businesses into Enterprise to strengthen

services and products and help customers

move to converged technologies.

• Global Services restructured its operating

model to create a new sales organisation

around three global industry verticals,

supported by a single, global commercial

unit. This will give us deeper focus

on fewer customers, improving their

experience of doing business with us.

2. Building a more

modern, productive

operation

We know that becoming more ecient

will make us more productive in the future,

better able to oer a truly dierentiated

customer experience.

To do that we need a smaller workforce in

some areas and a larger one in others. Our

recent investments in front line contact

centre people and engineers are part of our

plan to put resources, support and decision

making as close as possible to our customers.

To further boost productivity we also need

our people to have better places to work and

better digital skills. These will enable much

greater customer focus.

Productivity progress

• Our better workplace programme

is reducing the number of sites and

upgrading those that remain.

• Our cost transformation programme

remains on track, with c4,000 roles

removed in the year.

• Overall savings from our cost

transformation programme are currently

an annualised benet of £875m with an

associated cost of £386m.

• Outsourcing of our UK and Republic

of Ireland facilities management and

projects and construction teams took

eect on 1 April 2019. This has resulted

in approximately 1,900 employees

transferring out of BT.

• Openreach is committed to achieving a

world-class cost base to underpin our

bre build and has integrated key network

delivery teams to improve eciency.

• In Global Services we are redesigning our

service and portfolio operations to focus

on the needs of our largest multinational

customers.

3. Strategic sourcing

Through strategic sourcing, we delivered

signicant savings in 2018/19 and we are on

track to deliver more savings in the future.

This approach is changing the way we think

about procurement, which is also helping

suppliers. Thinking earlier helps them

optimise their own supply chains to support

our future plans. This gives everyone more

certainty and cuts back on unnecessary

cost, which in turn improves our customer

experience.

Strategic sourcing programme

• We are further rationalising our supplier

base to reduce risk and cost.

• We are signing better value multi-year

deals with more of a partnering ethos.

• We are working with our suppliers’

suppliers to cut raw material sourcing

costs.

22

BT Group plc Annual Report 2019

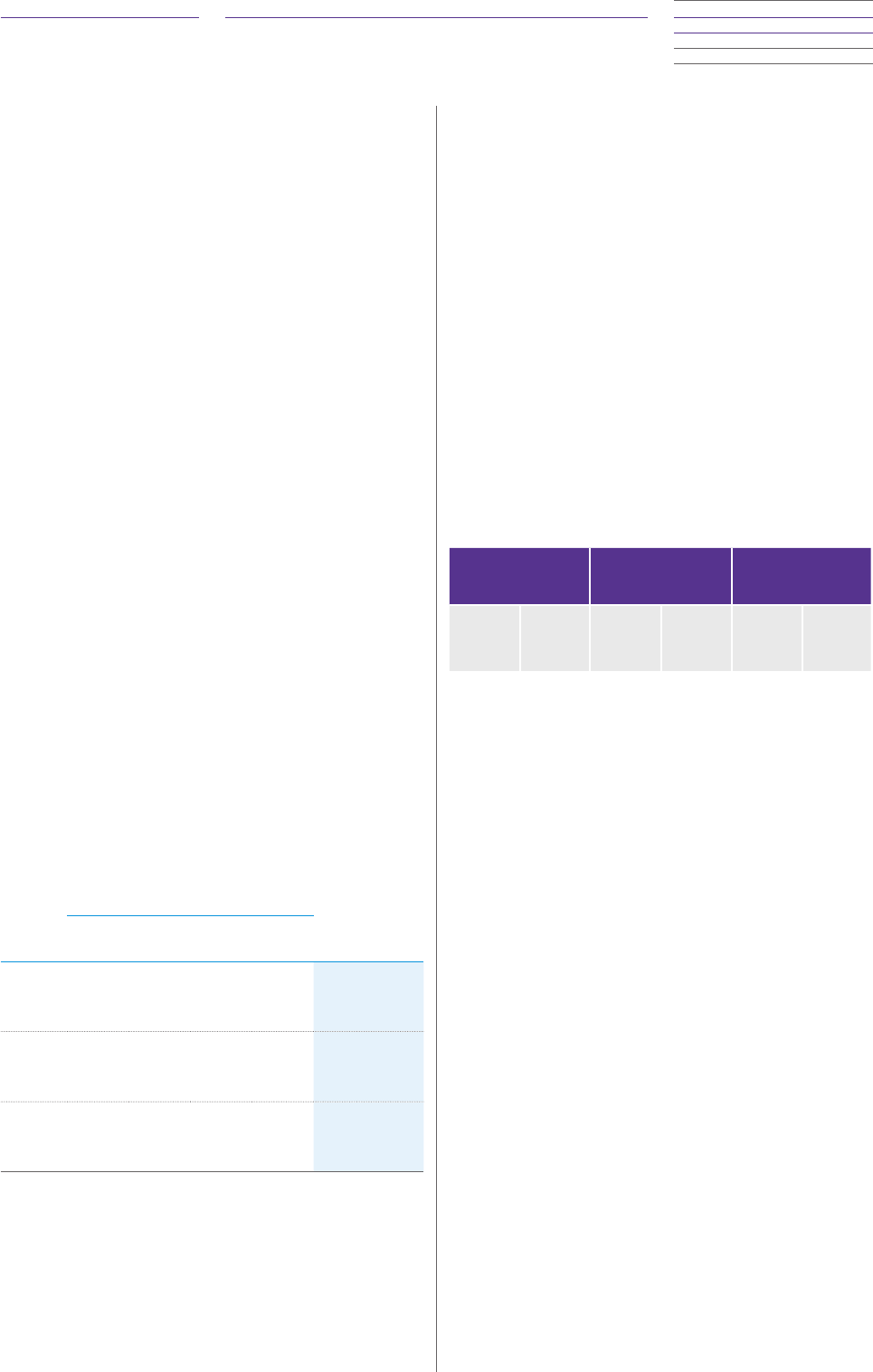

Our stakeholders

We rely on our

stakeholders for our

success as we build

the UK’s national

digital infrastructure.

Our main stakeholders are

customers, our people, the

communities in which we do

business, the environment,

shareholders, suppliers,

government and regulatory

bodies.

Customers

We oer our customers the latest

technologies and services to

enable them to communicate,

share, be entertained and do

business. We deliver and support

these products and services to

build valuable, high-quality, long-

term and sustainable relationships.

Our 28 million customer base is integral to

our success. Our customers are consumers,

businesses, multinational corporations,

public sector organisations and other

communications providers.

Some customers are also competitors

because we sell wholesale products and

services to other communications providers

in the UK and overseas.

Everything we do starts with the aim

of delivering a dierentiated customer

experience to generate value and create

loyalty.

You can nd more information on how our

customers t into our business model on

page 12.

People

Our people are central to the

transformation of our business,

and our ability to deliver our vision,

goals and strategic priorities.

We want them to use their skills and our

technology to deliver great products and

services for customers, communities and

societies around the world.

Our people strategy is summed up by our

ambition to be a brilliant place to work. We

want to deliver an outstanding customer

experience by getting our employee

experience right. That means making BT a

place where our people feel engaged and

inspired to be at their best.

At the heart of this are our values:

Personal